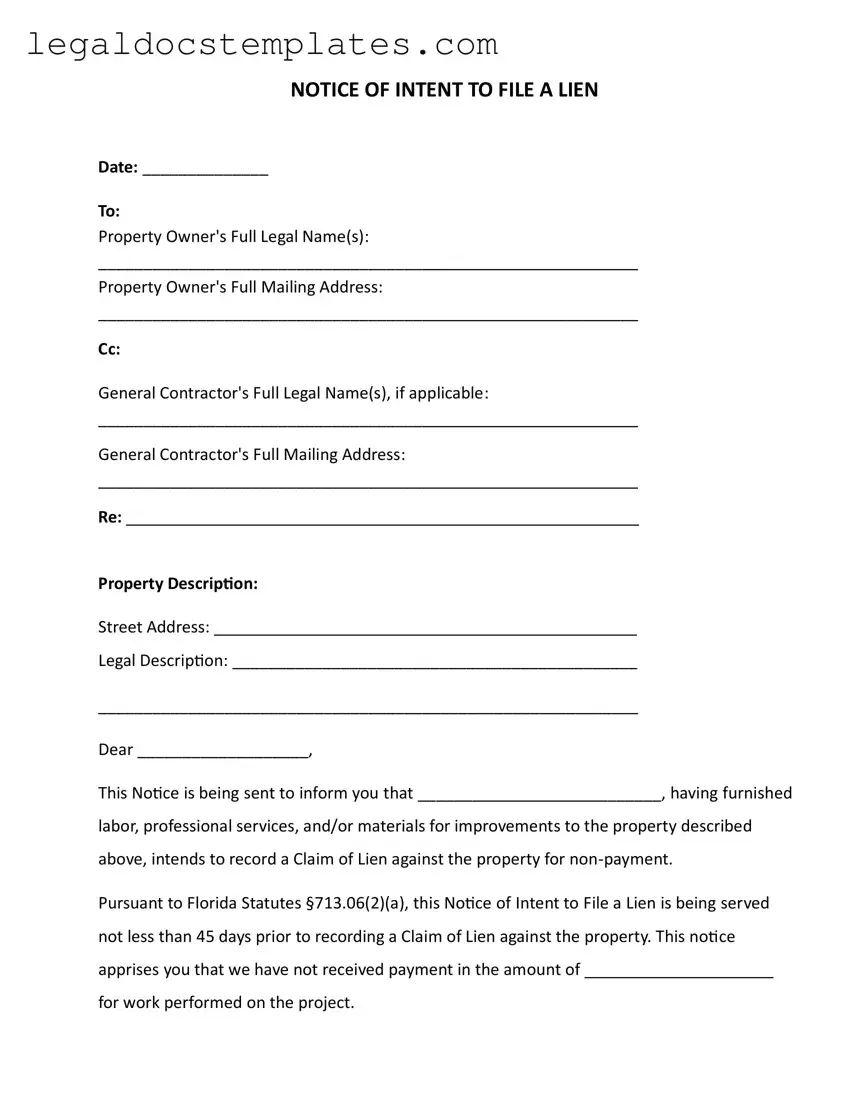

Fill Out Your Intent To Lien Florida Template

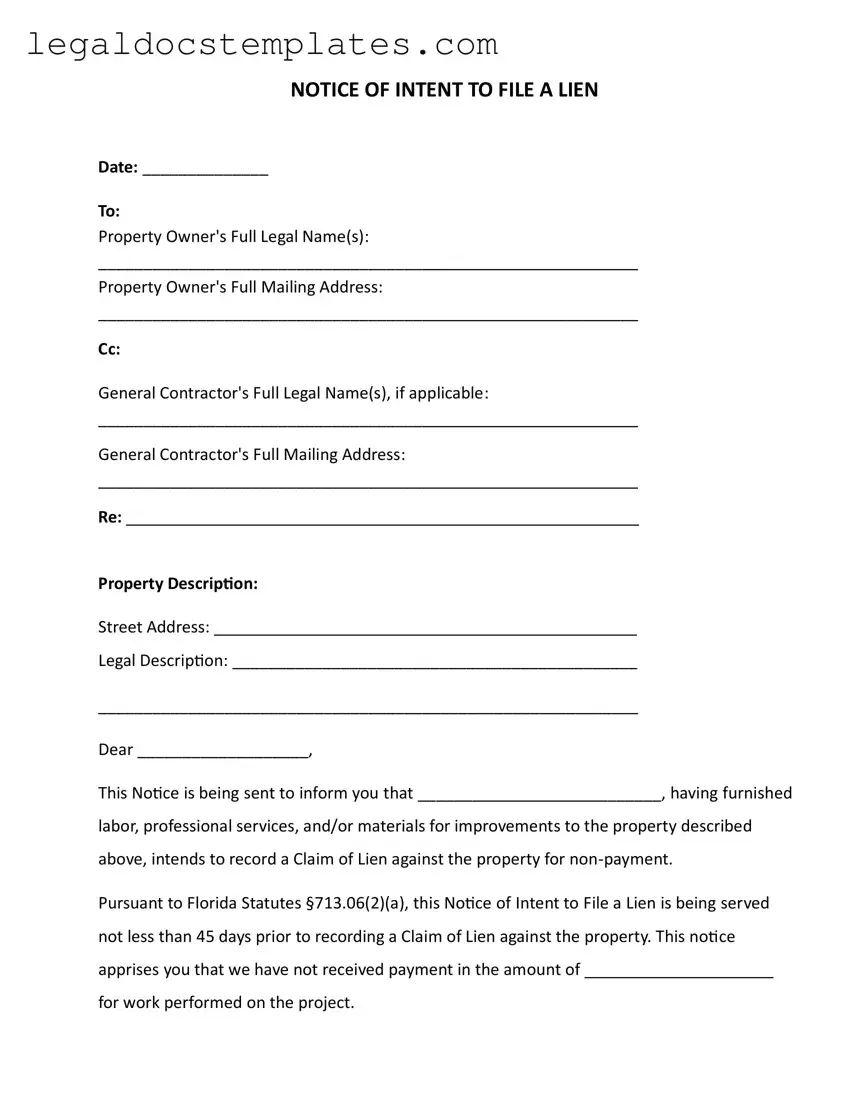

The Intent To Lien Florida form serves as a preliminary notification to property owners that a lien will be filed against their property due to unpaid labor, services, or materials. This legal document must be sent at least 45 days before filing the actual lien, as required by Florida Statutes §713.06(2)(a), to provide an opportunity for the property owner to settle the debt. It highlights the consequences of ignoring the notice, including potential foreclosure and additional costs. Click the button below to fill out your Intent To Lien Florida form.

Access Intent To Lien Florida Now

Fill Out Your Intent To Lien Florida Template

Access Intent To Lien Florida Now

Access Intent To Lien Florida Now

or

⇩ PDF Form

Don’t spend hours on this form

Complete Intent To Lien Florida online in minutes, fully digital.