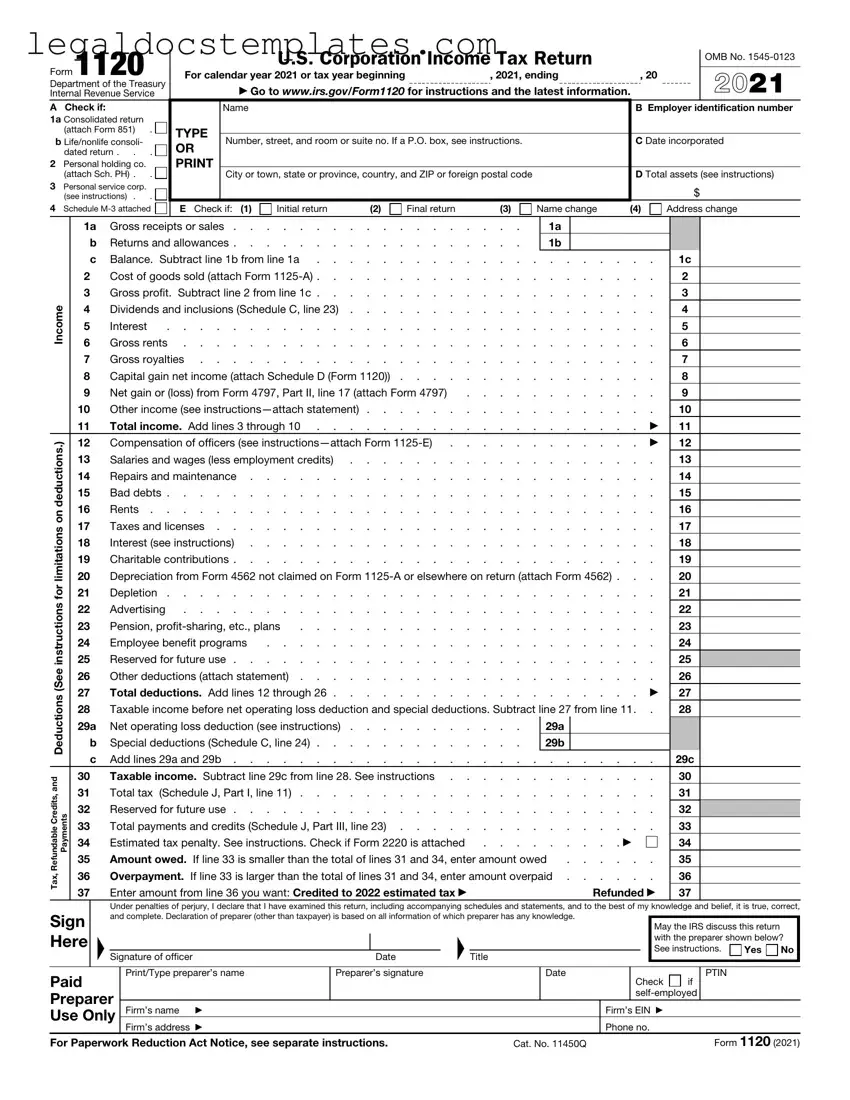

Form 1120 (2021) |

|

|

Page 2 |

Schedule C |

Dividends, Inclusions, and Special Deductions (see |

(a) Dividends and |

(b) % |

(c) Special deductions |

|

instructions) |

inclusions |

(a) × (b) |

|

|

1Dividends from less-than-20%-owned domestic corporations (other than debt-financed

2Dividends from 20%-or-more-owned domestic corporations (other than debt-financed

|

stock) |

65 |

|

|

See |

3 |

Dividends on certain debt-financed stock of domestic and foreign corporations . . |

instructions |

4 |

Dividends on certain preferred stock of less-than-20%-owned public utilities . . . |

23.3 |

5 |

Dividends on certain preferred stock of 20%-or-more-owned public utilities . . . . |

