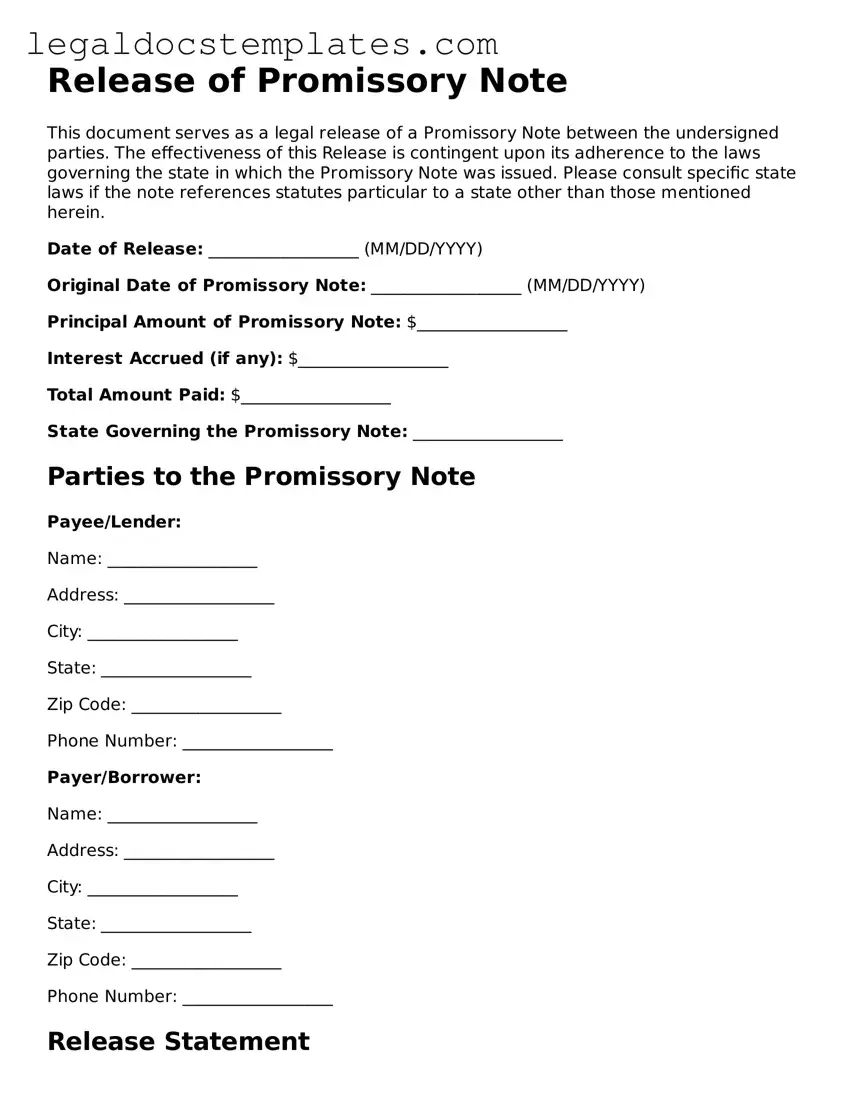

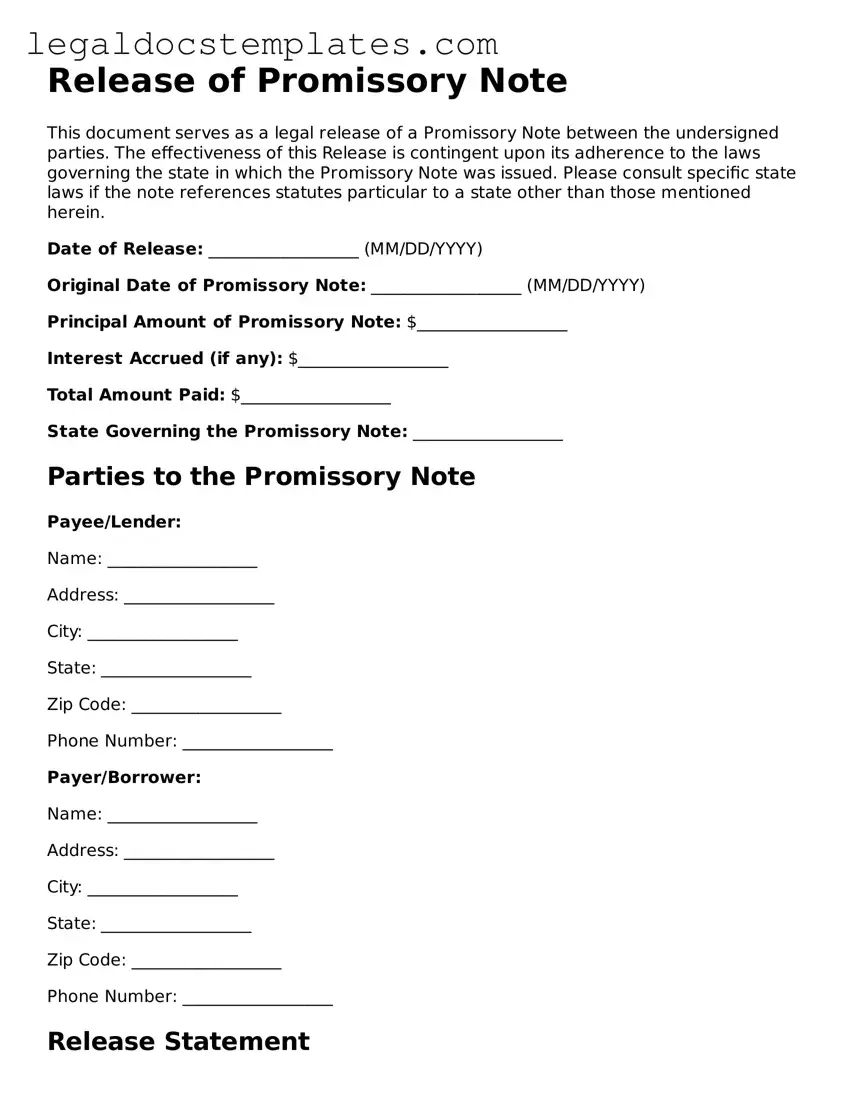

Printable Release of Promissory Note Template

A Release of Promissory Note form is a legal document that signifies the conclusion of a loan agreement, indicating that the borrower has fully repaid the debt to the lender. This essential form ensures that the borrower is released from any further obligations under the terms of the promissory note. For individuals seeking to conclude their loan agreements officially, filling out this form with accuracy is crucial – click the button below to start the process.

Access Release of Promissory Note Now

Printable Release of Promissory Note Template

Access Release of Promissory Note Now

Access Release of Promissory Note Now

or

⇩ PDF Form

Don’t spend hours on this form

Complete Release of Promissory Note online in minutes, fully digital.