When selling or purchasing a horse, using a Horse Bill of Sale form is crucial for both the buyer and the seller to ensure a smooth and clear transaction. However, mistakes in filling out this form can lead to misunderstandings, legal issues, or financial losses. Here are ten common errors to avoid.

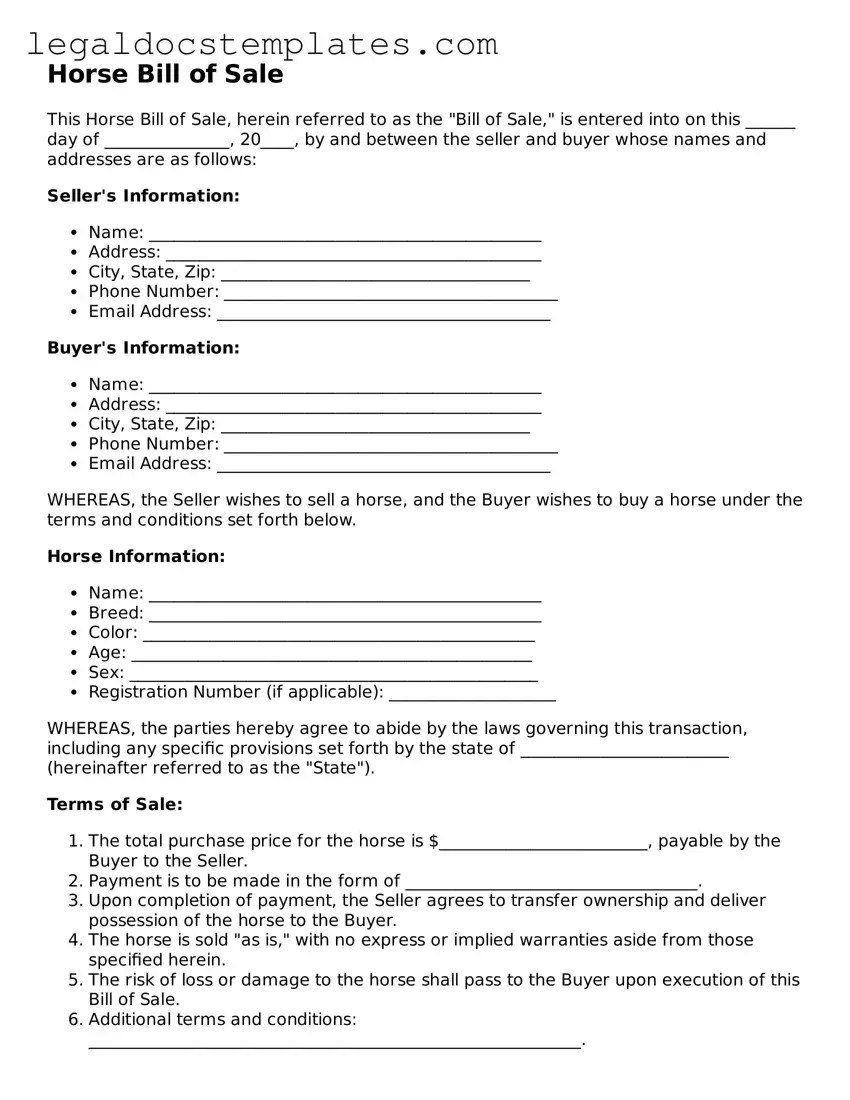

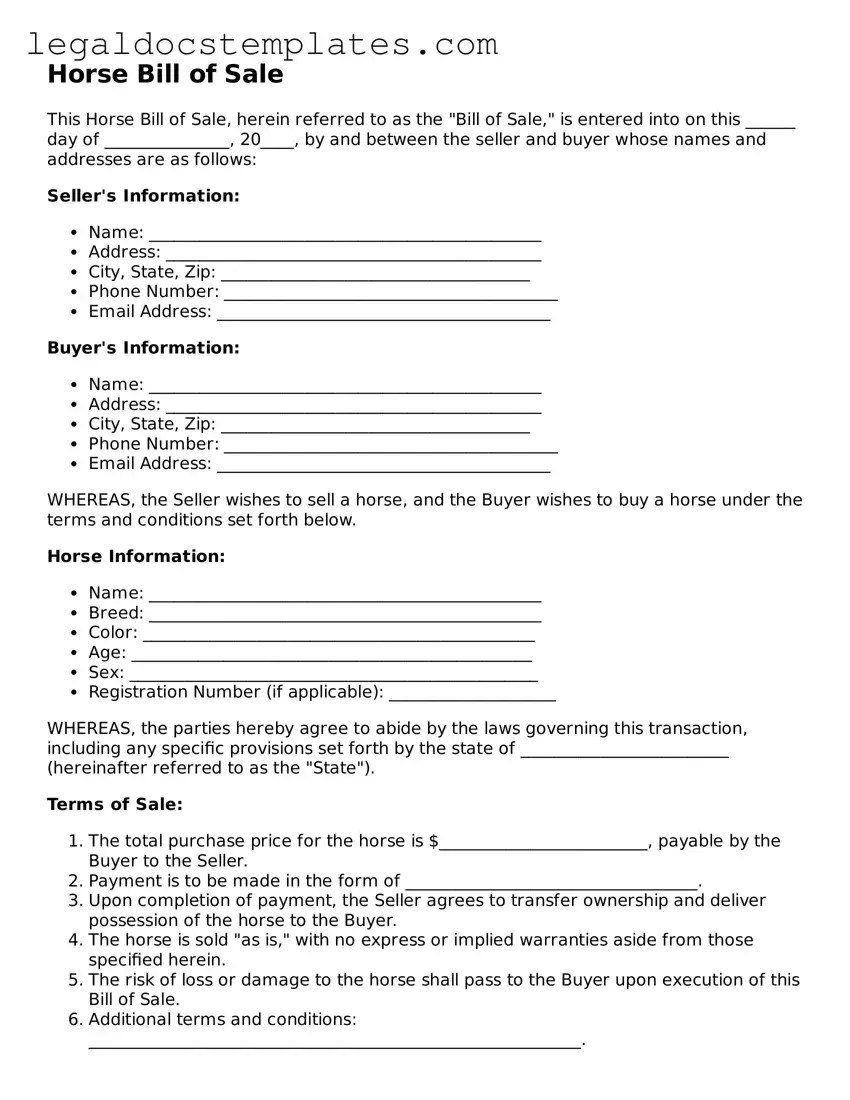

Firstly, many fail to include all relevant details of the horse, such as its name, age, breed, color, and registration number (if applicable). These identifiers are essential for the clear identification of the animal being sold. Without this information, disputes about the identity of the horse sold could arise.

Another frequent oversight is not specifying the sale date and the sale amount in clear terms. The date of sale helps in recording when the ownership officially changed hands, while the sale amount is crucial for tax and legal records. Failure to accurately document these details can lead to tax issues or even challenges to the legality of the sale.

Many individuals neglect to mention any warranties or guarantees that come with the horse, such as assurances of the horse's health or training level. This omission can lead to disputes if the buyer discovers issues with the horse that were not disclosed at the time of sale. Including a detailed description of the horse's health and training status can prevent such conflicts.

Another common mistake is not properly addressing the terms of the sale. This includes payment plans, trial periods, or return policies. Clearly outlining these terms in the bill of sale can prevent misunderstandings and potential legal disputes in the future.

