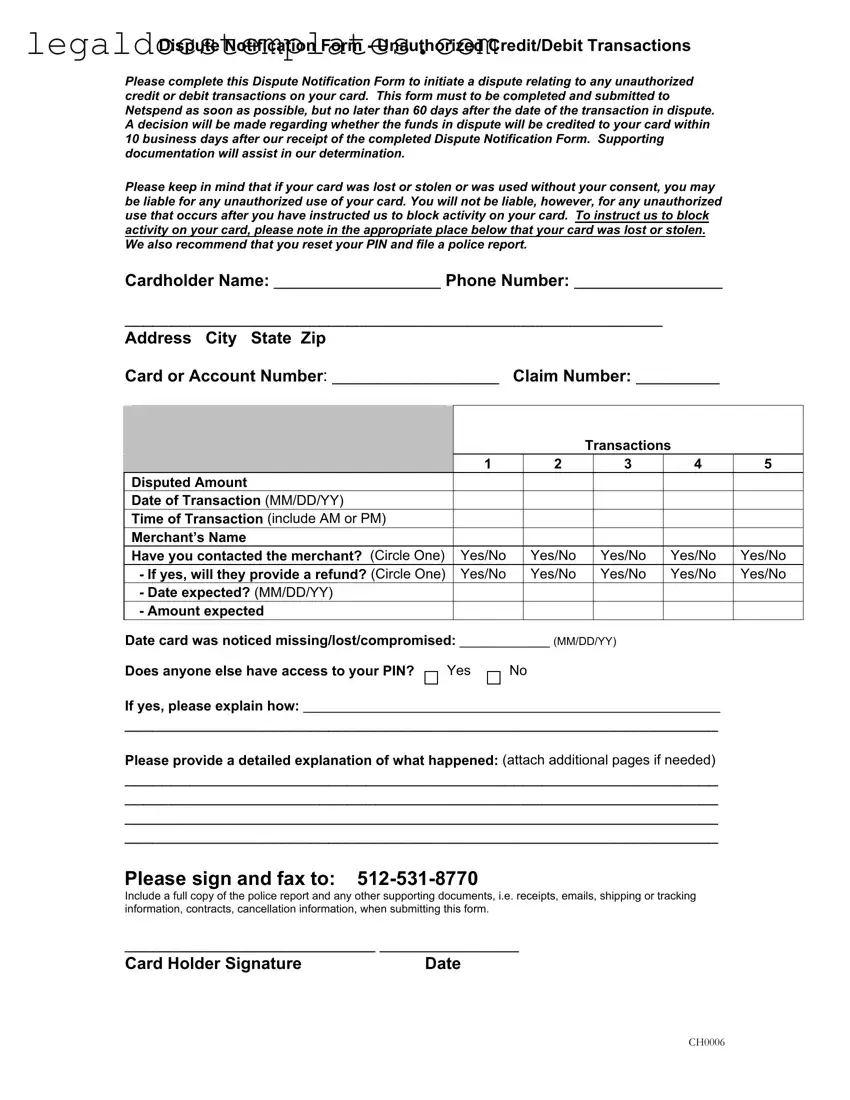

The Netspend Dispute Notification Form is a document designed for Netspend cardholders to report any unauthorized credit or debit transactions on their card. Its purpose is to initiate a formal dispute process with Netspend, aiming to potentially recover funds that were wrongfully deducted. Completing and submitting this form is a critical first step in contesting transactions that cardholders did not authorize.

You should submit the Netspend Dispute Notification Form as soon as you notice an unauthorized transaction on your card. However, there is a strict deadline for this process; the form must be submitted no later than 60 days after the transaction date of the unauthorized charge you are disputing. Acting promptly ensures that you meet this deadline and strengthens the possibility of resolving the dispute in your favor.

After you submit the completed Dispute Notification Form to Netspend, the company will review your claim. The review process considers the documentation and explanations you provide. Netspend aims to make a decision on whether the disputed funds will be credited back to your card within 10 business days following receipt of your completed form. The more thorough and detailed your submitted information and supporting documents are, the more it could help in their determination.

How many transactions can I dispute at once?

The Dispute Notification Form allows you to dispute up to five transactions at one time. For each transaction, you will need to provide specific details, including the disputed amount, the date and time of the transaction, and the merchant's name. If you need to dispute more than five transactions, you may need to submit additional forms.

Yes, it's recommended that you contact the merchant before filing a dispute with Netspend. In many cases, the merchant can resolve your issue faster or may be willing to refund the transaction without escalation. On the form, you are asked to indicate whether you have contacted the merchant and if a refund has been arranged. Noting this information on the form can assist with the dispute process.

What supporting documentation should I include with my submission?

When submitting your Dispute Notification Form, including any relevant supporting documentation can be critical to the resolution of your dispute. Such documents may include receipts, emails, shipping or tracking information, contracts, cancellation information, and a copy of the police report if your card was lost or stolen. This evidence can provide crucial context and proof to support your claim.

What if my card was lost or stolen?

If your card was lost or stolen, you should note this immediately on the Dispute Notification Form and also instruct Netspend to block any future transactions on your card. It is recommended that you also reset your PIN and file a police report, the copy of which should be submitted along with your dispute form. Taking these steps reduces your liability for unauthorized transactions and strengthens your dispute claim.

What should I do if someone else has access to my PIN?

If someone else has access to your PIN and unauthorized transactions have occurred, detail this in the designated section of the Dispute Notification Form. Providing a full explanation of how someone else obtained your PIN and any relevant circumstances can be crucial for the investigation. Netspend uses this information to understand the security breach and to assess your dispute claim more accurately.

The completed Dispute Notification Form can be submitted to Netspend by fax. The fax number provided for this purpose is 512-531-8770. Along with the form, make sure to include all supporting documentation that could aid in your dispute. Thorough and accurate submission is key to a favorable outcome. After submitting, keeping a copy of the form and all accompanying documents for your records is advisable.