26.7 |

6 |

Dividends from less-than-20%-owned foreign corporations and certain FSCs . . . |

50 |

7 |

Dividends from 20%-or-more-owned foreign corporations and certain FSCs . . . |

65 |

8 |

Dividends from wholly owned foreign subsidiaries |

100 |

|

|

See |

9 |

Subtotal. Add lines 1 through 8. See instructions for limitations |

instructions |

10Dividends from domestic corporations received by a small business investment

|

company operating under the Small Business Investment Act of 1958 |

100 |

11 |

Dividends from affiliated group members |

100 |

12 |

Dividends from certain FSCs |

100 |

13Foreign-source portion of dividends received from a specified 10%-owned foreign

|

corporation (excluding hybrid dividends) (see instructions) |

|

100 |

|

14 |

Dividends from foreign corporations not included on line 3, 6, 7, 8, 11, 12, or 13 |

|

|

|

(including any hybrid dividends) |

|

|

|

15 |

Reserved for future use |

|

|

|

|

16a |

Subpart F inclusions derived from the sale by a controlled foreign corporation (CFC) of |

|

|

|

the stock of a lower-tier foreign corporation treated as a dividend (attach Form(s) 5471) |

100 |

|

|

(see instructions) |

|

|

b |

Subpart F inclusions derived from hybrid dividends of tiered corporations (attach Form(s) |

|

|

|

5471) (see instructions) |

|

|

|

c |

Other inclusions from CFCs under subpart F not included on line 16a, 16b, or 17 (attach |

|

|

|

Form(s) 5471) (see instructions) |

|

|

17 |

Global Intangible Low-Taxed Income (GILTI) (attach Form(s) 5471 and Form 8992) . . |

18 |

Gross-up for foreign taxes deemed paid |

19 |

IC-DISC and former DISC dividends not included on line 1, 2, or 3 |

20 |

Other dividends |

21 |

Deduction for dividends paid on certain preferred stock of public utilities . . . . |

22 |

Section 250 deduction (attach Form 8993) |

23Total dividends and inclusions. Add column (a), lines 9 through 20. Enter here and on page 1, line 4 . . . . . . . . . . . . . . . . . . . . . .

24 |

Total special deductions. Add column (c), lines 9 through 22. Enter here and on page 1, line 29b |

Form 1120 (2021)

