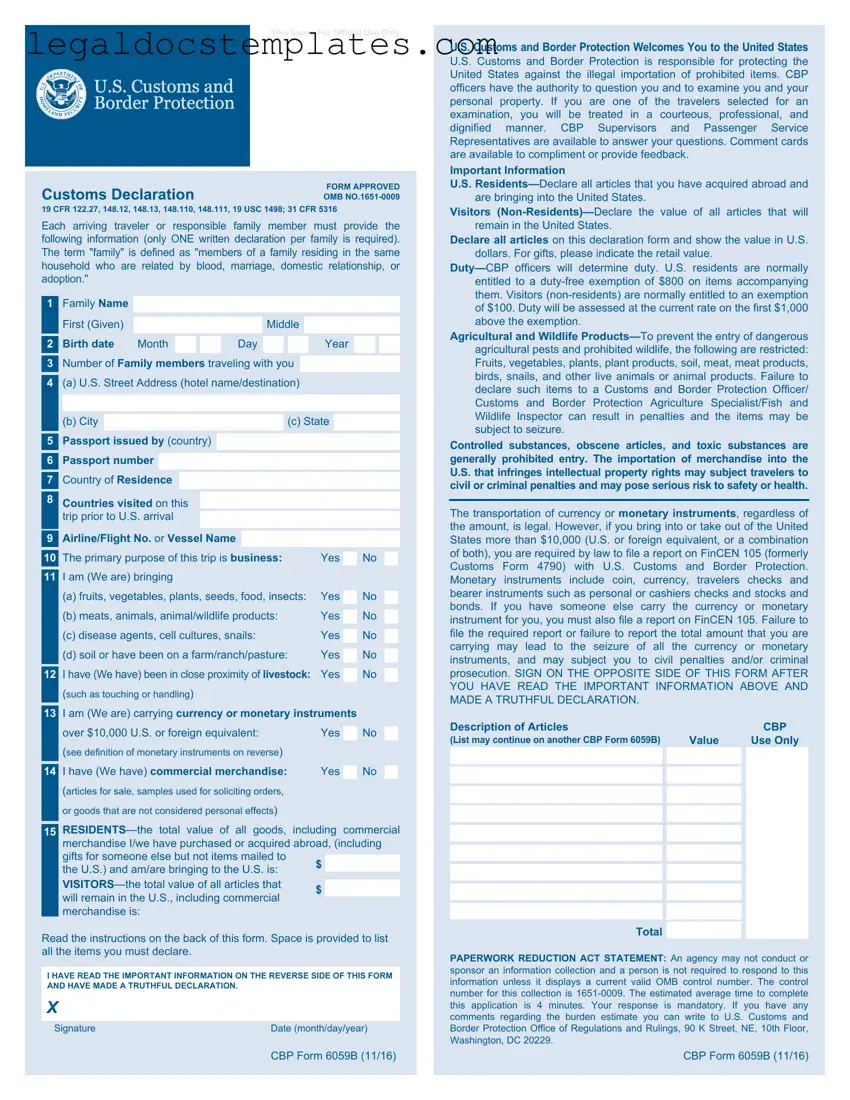

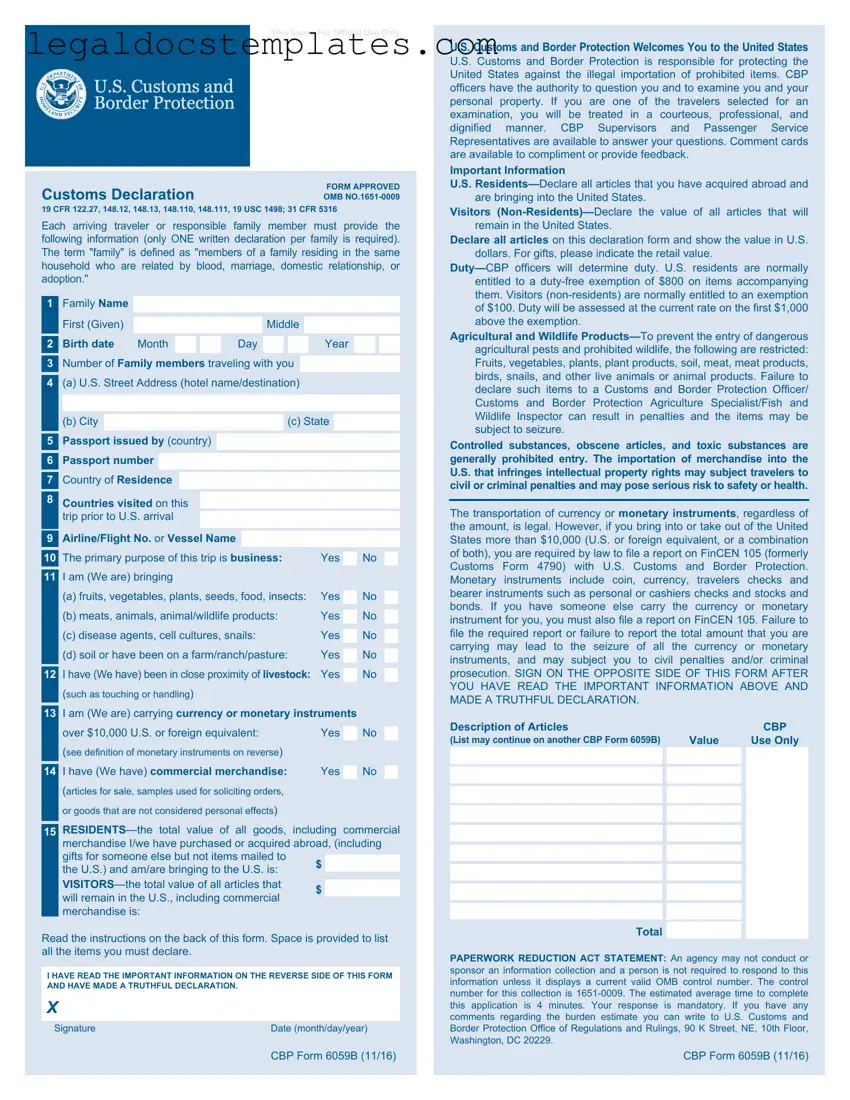

The CBP 6059B form, known for its use in declaring items brought into the United States from abroad, has parallels with several other documents across various contexts. One such document is the I-94 Arrival/Departure Record. This form, filled out by visitors entering the United States, records a person's entry and exit dates. Both forms are crucial for maintaining legal status and ensuring adherence to respective laws and regulations, especially for international travelers.

Another comparable document is the TSA's Secure Flight Passenger Data form, which collects basic information from travelers to conduct watchlist matching, enhancing aviation security. Like the CBP 6059B form, the Secure Flight form is part of a larger system to ensure the safety and legality of travel into and within the United States, reflecting the government's effort to balance openness with security.

The Ship Crew's Effects Declaration, unlike the CBP 6059B which is dealt with by passengers, is a mandatory declaration for crew members of ships entering U.S. ports. It lists personal effects and merchandise, mirroring the requirement for transparency and security in maritime arrivals comparable to air and land entries.

Similarly, the Aircraft/Vessel Report (CBP Form 1300) is for reporting all vessels or aircraft arriving in the U.S. It's akin to the CBP 6059B form in its purpose of tracking and controlling entries, albeit targeting different modes of transport and the entities operating them rather than individual passengers.

