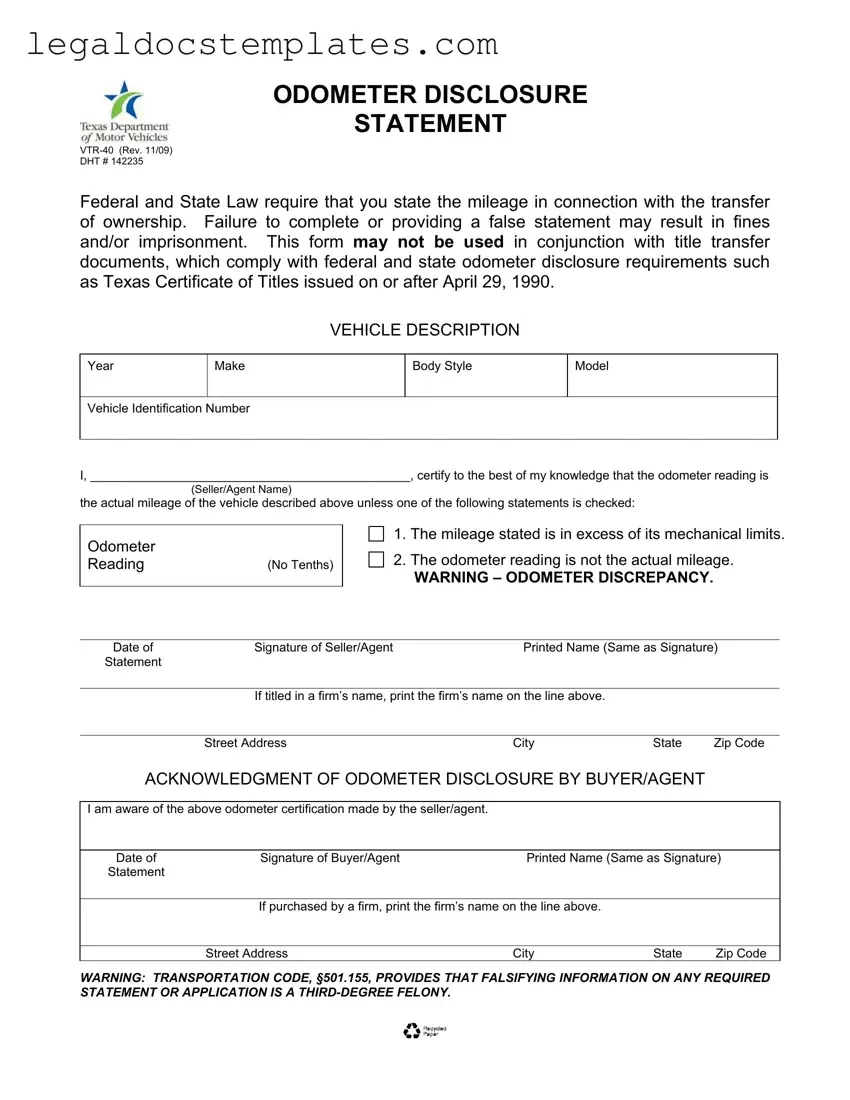

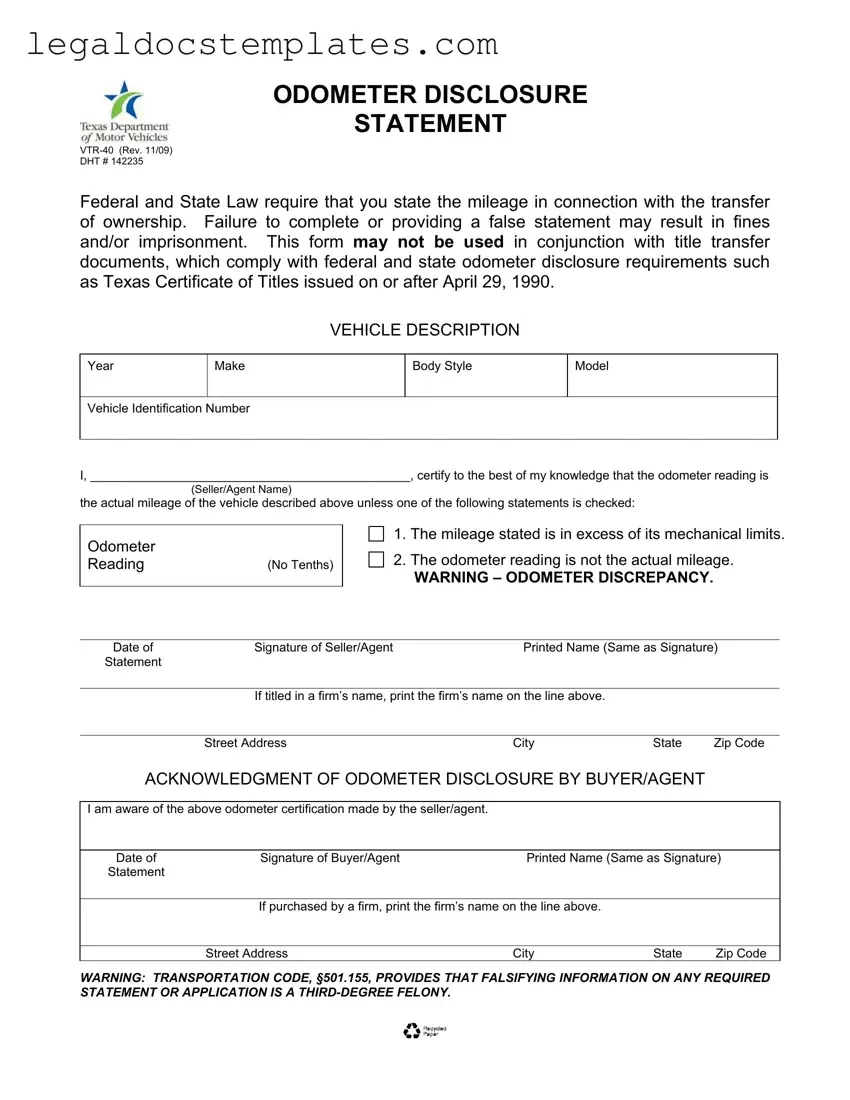

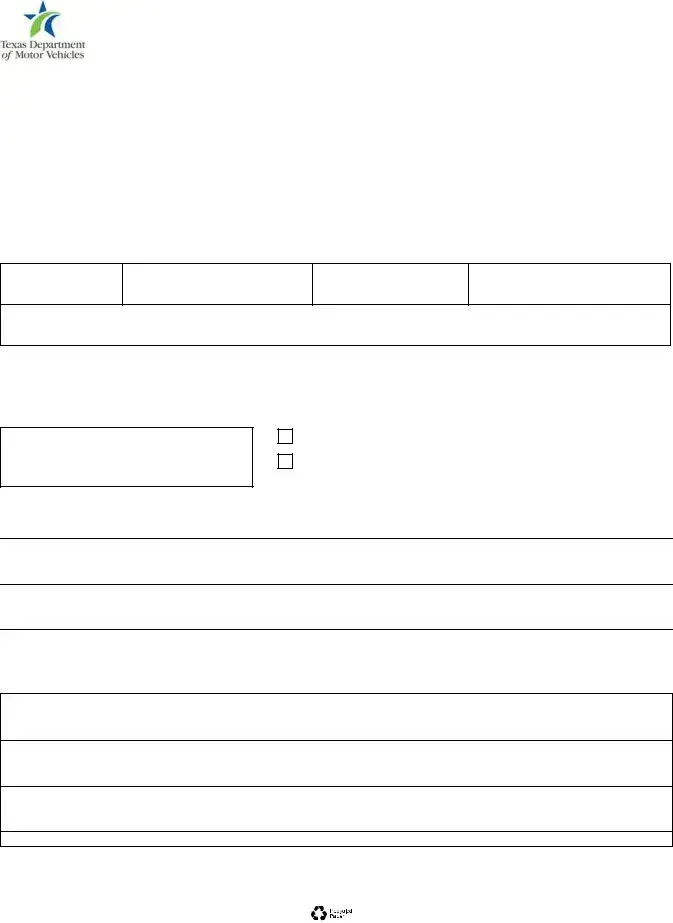

The Texas Odometer Statement form is crucial for accurately documenting a vehicle's mileage at the time of ownership transfer, ensuring transparency between the seller and buyer. Several other documents have similar roles or qualities in different contexts. Here, we’ll explore seven such documents and how they relate to the Texas Odometer Statement form.

Bill of Sale: Similar to the Odometer Statement, the Bill of Sale is vital during the process of buying and selling, particularly for personal property like vehicles and boats. It serves as proof of purchase and sale, detailing the transaction between the buyer and seller, including price and date of sale, akin to how the odometer statement records mileage accurately.

Vehicle Title: The Vehicle Title, much like the Texas Odometer Statement form, is mandatory in the transfer of vehicle ownership. It contains crucial information about the vehicle, including the make, model, year, and Vehicle Identification Number (VIN), as well as details about the owner. The odometer reading is also a key component on titles issued after specific dates, ensuring that the mileage is transparently communicated in ownership transfers.

Maintenance Record: Vehicle maintenance records, while not directly involved in the transfer of ownership, share the goal of accurately documenting the history of a vehicle. They track services performed, such as oil changes, tire rotations, and major repairs, paralleling how the odometer statement tracks mileage to provide a clear picture of the vehicle's condition over time.

