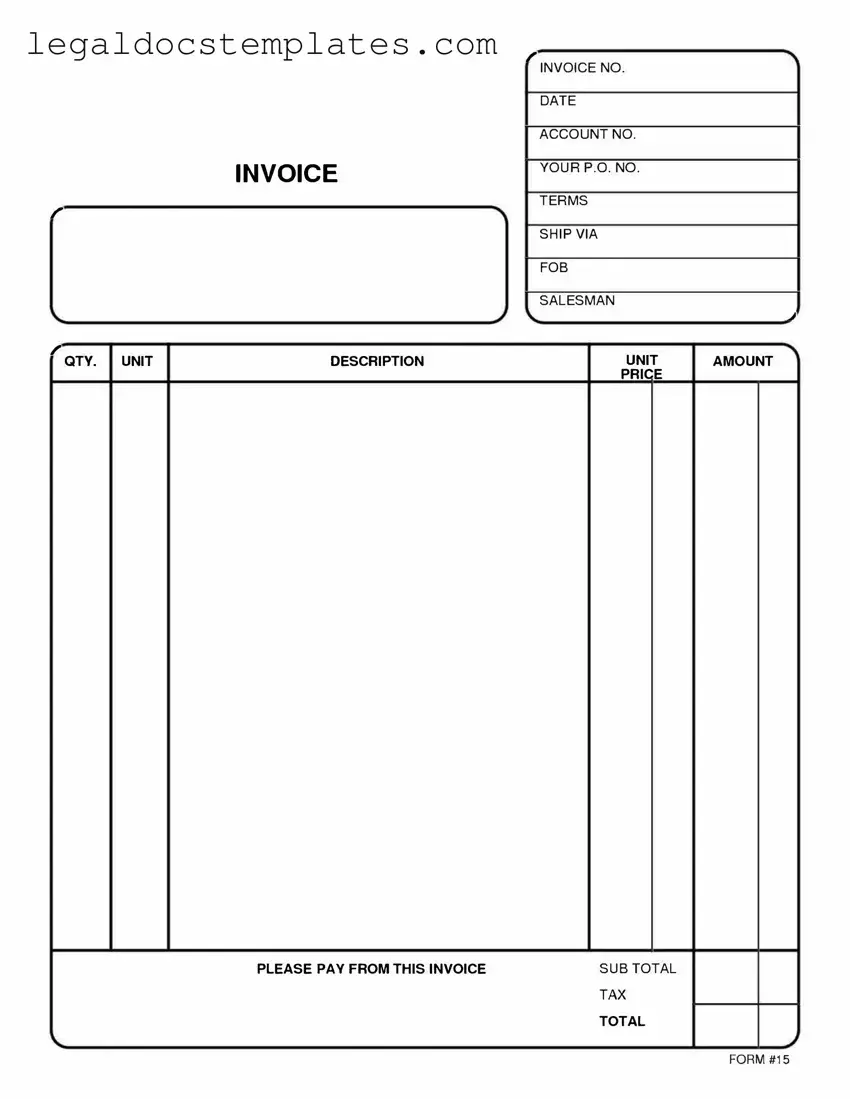

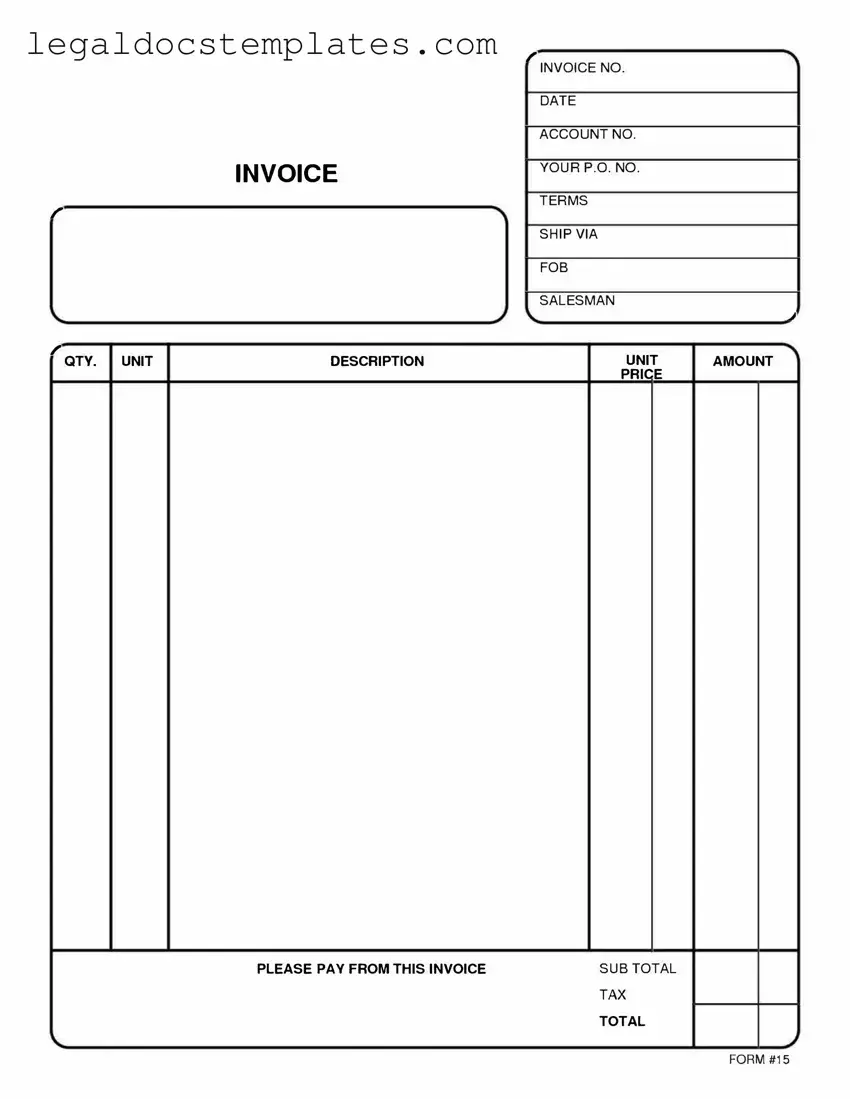

The Free And Invoice PDF form shares similarities with a Sales Receipt, as both serve as proof of a transaction between a seller and a buyer. However, while an invoice is a request for payment for goods or services rendered, a sales receipt is an acknowledgment that payment has already been received. Sales receipts usually provide details of the transaction, including the date, items purchased, quantities, and price, mirroring the structure of an invoice.

Quotation Forms are also akin to the Free And Invoice PDF form because they lay out the costs for goods or services before a sale is completed. A quotation form is often the first step in a sales process, offering potential buyers a formal estimate of prices. In contrast, an invoice is issued after the sale to request payment, making the invoice a follow-up document to a quotation form.

Purchase Orders bear resemblance to the Free And Invoice PDF form, as both are integral to the procurement process. A purchase order is created by the buyer and sent to the seller, detailing the types and quantities of products to be purchased. This contrasts with an invoice, which is issued by the seller to the buyer to request payment for the goods or services provided.

The Free And Invoice PDF form is akin to a Credit Memo, which is issued by a seller to a buyer. A credit memo indicates a reduction in the amount that a buyer owes to the seller, typically due to a return or an overpayment. Unlike an invoice that requests payment, a credit memo adjusts a previous invoice, either reducing the outstanding balance or suggesting future credit.

Proforma Invoices share similarities with the Free And Invoice PDF form because they both detail the goods or services offered by a seller to a buyer. However, a proforma invoice is sent before the delivery of goods or services as an estimate, not a demand for payment. It helps buyers understand the cost implications before committing to a purchase, whereas an invoice represents a formal request for payment post-delivery.