The Electronic System for Travel Authorization (ESTA) application shares objectives with the CBP 6059B, albeit it is strictly for visa waiver participants. ESTA pre-screens travelers before they embark, akin to how the CBP 6059B form safeguards post-arrival, ensuring those entering the country have legitimate intentions.

Customs Form 4457, for registering personal items before traveling abroad, is designed to facilitate smooth re-entry to the U.S. This form, like the CBP 6059B, aids in bypassing potential customs hurdles by certifying ownership of items travelers already possess, preventing re-import duties.

Similarly, the APHIS (Animal and Plant Health Inspection Service) Plant and Animal Declaration forms serve an analogous function for biosecurity, a concern addressed partially by the CBP 6059B. These forms target the prevention of harmful organisms' entry, underlining both forms' contributions to protecting the U.S. environment and agriculture.

The declaration form issued by the Centers for Disease Control and Prevention (CDC) for travelers coming into the U.S. serves to protect public health. This form, paralleling the CBP 6059B’s customs declaration, is focused on mitigating the spread of diseases by monitoring and managing health-related declarations and exposures during travel.

Finally, the ATF Form 6, required for the importation of firearms and ammunition, aligns with the CBP 6059B's goal of regulating what enters the country. Both forms serve as checks for potential risks, though targeting different concerns—ATF Form 6 focuses on regulating arms, while the CBP 6059B oversees general goods and personal items.

(c) State

(c) State

No

No