The IRS 1120 form is a document that corporations use to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form plays a crucial role in determining the income tax liability of a corporation. For...

The IRS 2553 form, officially referred to as the Election by a Small Business Corporation, serves a pivotal role for businesses opting to be treated as an S corporation for tax purposes. This designation allows businesses to pass corporate income,...

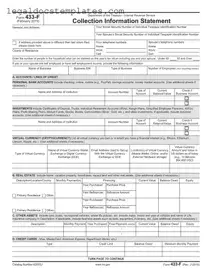

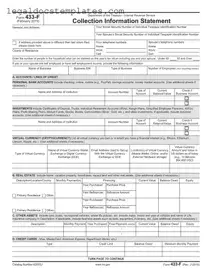

The IRS 433-F form, known as the Collection Information Statement, is a document used by the Internal Revenue Service to evaluate an individual's or business's ability to pay outstanding taxes. This form provides a detailed account of a taxpayer's financial...

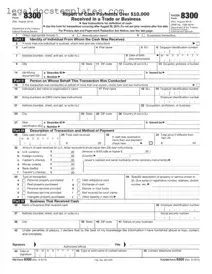

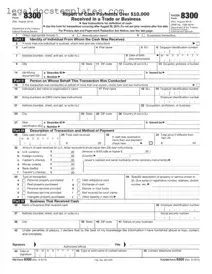

The IRS 8300 form is a crucial document used to report cash payments over $10,000 received in a trade or business transaction. This requirement aims to prevent money laundering by keeping track of large cash transactions. For those needing to...

The IRS 8879 form is an electronic signature authorization used by taxpayers who are filing their returns electronically through a tax preparer. This form does not themselves contain any tax information, but it authorizes the e-file provider to enter the...

The IRS 940 form is a document used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This tax funds state workforce agencies and pays unemployment compensation to workers who have lost their jobs. To easily fil...

The IRS 941 form is a quarterly tax form that businesses use to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. It also allows them to report their portion of social security or Medicare tax....

The IRS Schedule B 941 form is a tax document used by employers to report tax liability for semiweekly schedule depositors. It serves as a record of when payroll taxes were accrued, rather than when they were paid. For businesses...

The IRS Schedule C 1040 form is a tax document used by sole proprietors to report their business income and expenses to the Internal Revenue Service. This form plays a critical role in calculating the taxable income of individuals who...

The IRS Schedule C 1040 form is a document used by sole proprietors to report profits or losses from their business for the year. This essential form provides a detailed account of the income and expenses tied to the operation...

The IRS W-2 form is an essential document that employers use to report an employee's annual wages and the amount of taxes withheld from their paycheck. This form is vital for employees when preparing their tax returns, ensuring they receive...

The IRS W-3 form, also known as the Transmittal of Wage and Tax Statements, is a document employers are required to submit to the Social Security Administration. This form summarizes the total earnings, Social Security wages, Medicare wages, and withholding...