The Balance Sheet is quite similar to the Profit and Loss form, as both are crucial financial statements for any business. While the Profit and Loss form focuses on the income and expenses over a period, revealing the net income, the Balance Sheet provides a snapshot of a company's financial condition at a specific point in time. It lists assets, liabilities, and owners’ equity, offering a broader view of financial health. Together, they give stakeholders insight into profitability and financial stability.

Another document resembling the Profit and Loss form is the Cash Flow Statement. Both documents are essential for understanding a business's financial operations, but they serve different purposes. The Profit and Loss form details the company's revenues, costs, and expenses to show its profitability. Meanwhile, the Cash Flow Statement tracks the flow of cash in and out of a business, highlighting its liquidity. This statement categorizes cash flows into operating, investing, and financing activities, providing a clear picture of how the company earns and spends its cash over time.

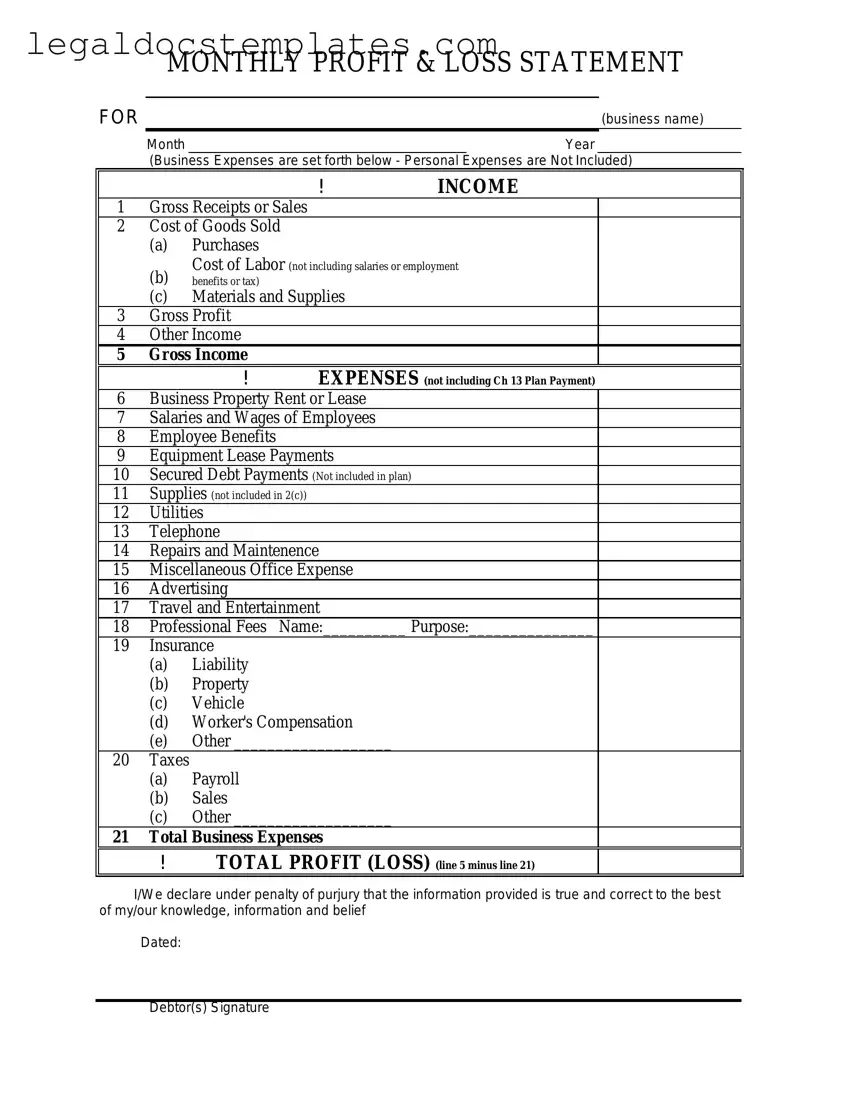

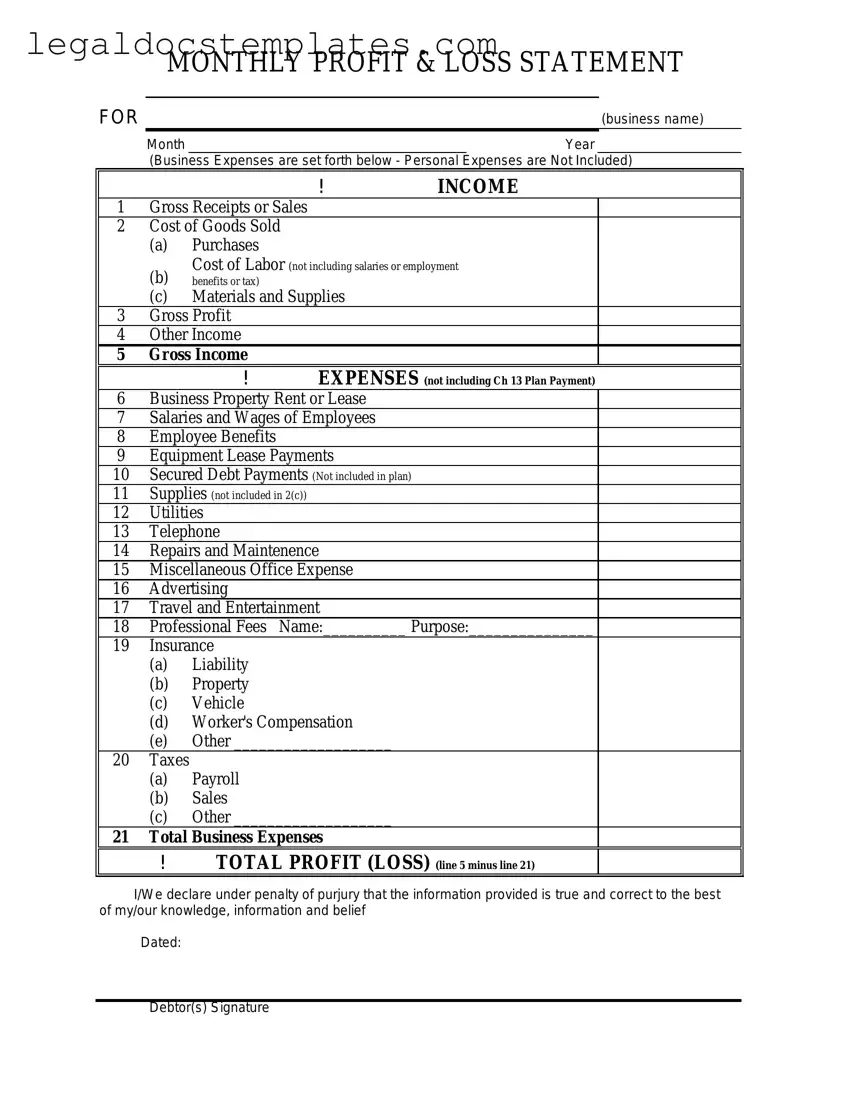

The Income Statement is often used interchangeably with the Profit and Loss form, and they essentially serve the same purpose, which is to demonstrate a company's financial performance over a specific period. They detail revenues, expenses, and profits or losses, showing how operational and non-operational activities impact the overall financial result. However, "Profit and Loss" is more commonly used in colloquial speech, whereas "Income Statement" is the term preferred in formal accounting contexts.

Statement of Retained Earnings is another document that has similarities with the Profit and Loss form, although it focuses on a different aspect of financial reporting. This statement explains changes in a company’s retained earnings over a period, often linking directly to the net income reported on the Profit and Loss form. It shows how much profit is reinvested in the business versus distributed to shareholders as dividends. Thus, it gives insights into a company’s dividend policy and growth strategy by detailing the accumulation of profits.

The Budget Report shares similarities with the Profit and Loss form by presenting financial data that can inform decision-making and performance evaluation. While the Profit and Loss form records actual income and expenditure over a period, showing the net profit or loss, a Budget Report outlines the financial plan for the future, including projected revenues and expenses. Comparing these actual and projected figures enables businesses to manage their finances more effectively, spot trends, and make adjustments as necessary.

Finally, the Break-even Analysis is related to the Profit and Loss form in that both are used to evaluate a business's financial performance and viability. The Break-even Analysis calculates the point at which total revenues equal total costs, and the business neither makes a profit nor incurs a loss. It helps in understanding how changes in price levels, costs, and volume affect profitability. In contrast, the Profit and Loss form provides a detailed record of past financial activity, showing the actual profit or loss achieved in a given period.