Fill Out Your IRS Schedule B 941 Template

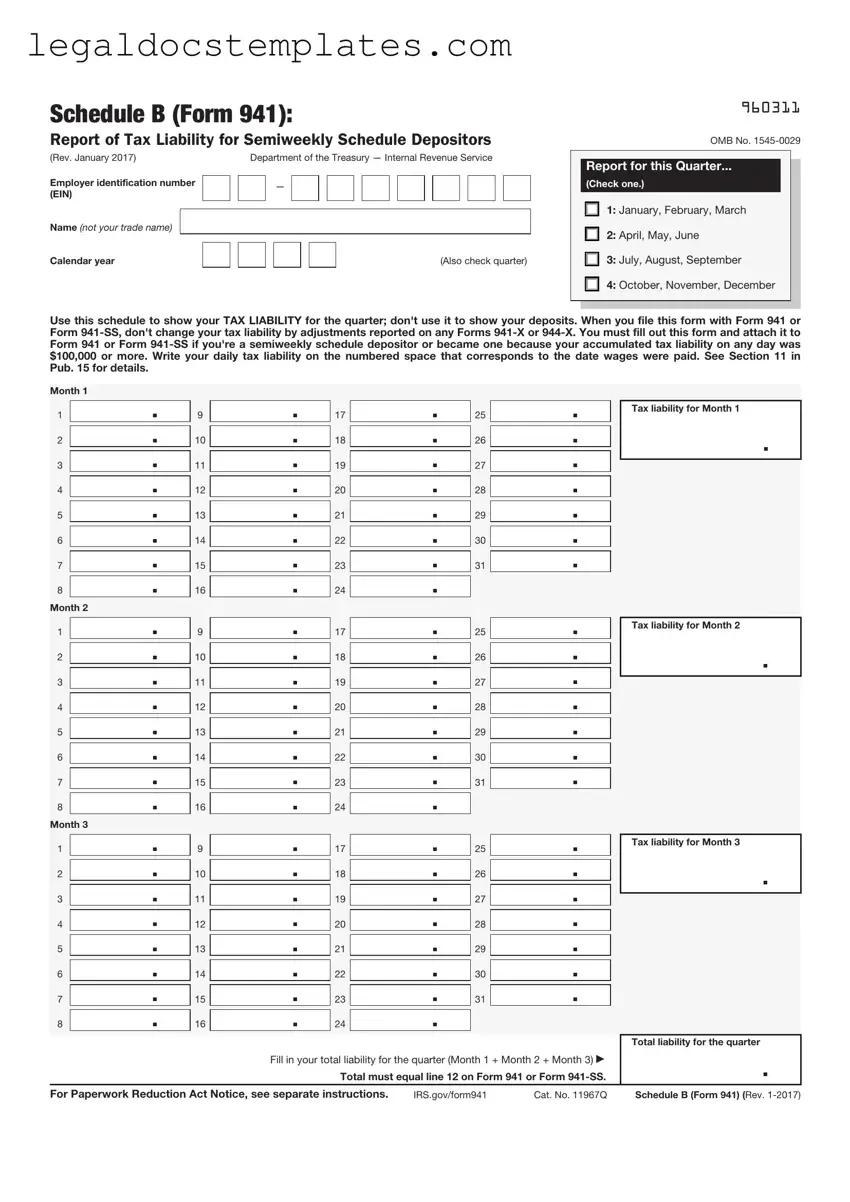

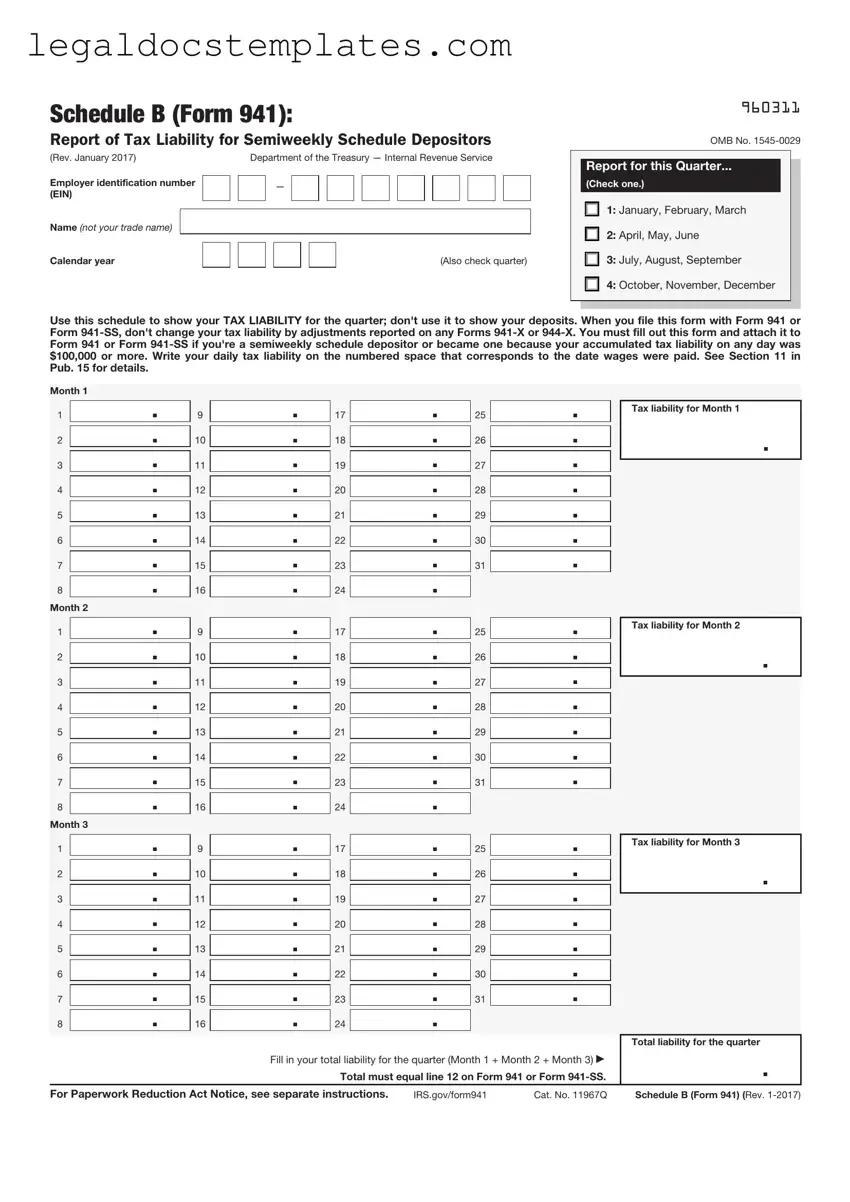

The IRS Schedule B 941 form is a tax document used by employers to report tax liability for semiweekly schedule depositors. It serves as a record of when payroll taxes were accrued, rather than when they were paid. For businesses that need to detail their tax liabilities for specific periods within a quarter, understanding and filling out this form correctly is crucial. Click the button below to begin filling out your form.

Access IRS Schedule B 941 Now

Fill Out Your IRS Schedule B 941 Template

Access IRS Schedule B 941 Now

Access IRS Schedule B 941 Now

or

⇩ PDF Form

Don’t spend hours on this form

Complete IRS Schedule B 941 online in minutes, fully digital.

.

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

. .

.