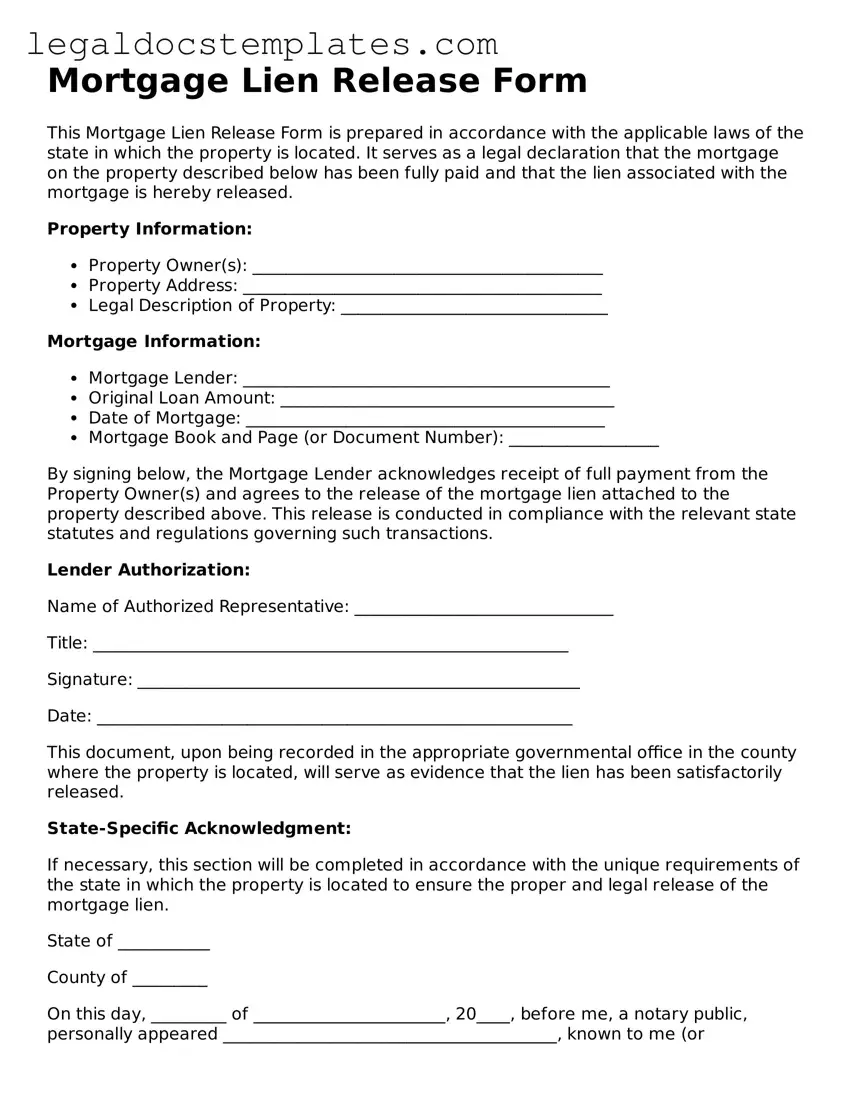

Printable Mortgage Lien Release Template

A Mortgage Lien Release form is a critical document indicating that a homeowner has fully paid off their mortgage, thereby releasing the lien the lender held on their property. This form is the final piece that ensures the property title is clear, signifying no more debt is owed on the home. For homeowners aiming to obtain this important document, a simple click on the button below will guide you through the process of filling out the form.

Access Mortgage Lien Release Now

Printable Mortgage Lien Release Template

Access Mortgage Lien Release Now

Access Mortgage Lien Release Now

or

⇩ PDF Form

Don’t spend hours on this form

Complete Mortgage Lien Release online in minutes, fully digital.