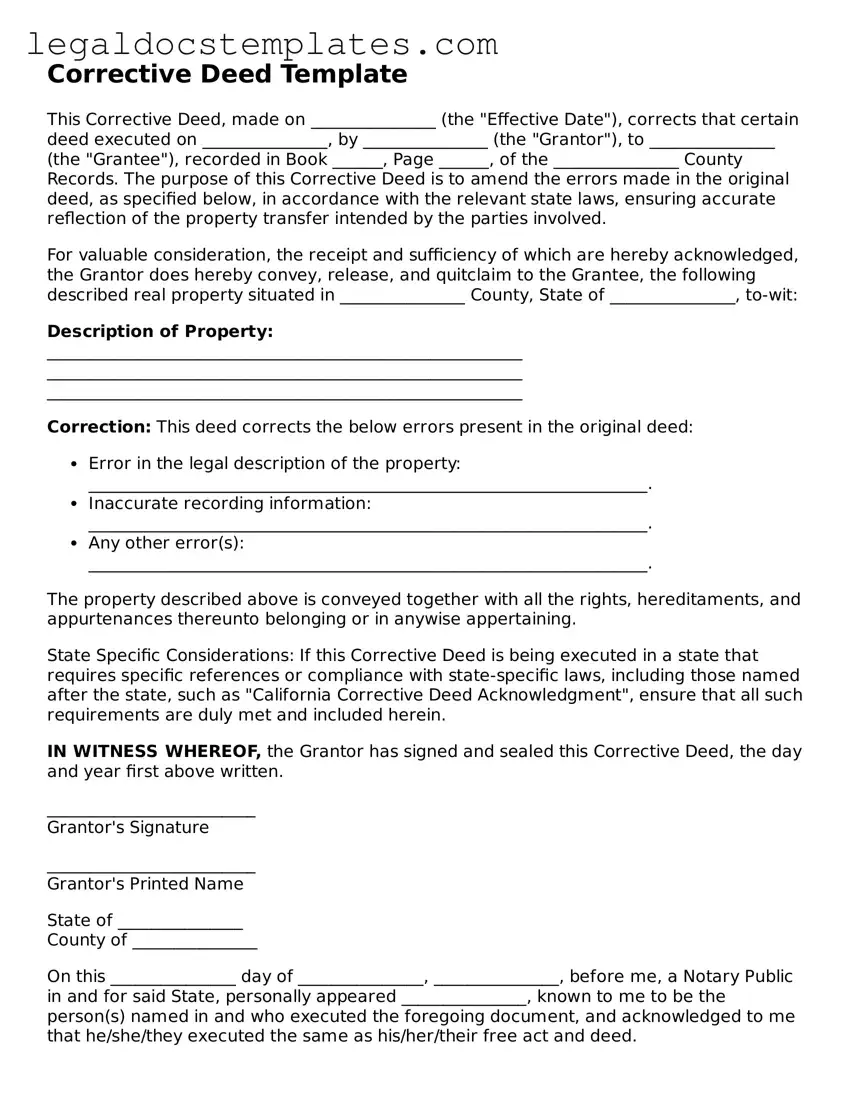

Corrective Deed Template

This Corrective Deed, made on _______________ (the "Effective Date"), corrects that certain deed executed on _______________, by _______________ (the "Grantor"), to _______________ (the "Grantee"), recorded in Book ______, Page ______, of the _______________ County Records. The purpose of this Corrective Deed is to amend the errors made in the original deed, as specified below, in accordance with the relevant state laws, ensuring accurate reflection of the property transfer intended by the parties involved.

For valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Grantor does hereby convey, release, and quitclaim to the Grantee, the following described real property situated in _______________ County, State of _______________, to-wit:

Description of Property:

_________________________________________________________

_________________________________________________________

_________________________________________________________

Correction: This deed corrects the below errors present in the original deed:

- Error in the legal description of the property: ___________________________________________________________________.

- Inaccurate recording information: ___________________________________________________________________.

- Any other error(s): ___________________________________________________________________.

The property described above is conveyed together with all the rights, hereditaments, and appurtenances thereunto belonging or in anywise appertaining.

State Specific Considerations: If this Corrective Deed is being executed in a state that requires specific references or compliance with state-specific laws, including those named after the state, such as "California Corrective Deed Acknowledgment", ensure that all such requirements are duly met and included herein.

IN WITNESS WHEREOF, the Grantor has signed and sealed this Corrective Deed, the day and year first above written.

_________________________

Grantor's Signature

_________________________

Grantor's Printed Name

State of _______________

County of _______________

On this _______________ day of _______________, _______________, before me, a Notary Public in and for said State, personally appeared _______________, known to me to be the person(s) named in and who executed the foregoing document, and acknowledged to me that he/she/they executed the same as his/her/their free act and deed.

_________________________

Notary Public

My commission expires: _______________