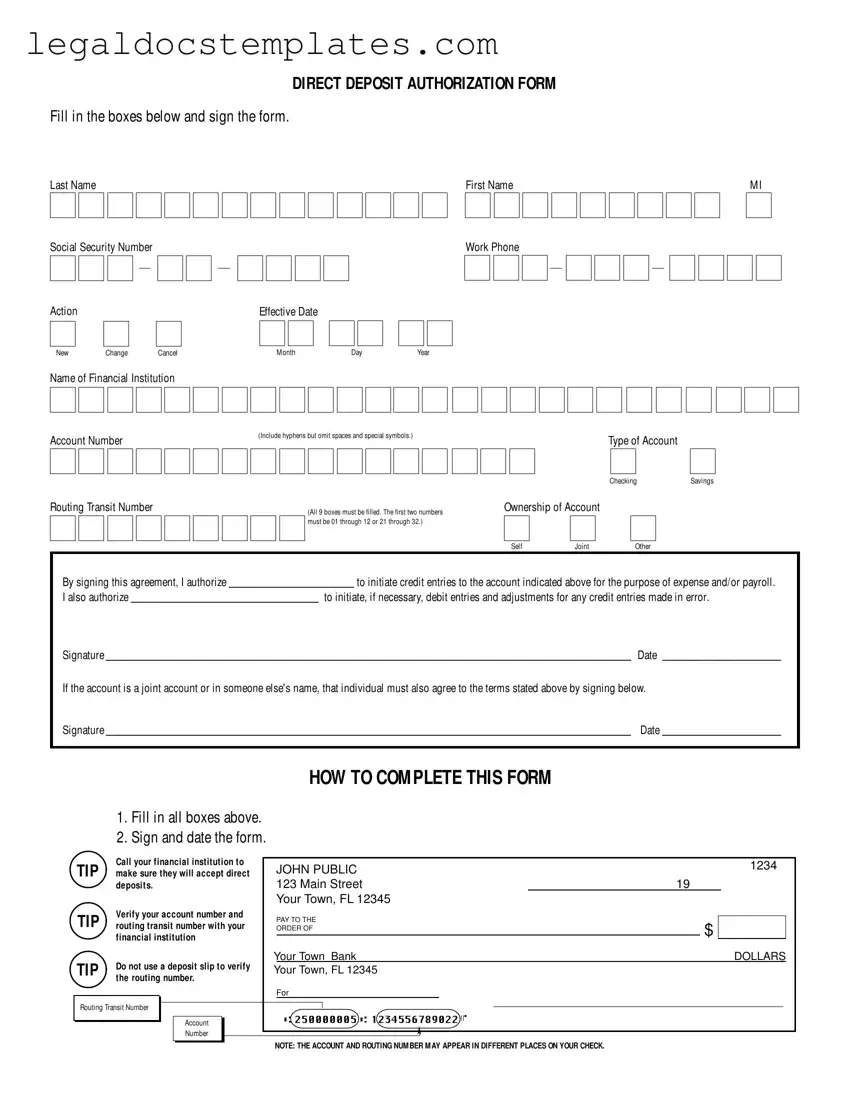

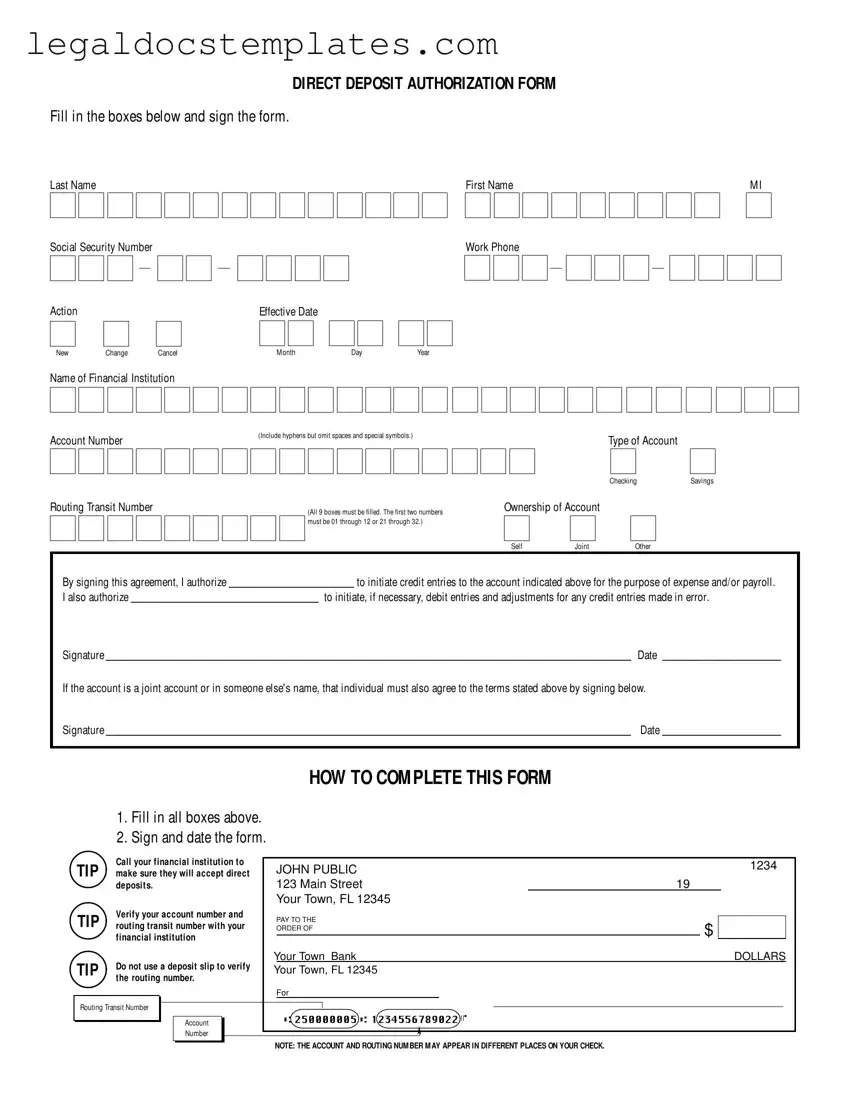

The Payroll Authorization form is quite similar to the Generic Direct Deposit Authorization form, as both are utilized to facilitate the deposit of funds into an employee's bank account by their employer. The main elements, such as employee information, bank account details (including account type and routing number), and authorization signatures, are present in both documents. However, the Payroll Authorization form may specifically focus on salary deposits, whereas the Generic Direct Deposit form can be applied to a variety of deposits beyond payroll, such as expense reimbursements.

A Bank Account Opening form shares characteristics with the Generic Direct Deposit form, primarily in gathering bank and personal information. This form is used when an individual decides to open a new bank account and requires submission of personal details, type of account to be opened (savings or checking), along with details about the financial institution. Unlike the direct deposit form, which authorizes transactions into an existing account, the account opening form initiates the creation of a new banking relationship.

The Electronic Funds Transfer (EFT) Authorization form is another document closely aligned with the Generic Direct Deposit form. It's designed to authorize the transfer of funds electronically from one bank account to another and covers a broad range of transactions, including bill payments and direct deposits. Both forms require the account holder's consent and include details like the account number, type, and routing number. However, the EFT Authorization form has a wider application, extending beyond employer-employee transactions.

