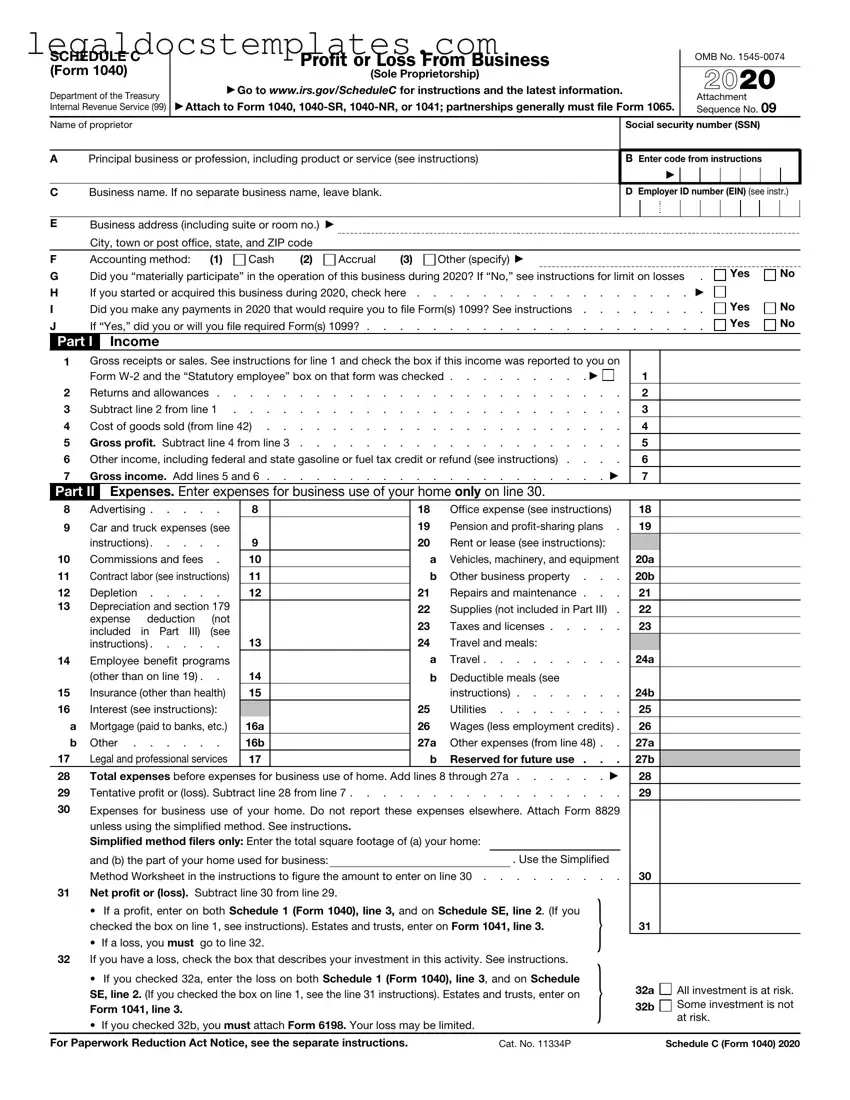

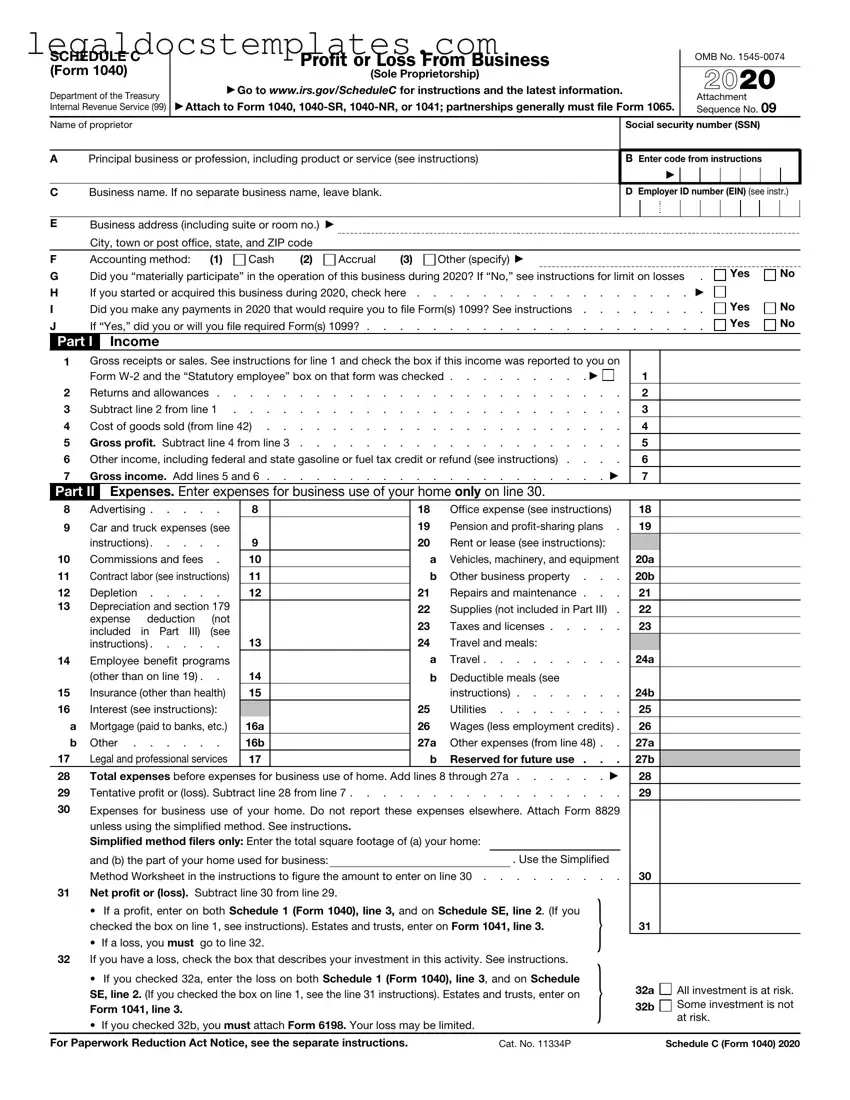

Filing taxes can often feel like navigating through a maze, especially when dealing with the IRS Schedule C form of the 1040, which is used by sole proprietors. A common mistake many make is not accurately reporting all their income. This doesn't just mean the money made from direct sales but also includes any other forms of income, such as interest on business accounts or any other payments received. It's easy to overlook these, but they are essential for a complete and accurate filing.

Expenses can also pose a significant hurdle. Often, individuals either overestimate or underestimate their deductible expenses. It's crucial to keep diligent records throughout the year to ensure that all legitimate business expenses are captured and properly documented. This includes keeping receipts and noting the business purpose of each expense. Accurate tracking helps avoid the mistake of missing out on valuable deductions or claiming inappropriate ones.

Another area where errors frequently occur is in the calculation of the home office deduction. Those working from home must meet specific criteria to claim this deduction, and the space must be used regularly and exclusively for business. Some mistakenly believe any use of a home office qualifies, not adhering to the strict requirements set by the IRS, potentially leading to issues upon review.

The use of incorrect forms is yet another mistake. The Schedule C is specifically for sole proprietors and single-member LLCs. However, owners of other types of businesses sometimes mistakenly use this form when other forms would be more appropriate for their business structure. Understanding the legal structure of your business and corresponding tax obligations is vital for proper filing.

