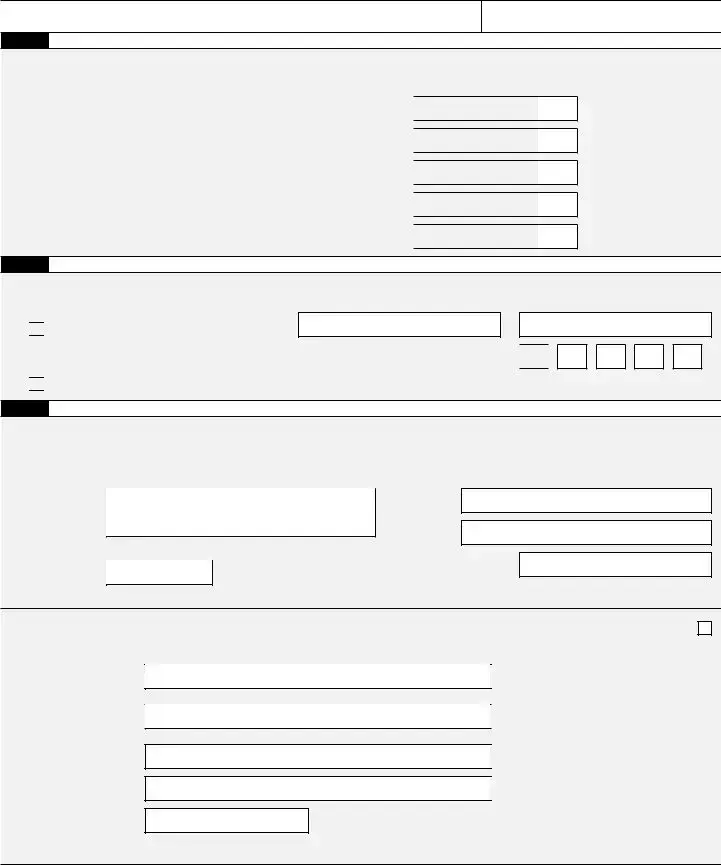

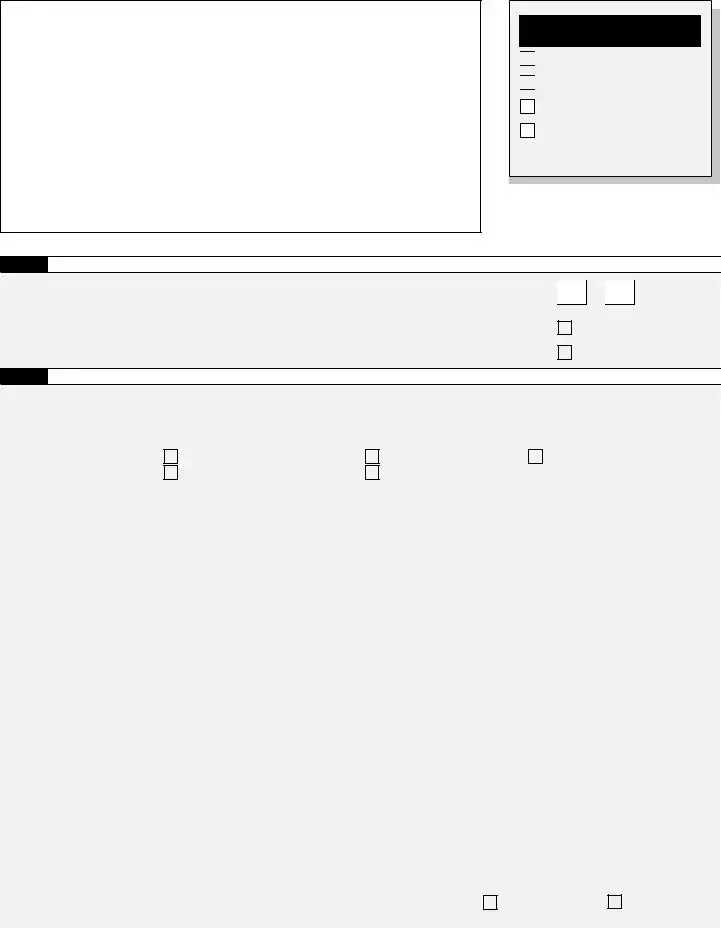

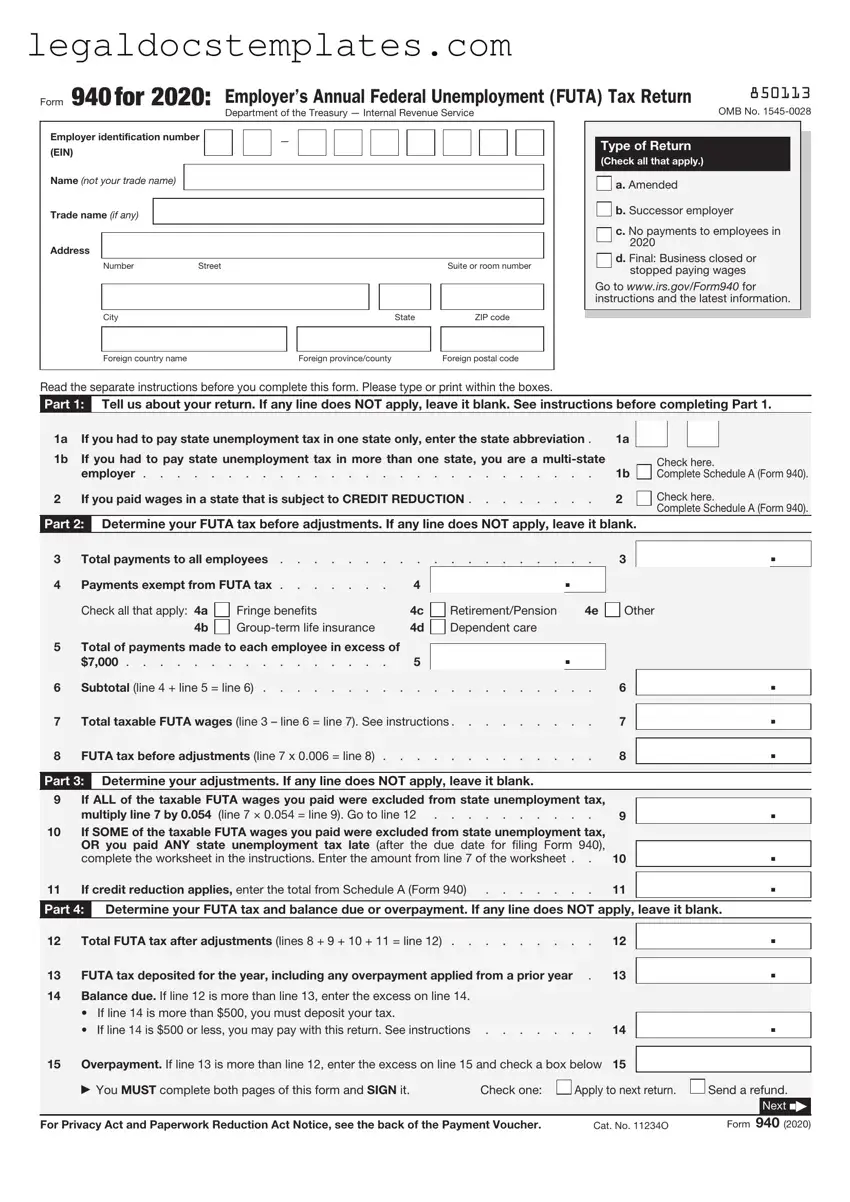

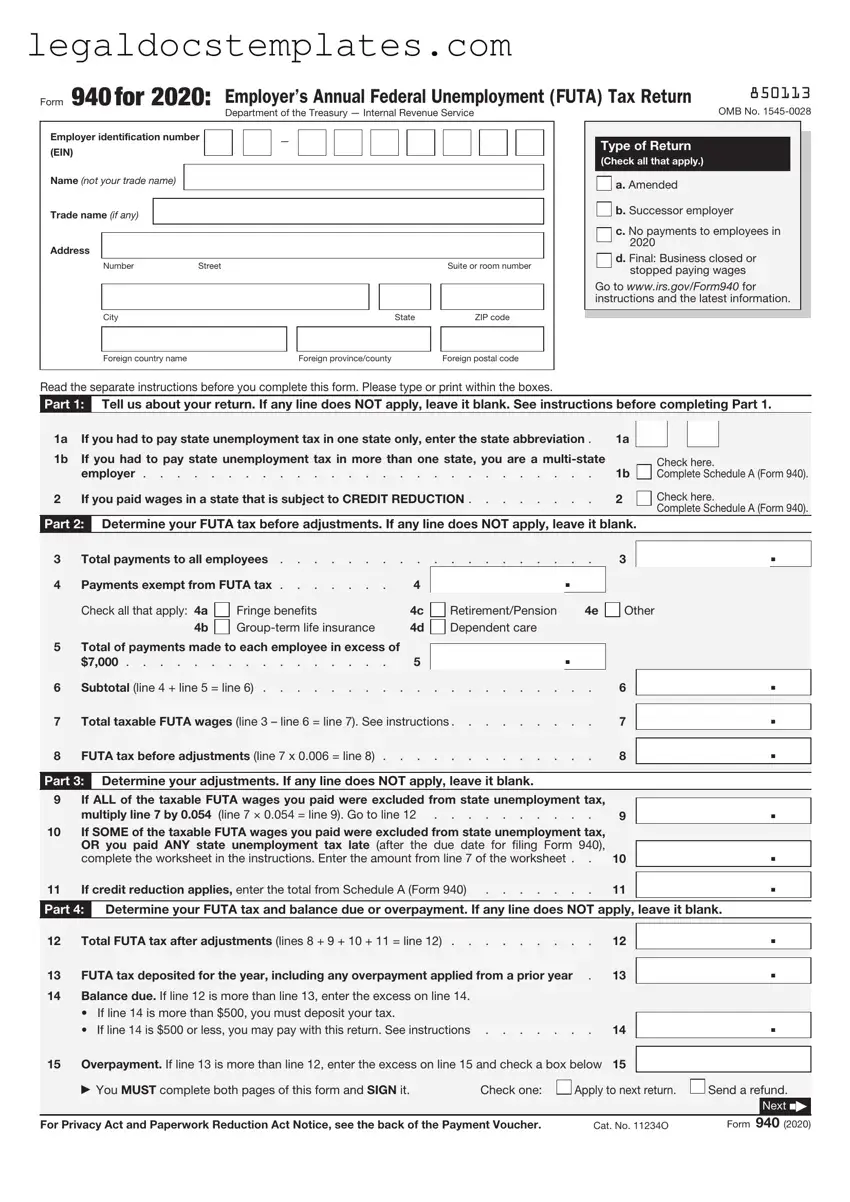

The IRS Form 940 is an annual tax form used by employers to report their federal unemployment tax liability. This form calculates how much the employer owes in unemployment tax for their employees. It helps fund state workforce agencies.

Employers who pay wages to employees and are involved in a business that affects commerce need to file Form 940. Specifically, if an employer has paid wages of $1,500 or more in any quarter, or had one or more employees for at least some part of a day in 20 or more different weeks of the year, they are required to file.