Change of Address forms for financial institutions also bear resemblance to the Generic Direct Deposit form in that they record critical personal information updates that could affect account transactions. While the core purpose of this form is to update contact details, it often requires verification of the account holder's identity and account number, similar to what is required for setting up or changing direct deposit instructions. This ensures that all correspondence and transactions are accurately directed to the account holder.

The Authorization for Automatic Payment form is quite similar, designed to set up recurring payments from a bank account for obligations such as mortgages, loans, or utility bills. Like the direct deposit form, it necessitates the account holder’s banking information, including the account number and routing number, and needs a signature to authorize the transactions. The key difference is in the flow of funds; automatic payments authorize funds to go out, whereas direct deposits authorize funds to come in.

A Travel Expense Reimbursement form, while not directly related to the banking details, can closely align with the information and authorization sections found in a Generic Direct Deposit form when an employee seeks reimbursement via direct deposit. This form collects employee identification and banking information to facilitate depositing the reimbursement into the employee's bank account. The similarity lies in the utilization of bank account and routing numbers to ensure the accurate processing of funds.

Lastly, the Tax Refund Direct Deposit form provided by the IRS during tax return filing is analogous to the Generic Direct Deposit form. Taxpayers use it to designate an account for receiving their tax refund electronically. This form includes the taxpayer's personal information, bank account, and routing numbers, mirroring the direct deposit form's requirement for designated account details to receive funds. While its application is specific to tax refunds, the principle of electronically transferring funds to a predetermined account remains consistent.

□

□