|

|

|

|

|

|

|

|

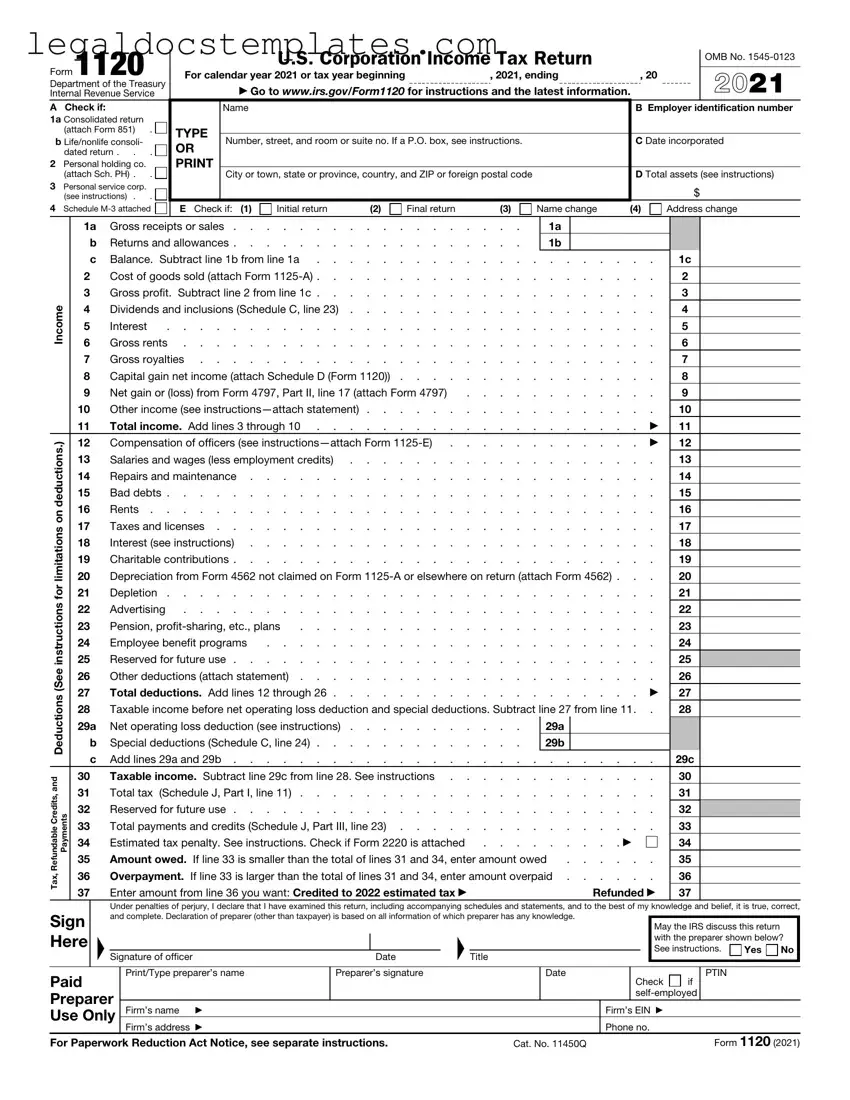

Form 1120 (2021) |

|

|

|

|

|

Page 3 |

Schedule J |

Tax Computation and Payment (see instructions) |

|

|

|

|

|

Part I—Tax Computation |

|

|

|

|

|

1 |

Check if the corporation is a member of a controlled group (attach Schedule O (Form 1120)). See instructions |

▶ |

|

|

2 |

Income tax. See instructions |

. . . . |

. . . |

2 |

|

3 |

Base erosion minimum tax amount (attach Form 8991) |

. . . . |

. . . |

3 |

|

4 |

Add lines 2 and 3 |

. . . . |

. . . |

4 |

|

5a |

Foreign tax credit (attach Form 1118) |

5a |

|

|

|

|

b |

Credit from Form 8834 (see instructions) |

5b |

|

|

|

|

c |

General business credit (attach Form 3800) |

5c |

|

|

|

|

d |

Credit for prior year minimum tax (attach Form 8827) |

5d |

|

|

|

|

e |

Bond credits from Form 8912 |

5e |

|

|

|

|

6 |

Total credits. Add lines 5a through 5e |

. . . . |

. . . |

6 |

|

7 |

Subtract line 6 from line 4 |

. . . . |

. . . |

7 |

|

8 |

Personal holding company tax (attach Schedule PH (Form 1120)) |

. . . . |

. . . |

8 |

|

9a |

Recapture of investment credit (attach Form 4255) |

9a |

|

|

|

|

b |

Recapture of low-income housing credit (attach Form 8611) |

9b |

|

|

|

|

c |

Interest due under the look-back method—completed long-term contracts (attach |

|

|

|

|

|

|

Form 8697) |

9c |

|

|

|

|

d |

Interest due under the look-back method—income forecast method (attach Form 8866) |

9d |

|

|

|

|

e |

Alternative tax on qualifying shipping activities (attach Form 8902) |

9e |

|

|

|

|

f |

Interest/tax due under section 453A(c) and/or section 453(l) |

9f |

|

|

|

|

g |

Other (see instructions—attach statement) |

9g |

|

|

|

|

10 |

Total. Add lines 9a through 9g |

. . . . |

. . . |

10 |

|

11 |

Total tax. Add lines 7, 8, and 10. Enter here and on page 1, line 31 |

. . . . |

. . . |

11 |

|

Part II—Reserved For Future Use

12 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part III—Payments and Refundable Credits

