The Salvation Army donation receipt functions in a manner akin to the Goodwill receipt, serving as a documented acknowledgment of charitable contributions. This receipt confirms the donation of goods to the Salvation Army and is pivotal for tax deduction purposes, mirroring the utility and structure of the Goodwill receipt. By detailing the items donated, their condition, and an estimated value, it similarly assists donors in substantiating claims for tax reductions.

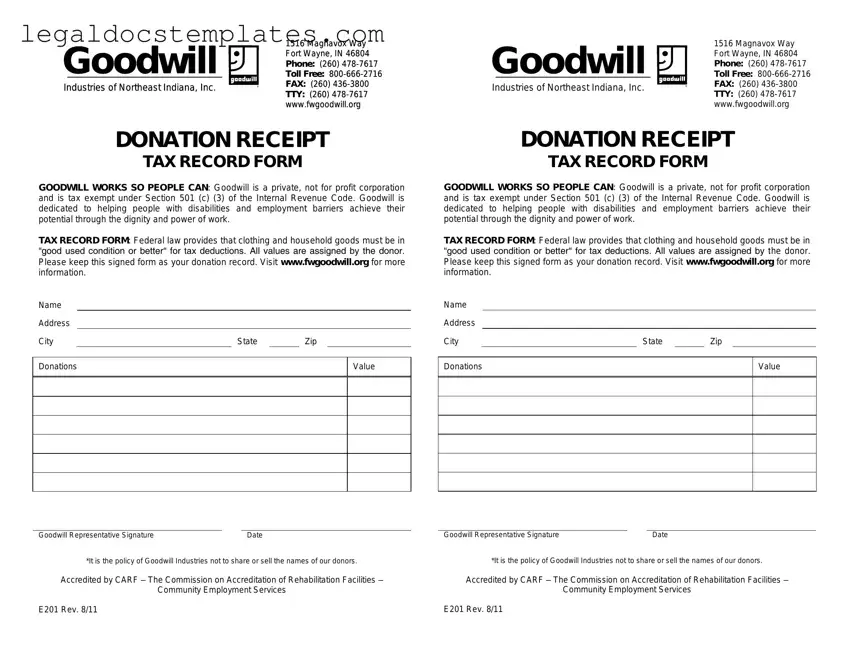

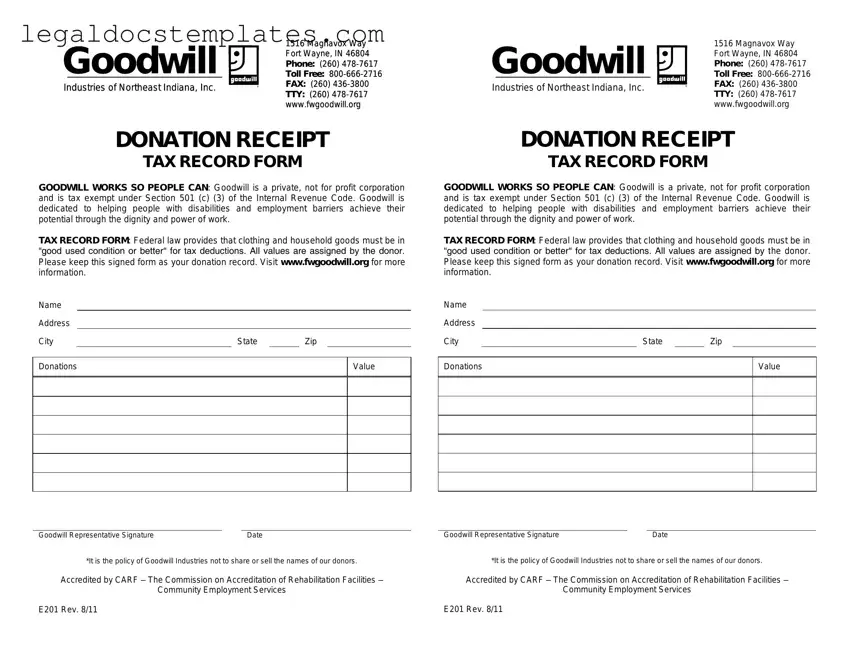

A tax deduction receipt from a nonprofit organization shares core similarities with the Goodwill donation receipt, operating as evidence of a charitable contribution. Such receipts are essential for individuals seeking to lower their taxable income through charitable donations. They list the donor's name, the date of the donation, and a description of the donated items, closely aligning with the format and purpose of the Goodwill receipt by providing necessary details for tax filing.

The Habitat for Humanity donation receipt also parallels the Goodwill receipt, recognizing the contribution of goods to another notable charitable institution. The receipt outlines the donation specifics, enabling donors to claim tax deductions. With its focus on building and renovating homes for families in need, Habitat for Humanity's receipt acknowledges various types of donations, including building materials, much like Goodwill's broad acceptance of goods, further emphasizing the correlation between their documentation practices.

An in-kind donation receipt is similar to the Goodwill donation receipt, acknowledging non-cash contributions to organizations. This includes donations of goods or services, which are critical for the operating capabilities of many nonprofits. The receipt documents the nature and estimated value of the contribution, akin to the Goodwill receipt, ensuring donors have the paperwork needed for tax purposes, underpinning the similarity in their functionalities.

A charitable contributions deduction form, like the Goodwill donation receipt, is integral for donors to benefit from tax deductions. This form is usually more detailed, requiring specific information about the donated items, their condition, and a fair market value estimate. Though it may be more comprehensive, its goal aligns with that of the Goodwill receipt: to provide donors with a document that supports their claim for a deduction, underscoring their comparable roles in the donation process.

A bookstore donation acknowledgment mirrors the Goodwill donation receipt when books are donated for resale or charitable purposes. It lists the volumes donated, often assigning a value to them for tax deduction purposes. This parallel process of valuating and acknowledging donations highlights the similarity between these receipts, catering to the needs of donors who contribute to different types of organizations yet seek recognition and tax benefits from their charitable actions.

The vehicle donation receipt issued by charities that accept cars, boats, or other vehicles as donations strongly resembles the Goodwill donation receipt in purpose and content. This type of receipt typically includes the donor's information, a description of the donated vehicle, and, sometimes, an estimated value or sale price. Similar to the Goodwill receipt, it plays a crucial role in confirming the donation and assisting the donor with tax deduction claims, underlining the resemblance in their contribution validation processes.

Finally, the thrift store donation receipt, provided by various thrift stores upon receiving donated goods, is closely related to the Goodwill donation receipt. It acknowledges the donation of items ranging from clothing to household goods, offering a basis for tax deductions. This type of receipt shares the goal of facilitating a tax benefit for the donor, illustrating their shared objective in encouraging and acknowledging donations to support their respective causes.