Warranty Deed: In real estate, a Warranty Deed performs a similar function to the odometer statement in vehicle transactions. It transfers property ownership while guaranteeing that the seller holds a clear title to the property. Though it deals with property rather than vehicles, the emphasis on transparency, accuracy, and legal compliance is a common thread.

Loan Agreement: A Loan Agreement, particularly for auto loans, often references the vehicle's condition, including its mileage. Like the Odometer Statement, it is an integral part of transactions involving financed purchases, ensuring that all parties have accurate information about the vehicle's value and condition as part of the financial agreement.

Lease Agreement: For vehicles, Lease Agreements often require accurate odometer readings at the start and end of the lease term, similar to how an odometer disclosure is needed when ownership changes hands. This ensures fair use and wear charges are assessed based on the actual mileage driven during the lease period.

Insurance Policy: Lastly, an Insurance Policy for a vehicle closely relates to the odometer statement as insurers often base their coverage rates on the vehicle's mileage. Accurate mileage disclosure helps in determining the insurance premium and coverage terms, making it as crucial for insurance purposes as the odometer statement is for sales transactions.

Each of these documents, while serving different purposes and involved in varying facets of legal, financial, and transactional activities, shares the common goal of ensuring accuracy, transparency, and adherence to regulations — much like the Texas Odometer Statement form does in the realm of vehicle sales.