13 |

2020 overpayment credited to 2021 |

. . . . . . . . |

13 |

|

|

14 |

2021 estimated tax payments |

. . . . . . . . |

14 |

|

|

15 |

2021 refund applied for on Form 4466 |

. . . . . . . . |

15 |

( |

) |

16 |

Combine lines 13, 14, and 15 |

. . . . . . . . |

16 |

|

|

17 |

Tax deposited with Form 7004 |

. . . . . . . . |

17 |

|

|

18 |

Withholding (see instructions) |

. . . . . . . . |

18 |

|

|

19 |

Total payments. Add lines 16, 17, and 18 |

. . . . . . . . |

19 |

|

|

20 |

Refundable credits from: |

|

|

|

|

|

|

a |

Form 2439 |

|

20a |

|

|

|

|

b |

Form 4136 |

|

20b |

|

|

|

|

c |

Reserved for future use |

|

20c |

|

|

|

|

d |

Other (attach statement—see instructions) |

|

20d |

|

|

|

|

21 |

Total credits. Add lines 20a through 20d |

. . . . . . . . |

21 |

|

|

22 |

Reserved for future use |

. . . . . . . . |

22 |

|

|

23 |

Total payments and credits. Add lines 19 and 21. Enter here and on page 1, line 33 . |

. . . . . . . . |

23 |

|

|

|

|

|

|

|

|

|

Form 1120 (2021) |

Schedule K Other Information (see instructions)

1 |

Check accounting method: a |

Cash |

b |

Accrual |

c |

Other (specify) ▶ |

2See the instructions and enter the: a Business activity code no. ▶

b Business activity ▶ c Product or service ▶

3 Is the corporation a subsidiary in an affiliated group or a parent–subsidiary controlled group? . . . . . . . . . .

If “Yes,” enter name and EIN of the parent corporation ▶

4At the end of the tax year:

aDid any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or tax-exempt organization own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of the

corporation’s stock entitled to vote? If “Yes,” complete Part I of Schedule G (Form 1120) (attach Schedule G) . . . . . .

bDid any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all

classes of the corporation’s stock entitled to vote? If “Yes,” complete Part II of Schedule G (Form 1120) (attach Schedule G) .

5At the end of the tax year, did the corporation:

aOwn directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of stock entitled to vote of any foreign or domestic corporation not included on Form 851, Affiliations Schedule? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (iv) below.

(ii)Employer

Identification Number

(if any)

(iii)Country of Incorporation

(iv)Percentage Owned in Voting

Stock

bOwn directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (iv) below.

(ii)Employer

Identification Number

(if any)

(iii)Country of Organization

(iv)Maximum

Percentage Owned in Profit, Loss, or Capital

6During this tax year, did the corporation pay dividends (other than stock dividends and distributions in exchange for stock) in

excess of the corporation’s current and accumulated earnings and profits? See sections 301 and 316 . . . . . . . .

If “Yes,” file Form 5452, Corporate Report of Nondividend Distributions. See the instructions for Form 5452. If this is a consolidated return, answer here for the parent corporation and on Form 851 for each subsidiary.

7At any time during the tax year, did one foreign person own, directly or indirectly, at least 25% of the total voting power of all classes of the corporation’s stock entitled to vote or at least 25% of the total value of all classes of the corporation’s stock? .

For rules of attribution, see section 318. If “Yes,” enter:

(a) Percentage owned ▶ |

and (b) Owner’s country ▶ |

(c)The corporation may have to file Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business. Enter the number of Forms 5472 attached ▶

8 Check this box if the corporation issued publicly offered debt instruments with original issue discount . . . . . . ▶

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments.

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments.

9Enter the amount of tax-exempt interest received or accrued during the tax year ▶ $

10Enter the number of shareholders at the end of the tax year (if 100 or fewer) ▶

11If the corporation has an NOL for the tax year and is electing to forego the carryback period, check here (see instructions) ▶

If the corporation is filing a consolidated return, the statement required by Regulations section 1.1502-21(b)(3) must be attached or the election will not be valid.

