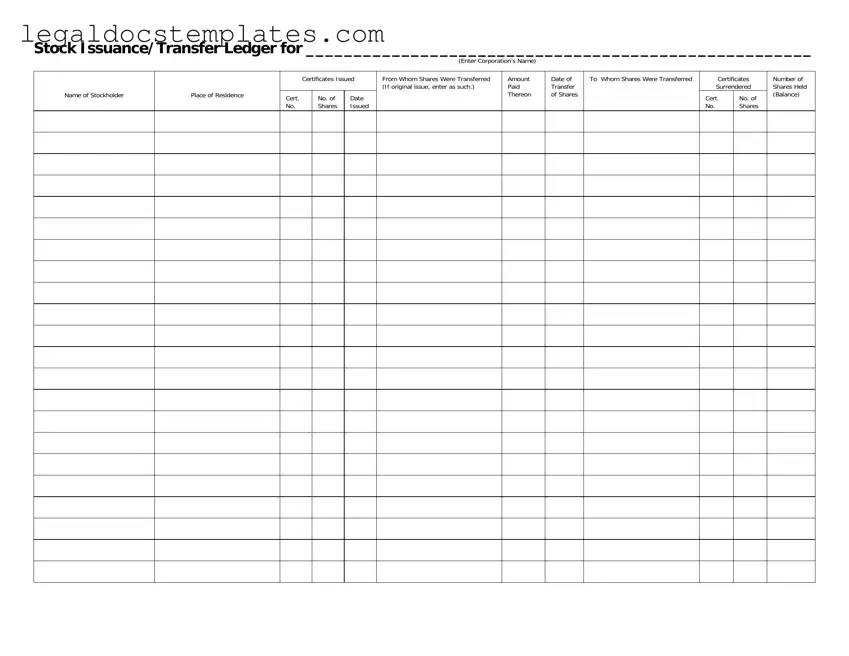

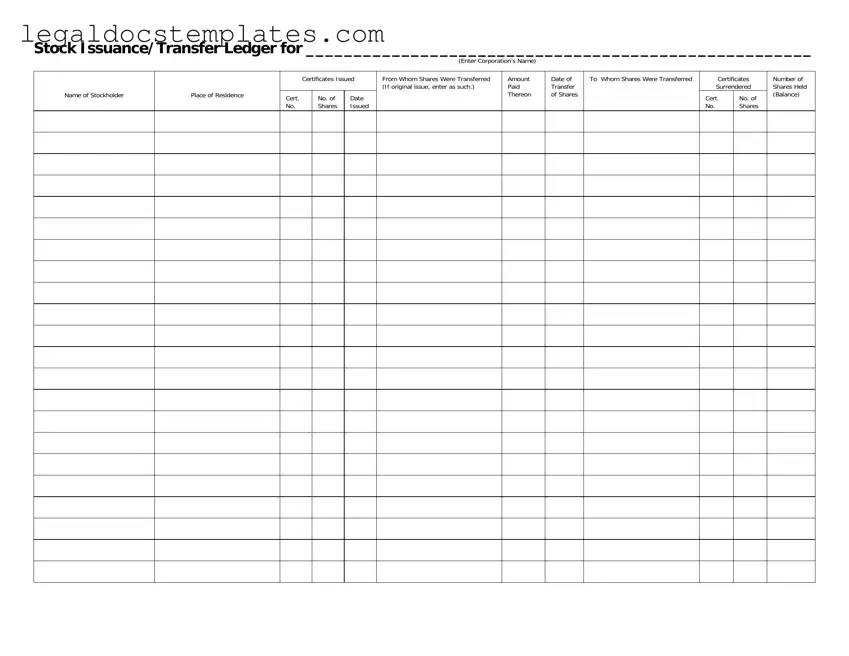

The Corporate Bylaws form is similar to the Stock Transfer Ledger in that it provides a structured framework for managing a corporation. Like the Stock Transfer Ledger, which tracks the issuance and transfer of stock within a corporation, Corporate Bylaws outline the rules and procedures that govern the corporation’s internal management. Both documents are essential for ensuring compliance with legal requirements and for maintaining orderly operations within a corporation.

The Shareholders Agreement closely resembles the Stock Transfer Ledger because it also deals with the ownership and transferability of shares within a company. However, while the Stock Transfer Ledger focuses on recording transactions and maintaining a historical record of share transfers, the Shareholders Agreement sets forth the rights and obligations of shareholders, including how shares can be transferred. This agreement is crucial for preventing disputes among shareholders and ensuring smooth transitions in ownership.

The Certificate of Incorporation is akin to the Stock Transfer Ledger as both are foundational documents in the life of a corporation. The Certificate of Incorporation establishes the existence of the corporation and includes basic information such as the corporation's name, purpose, and the number of shares it is authorized to issue. Meanwhile, the Stock Transfer Ledger tracks the issuance and movement of these shares post-incorporation. Both documents are vital for legal recognition and operational functionality of the corporation.

The Minutes of Board of Directors Meeting document has similarities to the Stock Transfer Ledger, primarily in its role of recording formal actions and decisions. While the Stock Transfer Ledger specifically logs the details of stock transactions, the Minutes of Board of Directors Meeting captures a broader range of corporate decisions, including those related to stock issuance and transfer policies. These minutes are essential for ensuring accountability and providing a historical account of the company's strategic decisions.

The Stock Subscription Agreement is closely related to the Stock Transfer Ledger, as it represents an agreement between a corporation and an investor, where the investor agrees to purchase stock at a future date. The connection to the Stock Transfer Ledger comes after the agreement is executed, and the transaction details need to be recorded. The Stock Transfer Ledger then serves as the official record of these new stock issuances and transfers, complementing the initial agreement by tracking the evolution of share ownership over time.

The Buy-Sell Agreement parallels the Stock Transfer Ledger by focusing on the conditions under which shares may be bought or sold, particularly in private firms. This agreement often defines scenarios such as death, divorce, or retirement of a shareholder and how their shares should be managed. The Stock Transfer Ledger subsequently documents the actual transfer of shares when these conditions are met, serving as a detailed historical record that ensures the agreement’s terms are fulfilled.

The Corporate Resolution for Authorizing the Sale of Shares is another document related to the Stock Transfer Ledger. Before shares can be sold or transferred, a corporation's board may need to authorize the sale, especially if it involves a significant number of shares or includes specific restrictions. The Stock Transfer Ledger provides the after-the-fact recording of these approved transactions, ensuring that each transfer is documented and the corporation's stock ownership is accurately maintained.

Finally, the Annual Report to Shareholders bears resemblance to the Stock Transfer Ledger as it offers stakeholders detailed information about the corporation's performance, governance, and strategic direction. Although the Annual Report is more comprehensive and focuses on financial and operational results, it can include information derived from the Stock Transfer Ledger, such as changes in stock ownership patterns. Together, these documents help to keep shareholders informed and engaged with the corporation's progress.