The Shareholder Register is highly similar to the Membership Ledger, as both are fundamental in tracking the ownership of a company. The Shareholder Register documents the issuance and transfer of a company's shares, including the name of the shareholder, their contact information, the number of shares held, and any transfers of shares. This document, like the Membership Ledger, serves as an official record for managing and verifying ownership stakes, ensuring legal and financial transparency.

Stock Certificates also share a resemblance with the Membership Ledger because they both serve as physical proof of ownership. A Stock Certificate is a document that certifies the number of shares owned by a shareholder in a corporation. Much like information recorded in a Membership Ledger, it includes details such as the name of the owner, the number of shares, and the certificate number. Both documents are essential for establishing and transferring ownership rights.

The Corporate Minutes document bears a resemblance to the Membership Ledger in that it records important corporate decisions and actions. Corporate Minutes focus on the proceedings and resolutions passed during corporate meetings, including changes in ownership or membership interests that might be noted in a Membership Ledger. These minutes ensure that all significant corporate actions, especially those affecting ownership and membership interests, are accurately documented for legal and historical reference.

Partnership Agreements share a connection with the Membership Ledger by detailing the ownership interests and operational roles within a partnership. While a Membership Ledger tracks the issuance and transfer of membership interests, a Partnership Agreement outlines the initial ownership percentages, duties, and profit-sharing ratios among partners. Both documents are crucial for defining and adjusting the ownership and operational structure of the entity.

The Unit Certificate in a Limited Liability Company (LLC) parallels the Membership Ledger form in its function to signify ownership. Similar to stock certificates in corporations, Unit Certificates specify an owner's interest in an LLC, including the member's name and the number of units owned. The Membership Ledger complements this by documenting the history of issued unit certificates, transfers, and current ownership status, thereby providing a complete ownership trail.

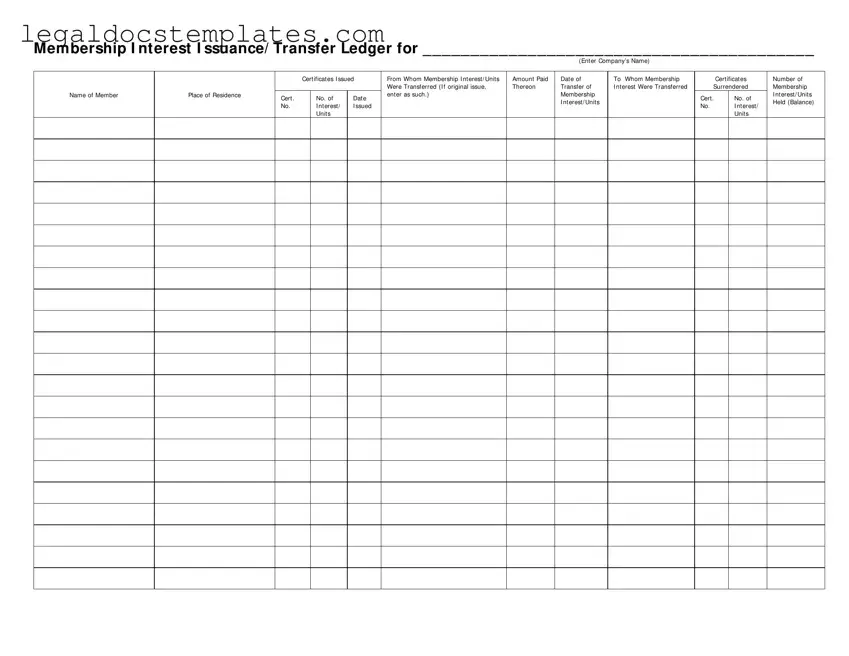

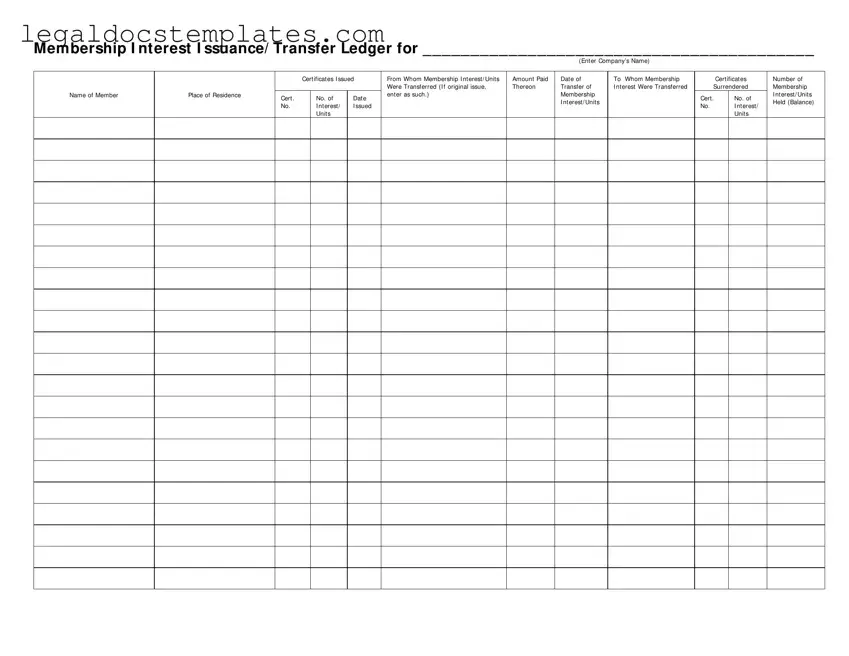

Transfer Ledgers are closely linked to the Membership Ledger as they both track the transfer of ownership interests. Transfer Ledgers are used across various types of entities, including corporations and LLCs, to record the details of ownership transfers, such as the transferring and receiving parties, the date, and the amount of interest transferred. This systematic recording is crucial for maintaining updated and accurate records of current ownership.

The Member List is akin to the Membership Ledger in that it provides a current overview of the entity's members. While the Membership Ledger offers a comprehensive historical account of membership issuances and transfers, the Member List presents a snapshot of current members, including their names and contact information. This document is essential for communication, legal identity verification, and the overall governance of the entity.

Lastly, the Cap Table, short for Capitalization Table, is comparable to the Membership Ledger as it outlines the equity ownership of a company. The Cap Table provides a detailed breakdown of shareholders’ and investors' equity percentages, types of securities owned (like stock, options, warrants), and the value of those securities. Similar to a Membership Ledger, this document is key in understanding the distribution of ownership and financial interests within the company, albeit from a broader financial perspective.