Including the signatures of both the buyer and the seller is a crucial step that is sometimes overlooked. Signatures legally bind both parties to the terms of the sale, making the document a vital piece of evidence in any future disputes. Notarization of the signatures, while not always mandatory, adds another layer of legal protection.

A significant error is failing to verify the information included in the Horse Bill of Sale. Incorrect details, such as the wrong registration number or incorrect descriptions, can void the sale or lead to legal challenges. Both parties should verify all information on the bill to ensure its accuracy before completing the sale.

Omitting the inclusion of any applicable laws or regulations governing the sale is another oversight. Different states may have specific requirements for the sale of horses, and failing to abide by these regulations can invalidate the bill of sale.

Failure to include any liens or encumbrances on the horse is yet another mistake. If the horse is subject to any claims or liabilities, these should be disclosed in the bill of sale. Omitting this information can lead to financial and legal complications for the buyer.

Not providing copies of the completed bill to all involved parties is a procedural lapse that some commit. Ensuring that both the buyer and seller, and any other relevant parties, have a copy of the bill is essential for transparency and future reference.

Lastly, a common mistake is treating the Horse Bill of Sale as a mere formality rather than an important legal document. Recognizing the significance of this document and ensuring it is thoroughly and accurately completed can protect both the buyer's and seller's interests and prevent future legal issues.