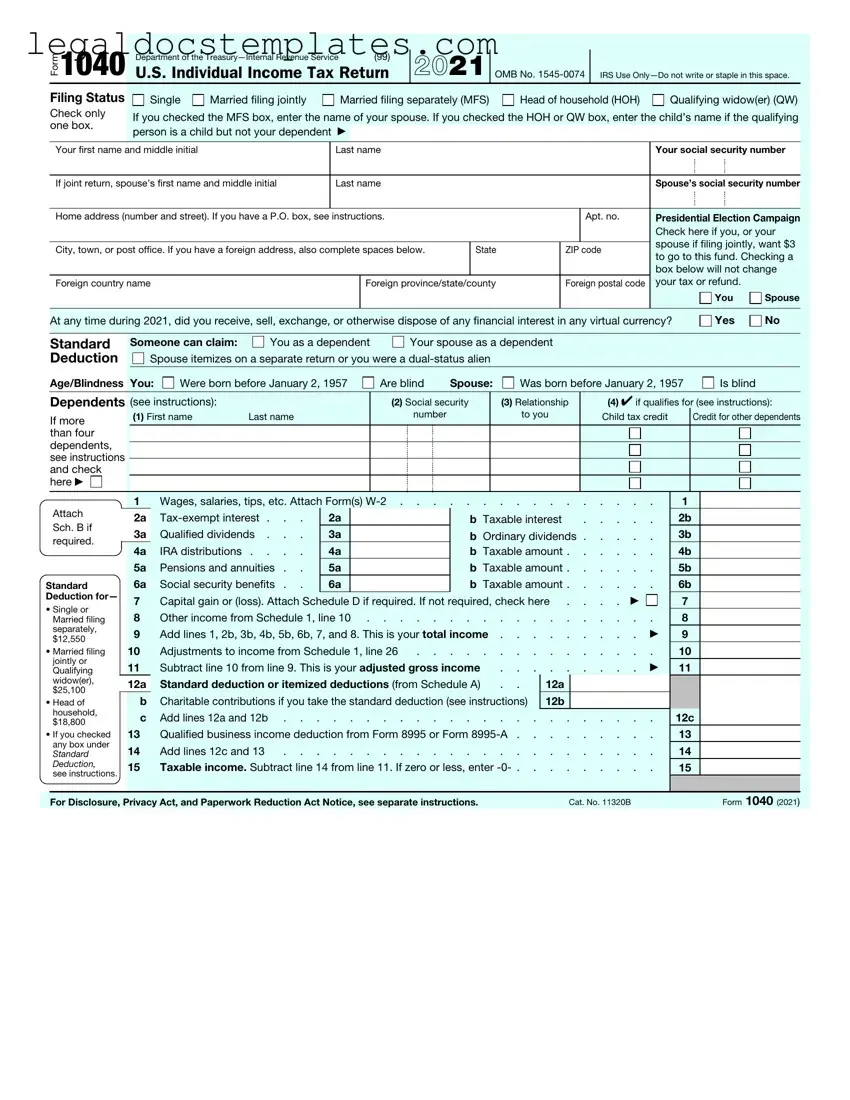

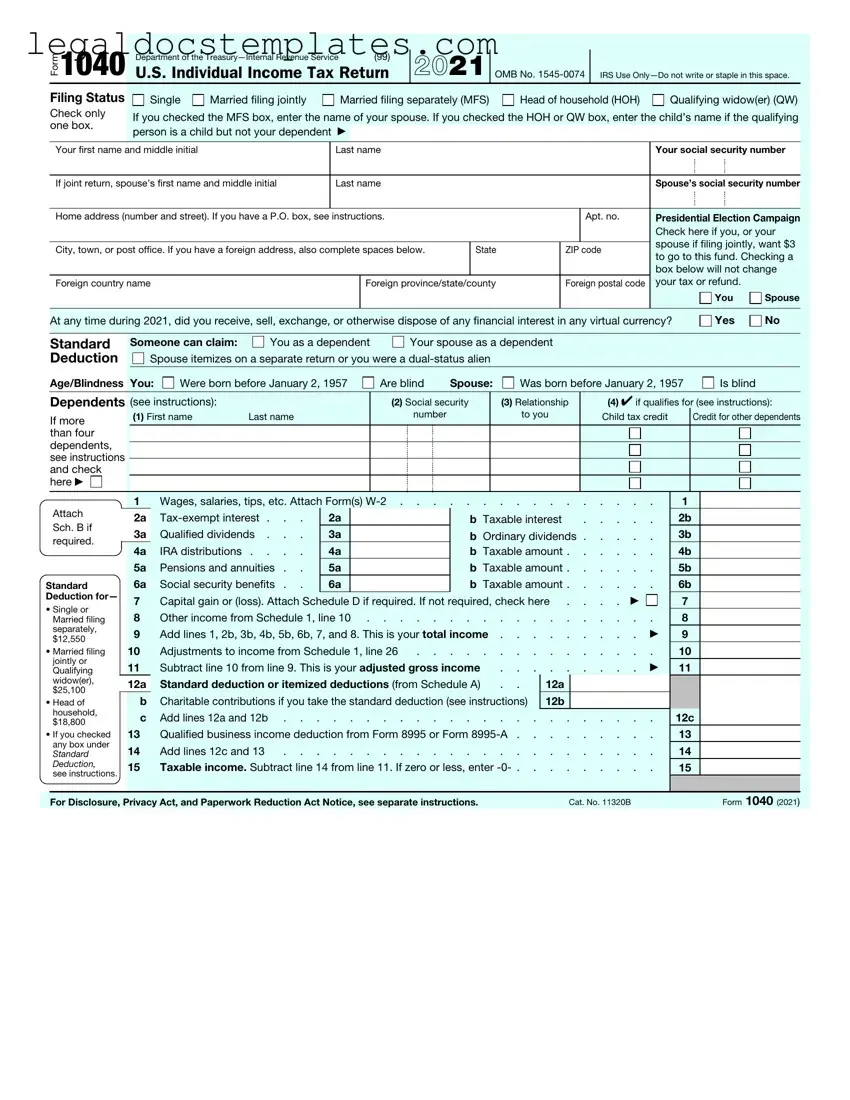

The IRS 1040 form is the standard federal income tax form used by individuals in the United States to file their annual income taxes. It serves as the primary vehicle for individuals to calculate and report their income, deductions, and credits to the Internal Revenue Service (IRS). You need to file a 1040 form if you have earned income during the year, have specific types of unearned income, such as dividends or interest, or if you qualify for certain credits and deductions. This form is required regardless of whether you owe taxes or are entitled to a refund.

As of the current tax year, there are a few different versions of the IRS 1040 form, each designed for specific tax situations:

-

Form 1040:

The standard form used by most U.S. taxpayers.

-

Form 1040-SR:

A version of the 1040 for taxpayers aged 65 and older, which has a larger font size and includes a chart to calculate the standard deduction.

-

Form 1040-NR:

A version for nonresident aliens who need to report income from U.S. sources.

The IRS 1040 form is divided into sections that cover different aspects of your financial information:

-

Filing Status and Personal Information:

Where you provide basic information such as your name, address, Social Security number, and filing status.

-

Income:

Where you report various types of income, including wages, salaries, interest, dividends, and distributions from retirement accounts.

-

Deductions:

This section allows you to claim deductions such as the standard deduction or itemized deductions, reducing your taxable income.

-

Tax and Credits:

Where you calculate the amount of tax you owe, and claim any applicable tax credits, which can reduce your tax bill directly.

-

Other Taxes:

For reporting additional taxes, such as self-employment tax or household employment taxes.

-

Payments:

Where you report any federal income tax withheld from your pay, estimated tax payments you've made, and other refundable credits.

-

Refund or Amount You Owe:

