The Louisiana Act of Donation form shares similarities with the Grant Deed, commonly used in real estate transactions. Both documents are integral in the process of transferring property rights, but a Grant Deed carries with it warranties that the property is free from any undisclosed encumbrances. This contrasts with the Act of Donation, which often does not include such warranties, focusing instead on the act of giving property, typically without monetary exchange.

Another document akin to the Louisiana Act of Donation form is the Quitclaim Deed. This document is used to transfer any ownership interest the grantor may have in a piece of property, without making any guarantees about the extent of their interest. Similar to the Act of Donation, a Quitclaim Deed is straightforward in its execution but differs in that it's often used between parties who know each other and where there is trust, as it offers minimum protection to the grantee.

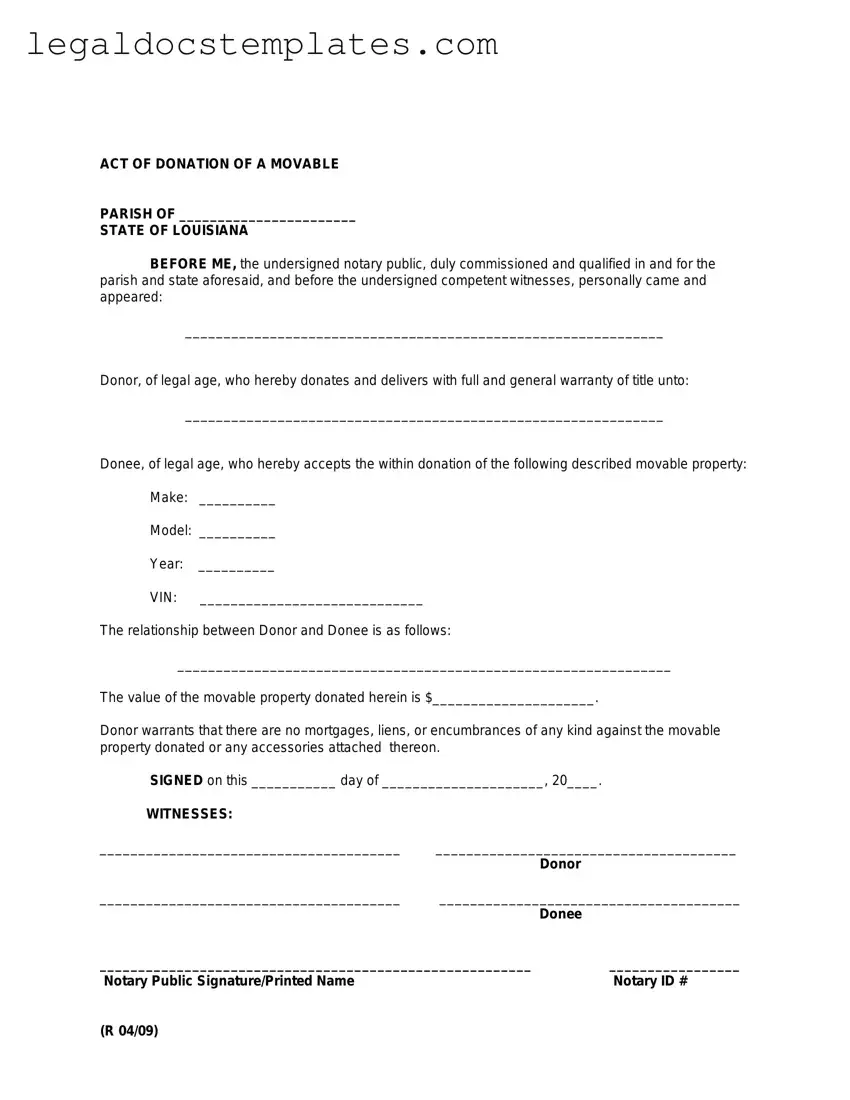

The Louisiana Act of Donation form also has similarities with the Bill of Sale. This document is used to transfer ownership of personal property, such as vehicles or furniture, from one party to another. While the Bill of Sale typically involves the exchange of money, similar to the Act of Donation, it is evidence of a transfer of ownership. Both documents serve as legal proof that an item or property has been given from one party to another, though the specifics of what is being transferred and the conditions involved may differ.

A Warranty Deed, used in many states for real estate transactions, shares a basic premise with the Louisiana Act of Donation form—the transfer of property. However, a Warranty Deed comes with significant assurances from the seller to the buyer, including that the property is free of liens and encumbrances. The Act of Donation, in contrast, may not always offer such comprehensive guarantees, focusing rather on the gratuitous aspect of the transaction.

The Gift Affidavit is another document related to the Louisiana Act of Donation form, in that it formally documents the transfer of a gift of significant value from one party to another. While the Act of Donation is used primarily for real estate, a Gift Affidavit can apply to various types of valuable gifts. Both documents serve to legalize the act of giving something of value from one person to another, often requiring notarization to confirm the authenticity of the parties’ signatures.

Lastly, the Trust Transfer Deed bears resemblance to the Louisiana Act of Donation form as it is used to transfer property into, or out of, a trust. Like the Act of Donation, a Trust Transfer Deed is a means of transferring property without the traditional buying and selling process. However, it specifically pertains to the management of property within a trust arrangement, offering a unique approach to handling property transfer compared to the broader application of the Act of Donation.