12Enter the available NOL carryover from prior tax years (do not reduce it by any deduction reported on

page 1, line 29a.) . . . . . . . . . . . . . . . . . . . . . . . . . ▶ $

Schedule K Other Information (continued from page 4)

13 |

Are the corporation’s total receipts (page 1, line 1a, plus lines 4 through 10) for the tax year and its total assets at the end of the |

Yes No |

|

|

tax year less than $250,000? |

|

|

If “Yes,” the corporation is not required to complete Schedules L, M-1, and M-2. Instead, enter the total amount of cash |

|

|

distributions and the book value of property distributions (other than cash) made during the tax year ▶ $ |

|

14 |

Is the corporation required to file Schedule UTP (Form 1120), Uncertain Tax Position Statement? See instructions . . . . |

|

|

If “Yes,” complete and attach Schedule UTP. |

|

15a |

Did the corporation make any payments in 2021 that would require it to file Form(s) 1099? |

|

b |

If “Yes,” did or will the corporation file required Form(s) 1099? |

|

16During this tax year, did the corporation have an 80%-or-more change in ownership, including a change due to redemption of its

own stock? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17During or subsequent to this tax year, but before the filing of this return, did the corporation dispose of more than 65% (by value)

of its assets in a taxable, non-taxable, or tax deferred transaction? . . . . . . . . . . . . . . . . . .

18Did the corporation receive assets in a section 351 transfer in which any of the transferred assets had a fair market basis or fair

market value of more than $1 million? . . . . . . . . . . . . . . . . . . . . . . . . . . .

19During the corporation’s tax year, did the corporation make any payments that would require it to file Forms 1042 and 1042-S under chapter 3 (sections 1441 through 1464) or chapter 4 (sections 1471 through 1474) of the Code? . . . . . . . .

20 Is the corporation operating on a cooperative basis?. . . . . . . . . . . . . . . . . . . . . . .

21During the tax year, did the corporation pay or accrue any interest or royalty for which the deduction is not allowed under section

267A? See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” enter the total amount of the disallowed deductions ▶ $

22Does the corporation have gross receipts of at least $500 million in any of the 3 preceding tax years? (See sections 59A(e)(2)

and (3)) . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

If “Yes,” complete and attach Form 8991.

23Did the corporation have an election under section 163(j) for any real property trade or business or any farming business in effect

|

during the tax year? See instructions |

24 |

Does the corporation satisfy one or more of the following? See instructions |

aThe corporation owns a pass-through entity with current, or prior year carryover, excess business interest expense.

bThe corporation’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years preceding the current tax year are more than $26 million and the corporation has business interest expense.

cThe corporation is a tax shelter and the corporation has business interest expense. If “Yes,” complete and attach Form 8990.

25 |

Is the corporation attaching Form 8996 to certify as a Qualified Opportunity Fund? |

|

If “Yes,” enter amount from Form 8996, line 15 . . . . ▶ $ |

26Since December 22, 2017, did a foreign corporation directly or indirectly acquire substantially all of the properties held directly or indirectly by the corporation, and was the ownership percentage (by vote or value) for purposes of section 7874 greater than 50% (for example, the shareholders held more than 50% of the stock of the foreign corporation)? If “Yes,” list the ownership

percentage by vote and by value. See instructions . . . . . . . . . . . . . . . . . . . . . . .

Percentage: By Vote |

By Value |

Form 1120 (2021)

