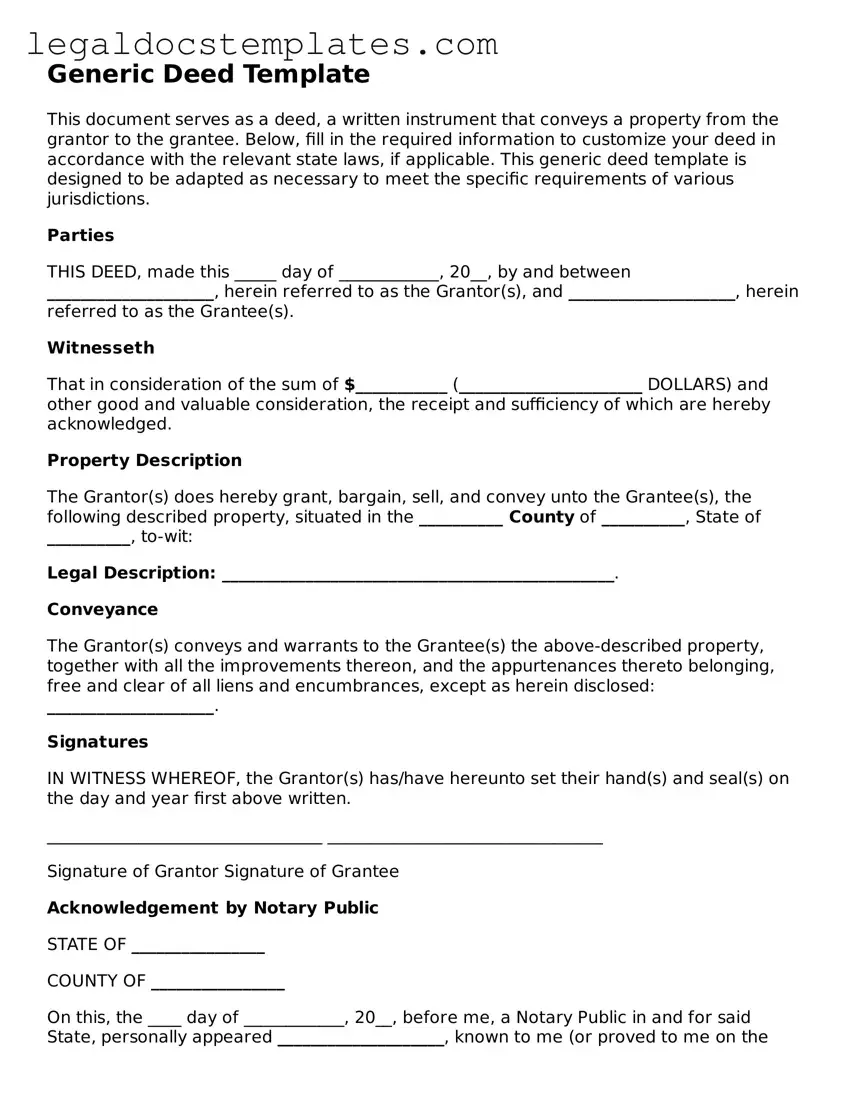

Generic Deed Template

This document serves as a deed, a written instrument that conveys a property from the grantor to the grantee. Below, fill in the required information to customize your deed in accordance with the relevant state laws, if applicable. This generic deed template is designed to be adapted as necessary to meet the specific requirements of various jurisdictions.

Parties

THIS DEED, made this _____ day of ____________, 20__, by and between ____________________, herein referred to as the Grantor(s), and ____________________, herein referred to as the Grantee(s).

Witnesseth

That in consideration of the sum of $___________ (______________________ DOLLARS) and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged.

Property Description

The Grantor(s) does hereby grant, bargain, sell, and convey unto the Grantee(s), the following described property, situated in the __________ County of __________, State of __________, to-wit:

Legal Description: _______________________________________________.

Conveyance

The Grantor(s) conveys and warrants to the Grantee(s) the above-described property, together with all the improvements thereon, and the appurtenances thereto belonging, free and clear of all liens and encumbrances, except as herein disclosed: ____________________.

Signatures

IN WITNESS WHEREOF, the Grantor(s) has/have hereunto set their hand(s) and seal(s) on the day and year first above written.

_________________________________ _________________________________

Signature of Grantor Signature of Grantee

Acknowledgement by Notary Public

STATE OF ________________

COUNTY OF ________________

On this, the ____ day of ____________, 20__, before me, a Notary Public in and for said State, personally appeared ____________________, known to me (or proved to me on the oath of ____________________) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I have hereunto set my hand and official seal.

_________________________________

Notary Public

My Commission Expires: ______________