Where you calculate whether you are due a refund or owe additional taxes.

Normally, the deadline to file your IRS 1040 form is April 15th of the year following the tax year. However, if April 15th falls on a weekend or a legal holiday, the deadline is extended to the next business day. In certain circumstances, such as natural disasters or personal reasons, you may qualify for an extension to file your return, but it's important to note that an extension to file is not an extension to pay any taxes you owe.

Yes, the IRS encourages taxpayers to file their forms electronically. Electronic filing (e-filing) is not only faster but also more secure and accurate compared to paper filing. Additionally, e-filing can result in a quicker tax refund if you are entitled to one. The IRS provides several options for e-filing, including Free File for taxpayers who qualify based on income, and various approved tax preparation software.

If you realize you've made an error on your filed IRS 1040 form, you can correct it by filing an amended tax return using Form 1040-X. This form allows you to make changes to your previously filed 1040 forms, including changes to your income, deductions, or credits. It's important to file Form 1040-X as soon as you discover the error to avoid potential interest and penalties. Additionally, you can use this form to claim a refund within three years from the date you filed your original return or within two years from the date you paid the tax, whichever is later.

There are several resources available if you need help completing your IRS 1040 form. The IRS offers free tax help for taxpayers who qualify, including the Volunteer Income Tax Assistance (VITA) program for those who make $57,000 or less, persons with disabilities, and limited English-speaking taxpayers. The Tax Counseling for the Elderly (TCE) program offers free tax help for all taxpayers, particularly those who are 60 years of age and older. Additionally, you can seek help from a professional tax preparer, use approved tax preparation software, or contact the IRS directly for guidance.