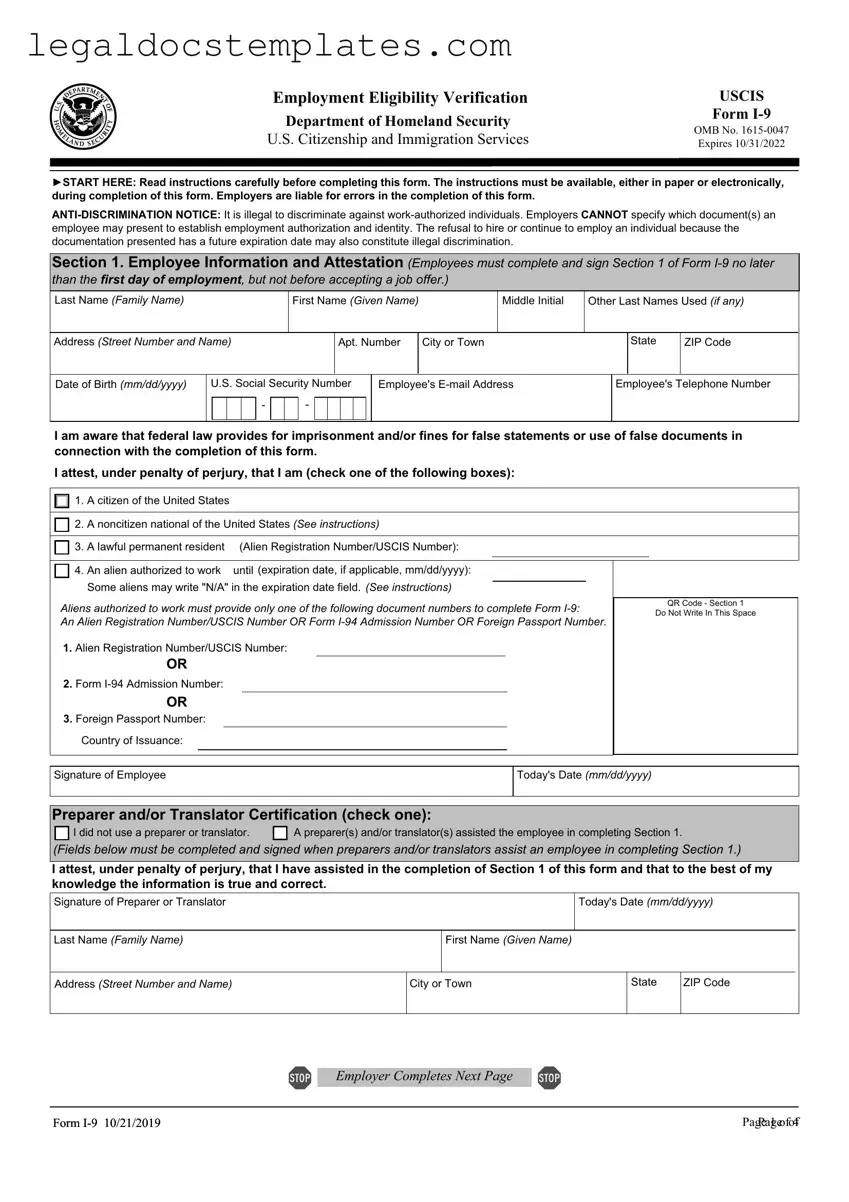

The USCIS I-9 form, known as the Employment Eligibility Verification form, is a document that all U.S. employers must fill out to verify the identity and employment authorization of individuals hired for employment in the United States. Both the employer and the employee must complete their respective sections of the form.

All employees hired after November 6, 1986, must complete an I-9 form at the time of hire. This requirement applies to both U.S. citizens and non-citizens. Employers are responsible for ensuring the form is completed properly and on time.

To complete the I-9 form, employees need to provide documents that prove both identity and employment authorization. These documents are categorized into three lists:

-

List A documents establish both identity and employment authorization (e.g., U.S. passport, Permanent Resident Card).

-

List B documents establish identity only (e.g., driver's license, state ID card).

-

List C documents establish employment authorization only (e.g., Social Security card, birth certificate).

Employees must present one selection from List A or a combination of one selection from List B and one from List C.

Employers are required to retain completed I-9 forms for either three years after the date of hire or one year after the date of termination, whichever is later. These forms must be stored securely and made available for inspection by authorized government officers upon request.

Yes, the I-9 form can be completed electronically, provided the system used complies with specific requirements set by USCIS. This includes proper data collection, a comprehensive audit trail, retention guidelines, and the capability for government inspection. Many employers find electronic completion advantageous for storage and organization.

If errors are discovered on the I-9 form, they should be corrected as soon as possible. Employers should instruct employees to make the corrections if the errors are in the employee’s section. Corrections should be made by drawing a line through the incorrect information, entering the correct information, and initialing and dating the change. It's crucial not to erase or use correction fluid on the form.

Are there penalties for not complying with I-9 requirements?

Yes, there are significant penalties for failing to comply with I-9 requirements, which can range from monetary fines to criminal penalties for more serious infractions. Penalties can be imposed for not completing I-9 forms, not maintaining them properly, or not producing them upon lawful request from government officials.

How can employers ensure compliance with I-9 requirements?

Employers can ensure compliance with I-9 requirements by:

-

Training staff responsible for I-9 forms on the correct procedures.

-

Regularly reviewing and updating their I-9 processes.

-

Conducting internal audits of their I-9 records.

-

Using electronic I-9 management systems that comply with USCIS guidelines.

-

Consulting with an attorney specializing in employment or immigration law for complex situations or questions.