Form 1120 (2021) |

|

|

|

|

|

|

|

|

|

|

|

|

Page 6 |

Schedule L |

|

Balance Sheets per Books |

|

|

Beginning of tax year |

|

|

End of tax year |

|

|

|

|

Assets |

|

|

|

|

(a) |

|

(b) |

|

(c) |

|

|

(d) |

1 |

Cash |

|

|

|

|

|

|

|

|

|

|

2a |

Trade notes and accounts receivable . . . |

|

|

|

|

|

|

|

|

|

b |

Less allowance for bad debts . . |

. . . |

|

( |

|

) |

|

( |

) |

|

|

3 |

Inventories |

|

|

|

|

|

|

|

|

|

4 |

U.S. government obligations |

. . . . . |

|

|

|

|

|

|

|

|

|

|

5 |

Tax-exempt securities (see instructions) . . |

|

|

|

|

|

|

|

|

|

|

6 |

Other current assets (attach statement) . . |

|

|

|

|

|

|

|

|

|

|

7 |

Loans to shareholders |

|

|

|

|

|

|

|

|

|

|

8 |

Mortgage and real estate loans |

|

|

|

|

|

|

|

|

|

|

9 |

Other investments (attach statement) . . . |

|

|

|

|

|

|

|

|

|

|

10a |

Buildings and other depreciable assets . . |

|

|

|

|

|

|

|

|

|

b |

Less accumulated depreciation . . |

. . . |

|

( |

|

) |

|

( |

) |

|

|

11a |

Depletable assets |

|

|

|

|

|

|

|

|

|

b |

Less accumulated depletion . . . |

. . . |

|

( |

|

) |

|

( |

) |

|

|

12 |

Land (net of any amortization) |

|

|

|

|

|

|

|

|

|

13a |

Intangible assets (amortizable only) |

. . . |

|

|

|

|

|

|

|

|

|

|

b |

Less accumulated amortization . . |

. . . |

|

( |

|

) |

|

( |

) |

|

|

14 |

Other assets (attach statement) |

|

|

|

|

|

|

|

|

|

|

15 |

Total assets |

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

16 |

Accounts payable |

|

|

|

|

|

|

|

|

|

|

17 |

Mortgages, notes, bonds payable in less than 1 year |

|

|

|

|

|

|

|

|

|

|

18 |

Other current liabilities (attach statement) . . |

|

|

|

|

|

|

|

|

|

|

19 |

Loans from shareholders |

|

|

|

|

|

|

|

|

|

|

20 |

Mortgages, notes, bonds payable in 1 year or more |

|

|

|

|

|

|

|

|

|

|

21 |

Other liabilities (attach statement) . . . . |

|

|

|

|

|

|

|

|

|

|

22 |

Capital stock: |

a Preferred stock . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

b Common stock . . . . |

|

|

|

|

|

|

|

|

|

|

23 |

Additional paid-in capital |

|

|

|

|

|

|

|

|

|

|

24 |

Retained earnings—Appropriated (attach statement) |

|

|

|

|

|

|

|

|

|

|

25 |

Retained earnings—Unappropriated . . . |

|

|

|

|

|

|

|

|

|

|

26 |

Adjustments to shareholders’ equity (attach statement) |

|

|

|

|

|

|

|

|

|

|

27 |

Less cost of treasury stock |

|

|

|

|

( |

) |

|

|

( |

) |

28 |

Total liabilities and shareholders’ equity . . |

|

|

|

|

|

|

|

|

|

Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return

Note: The corporation may be required to file Schedule M-3. See instructions.

1 |

Net income (loss) per books |

7 |

Income recorded on books this year |

2 |

Federal income tax per books |

|

|

not included on this return (itemize): |

3 |

Excess of capital losses over capital gains . |

|

|

Tax-exempt interest $ |

4Income subject to tax not recorded on books this year (itemize):

|

|

|

8 |

|

Deductions on this return not charged |

5 |

Expenses recorded on books this year not |

|

against book income this year (itemize): |

|

deducted on this return (itemize): |

a |

Depreciation . . $ |

a |

Depreciation . . . . $ |

b |

Charitable contributions $ |

bCharitable contributions . $

cTravel and entertainment . $

|

|

|

9 |

Add lines 7 and 8 |

6 |

Add lines 1 through 5 |

10 |

Income (page 1, line 28)—line 6 less line 9 |

Schedule M-2 Analysis of Unappropriated Retained Earnings per Books (Schedule L, Line 25)

1 |

Balance at beginning of year |

5 |

Distributions: a Cash |

2 |

Net income (loss) per books |

|

|

|

b Stock . . . . |

3 |

Other increases (itemize): |

|

|

|

c Property . . . . |

|

|

|

6 |

Other decreases (itemize): |

|

|

|

7 |

Add lines 5 and 6 |

4 |

Add lines 1, 2, and 3 |

8 |

Balance at end of year (line 4 less line 7) |

Form 1120 (2021)

If checked, the corporation may have to file

If checked, the corporation may have to file