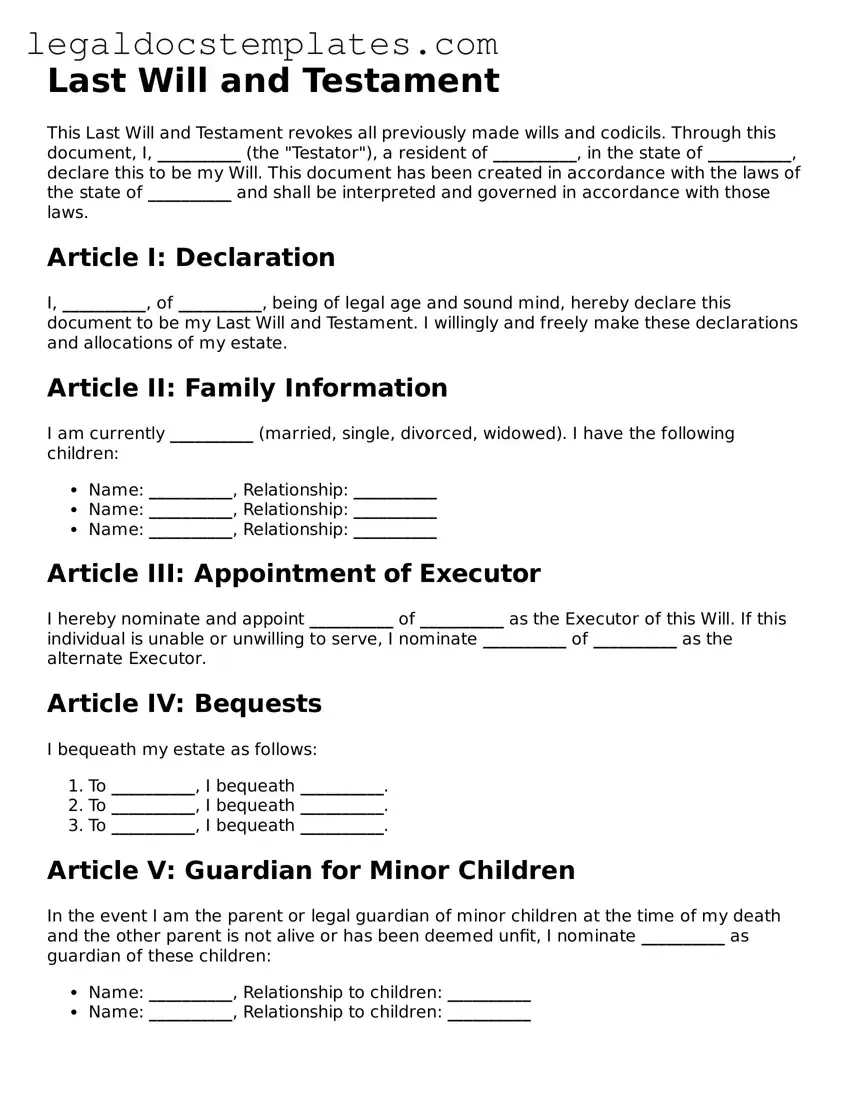

Last Will and Testament

This Last Will and Testament revokes all previously made wills and codicils. Through this document, I, __________ (the "Testator"), a resident of __________, in the state of __________, declare this to be my Will. This document has been created in accordance with the laws of the state of __________ and shall be interpreted and governed in accordance with those laws.

Article I: Declaration

I, __________, of __________, being of legal age and sound mind, hereby declare this document to be my Last Will and Testament. I willingly and freely make these declarations and allocations of my estate.

Article II: Family Information

I am currently __________ (married, single, divorced, widowed). I have the following children:

- Name: __________, Relationship: __________

- Name: __________, Relationship: __________

- Name: __________, Relationship: __________

Article III: Appointment of Executor

I hereby nominate and appoint __________ of __________ as the Executor of this Will. If this individual is unable or unwilling to serve, I nominate __________ of __________ as the alternate Executor.

Article IV: Bequests

I bequeath my estate as follows:

- To __________, I bequeath __________.

- To __________, I bequeath __________.

- To __________, I bequeath __________.

Article V: Guardian for Minor Children

In the event I am the parent or legal guardian of minor children at the time of my death and the other parent is not alive or has been deemed unfit, I nominate __________ as guardian of these children:

- Name: __________, Relationship to children: __________

- Name: __________, Relationship to children: __________

Article VI: Debts and Expenses

I direct that my just debts, funeral expenses, and the expenses of the administration of my estate be paid as soon as practicable after my death from the assets of my estate.

Article VII: Declaration

This Will is made by me, __________, willingly and without any duress or undue influence. I declare it to be my Last Will and Testament, in the presence of the witnesses, who signed it in my presence and in the presence of each other. This document, consisting of ___ pages, including this page, is declared to the best of my knowledge to be complete and valid.

Date: __________

City, State: __________

Signatures

Testator:

______________________

Witness #1:

______________________

Name: __________, Address: __________

Witness #2:

______________________

Name: __________, Address: __________

Witness #3:

Optional in some states but recommended:

______________________

Name: __________, Address: __________

Notarization

This document was acknowledged before me on __________, by __________, the testator.

Notary Public:

Signature: ______________________

My commission expires: __________