Packing Slips are related to the Free And Invoice PDF form as they accompany goods during shipment, detailing the contents of the package. Although a packing slip doesn't request payment or list prices like an invoice, it plays a crucial role in ensuring the accuracy of a shipment, facilitating smooth transaction and delivery processes similar to the way an invoice facilitates payment processes.

Service Contracts, while not requests for payment themselves, are closely related to the Free And Invoice PDF form. These contracts outline the terms and conditions of the services to be provided, including scope, duration, and costs. An invoice might later be issued based on the conditions agreed upon in the service contract, making these documents complementary in nature.

Warranty Documents, which guarantee the condition or longevity of a product, share an indirect relationship with the Free And Invoice PDF form. Though primarily focusing on post-sale assurances rather than financial transactions, warranty documents often accompany invoices which detail the sale of the warranted goods. Together, they provide a comprehensive overview of the transaction, including the buyer’s rights concerning product quality.

Consignment Agreements, detailing the terms under which goods are to be sold on consignment, bear resemblance to the Free And Invoice PDF form. These agreements establish the relationship between consignor and consignee, unlike an invoice which formalizes a sale transaction. The consignment process can culminate in the creation of an invoice once goods are sold, highlighting the interconnectedness of these documents.

The Bill of Lading is another document related to the Free And Invoice PDF form, serving as a receipt for goods shipped by a carrier. It outlines the terms of the carriage agreement, the condition of the goods, and their destination. Although its primary function is not to request payment, the information it provides can be crucial for generating an accurate invoice, especially in international trade, thereby supporting the invoicing process.