The Independent Contractor Agreement closely resembles the Independent Contractor Pay Stub form in purpose and content. This agreement outlines the terms and conditions between a contractor and their client, including payment details similar to those found on a pay stub. It serves as a foundational document that clarifies the nature of the work, payment schedule, and responsibilities of both parties, thus providing a comprehensive backdrop for the transactional details recorded on the pay stubs.

An Invoice generated by an independent contractor bears a strong similarity to the Independent Contractor Pay Stub. Invoices detail the services provided, the cost of these services, and the payment terms. Like pay stubs, they serve as a record of the transaction between the contractor and the client but are primarily focused on requesting payment for completed work, reflecting a complementary piece in the financial exchanges between independent contractors and their clients.

The 1099-MISC Form, used for reporting earnings to the Internal Revenue Service (IRS), shares key features with the Independent Contractor Pay Stub. This form records an individual's income from self-employment or other non-employee compensations over the year. While a pay stub details individual payments for services, the 1099-MISC aggregates these amounts to report annual income, making it an essential document for tax purposes for independent contractors.

A Project Contract can be considered similar to the Independent Contractor Pay Stub in its formalization of the work arrangement between a contractor and a client. It details the specifics of the project, including the scope of work, deadlines, and compensation agreements. The pay stub, in turn, acts as a record of the payment transactions based on the agreed terms in the project contract, ensuring both parties have a documented understanding and agreement on the financial aspects of the project.

Time Sheets or Work Logs used by independent contractors also share a functional similarity with the Independent Contractor Pay Stub. These documents track the hours worked or milestones achieved, which are crucial for calculating payment. While the time sheets record the quantity and sometimes the nature of the work done, the pay stub translates these hours or achievements into monetary compensation, providing a clear link between work performed and payment received.

The Service Agreement, much like the Independent Contractor Agreement, sets the terms of service between a contractor and a client, including provisions for compensation that will be later detailed in the pay stubs. It is more specific to the services provided rather than the general working relationship. The pay stub, then, acts as a transactional documentation of these agreements, offering a detailed account of how the services have been compensated according to the agreement.

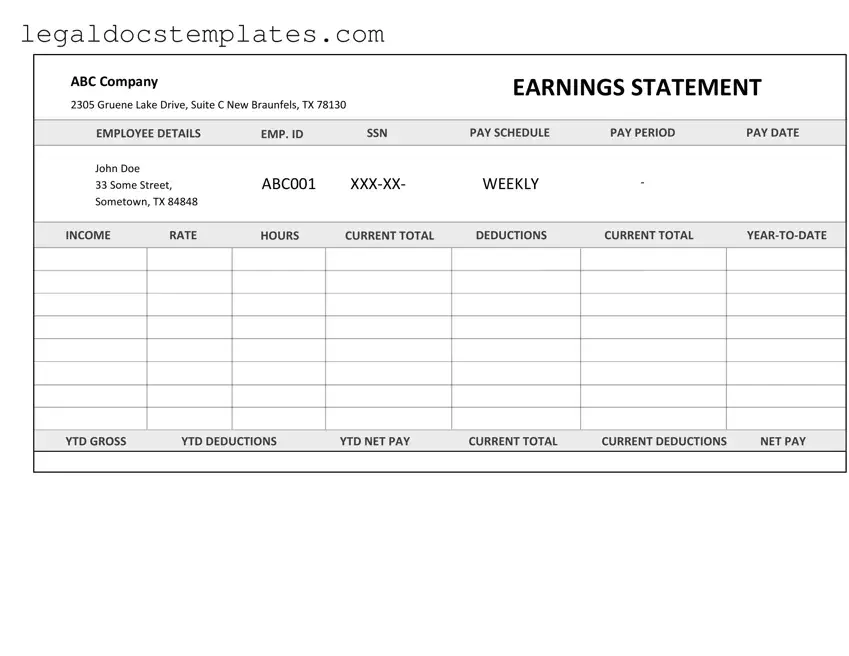

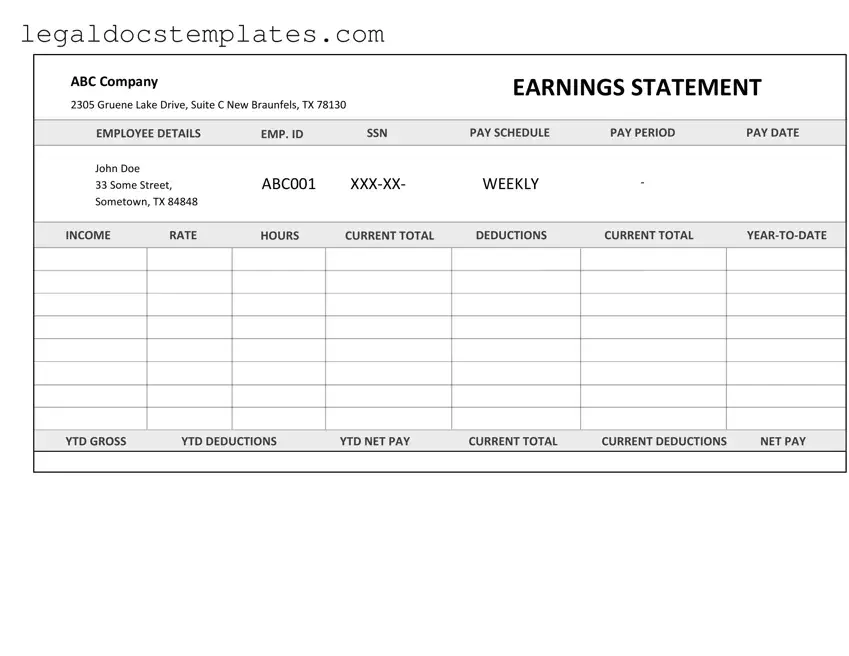

A Receipt issued upon payment to an independent contractor is akin to an Independent Contractor Pay Stub in its function as proof of payment. While a pay stub summarizes the details of the payment like amount, deductions, and net pay, a receipt acknowledges the receipt of the payment. These documents complement each other in providing a full picture of the financial transaction between an independent contractor and their client, ensuring both have a record for their accounts.