The due date for filing Form 940 is January 31st of the year following the reported year. However, if the employer has deposited all the FUTA tax when it was due, they have until February 10th to file.

How is the FUTA tax rate determined?

The FUTA tax rate is typically 6.0% of the first $7,000 paid to each employee annually. Employers may receive a credit of up to 5.4% against their FUTA tax, reducing the effective rate to 0.6%, if they have paid their state unemployment taxes in full and on time.

What qualifies for a credit reduction?

A credit reduction state is one that has not repaid money it borrowed from the federal government to pay unemployment benefits. Employers in these states may have a reduced credit on their Form 940, which results in a higher tax due to the IRS.

What should I do if I overpaid my FUTA tax?

If you overpaid your FUTA tax, you can choose to have the overpayment refunded or applied to your next return. To do this, complete the Form 940 according to the instructions, including the amount of the overpayment and your choice of refund or credit.

Yes, Form 940 can be filed electronically through the IRS e-file system. Filing electronically is convenient and ensures faster processing of returns. Employers can use IRS-approved e-file providers or software to file.

Employers who fail to file Form 940 by the deadline may face penalties. The penalty rate is typically 5% of the unpaid tax for each month or part of a month the return is late, up to 25%. Further penalties may apply for not paying the tax due on time.

.

. .

. .

. .

. .

.

No.

No.