Errors in reporting car and truck expenses also trip up many filers. For these expenses, one can opt to use either the standard mileage rate or actual expense method. However, switching between methods or inaccurately calculating expenses can lead to problems. Keeping a detailed mileage log and all receipts related to vehicle expenses is a good practice.

Miscategorizing employees as independent contractors or vice versa can lead to significant issues with the IRS. This not only affects how you report on Schedule C but also impacts employment taxes. Clear understanding of the distinction between an employee and an independent contractor based on IRS guidelines is essential.

Not correctly separating personal and business expenses is a frequent oversight. Even if you use your personal vehicle or home for business, you need to distinguish between its business and personal use strictly. This separation is crucial for accurate tax reporting and compliance with IRS rules.

Failing to report carryover losses is another area that is often neglected. If your business expenses exceed your income, you may have a net loss that can be carried over to the next tax year. However, not properly documenting or forgetting to report these losses can result in missing out on potential tax benefits.

Trying to deduct non-deductible expenses can also lead to complications. While many expenses are deductible, some, such as personal living expenses or fines and penalties, are not. Distinguishing between these is fundamental to avoiding claims that may be disallowed upon an audit.

Lastly, doing it all yourself without seeking professional guidance can be a mistake. Tax laws are complex and constantly changing. Professional tax advisors or accountants can provide valuable assistance in navigating these complexities, ensuring compliance, and potentially saving money.

Yes

Yes  No

No

Yes

Yes

No

No

Yes

Yes  No

No

No

No

No

No