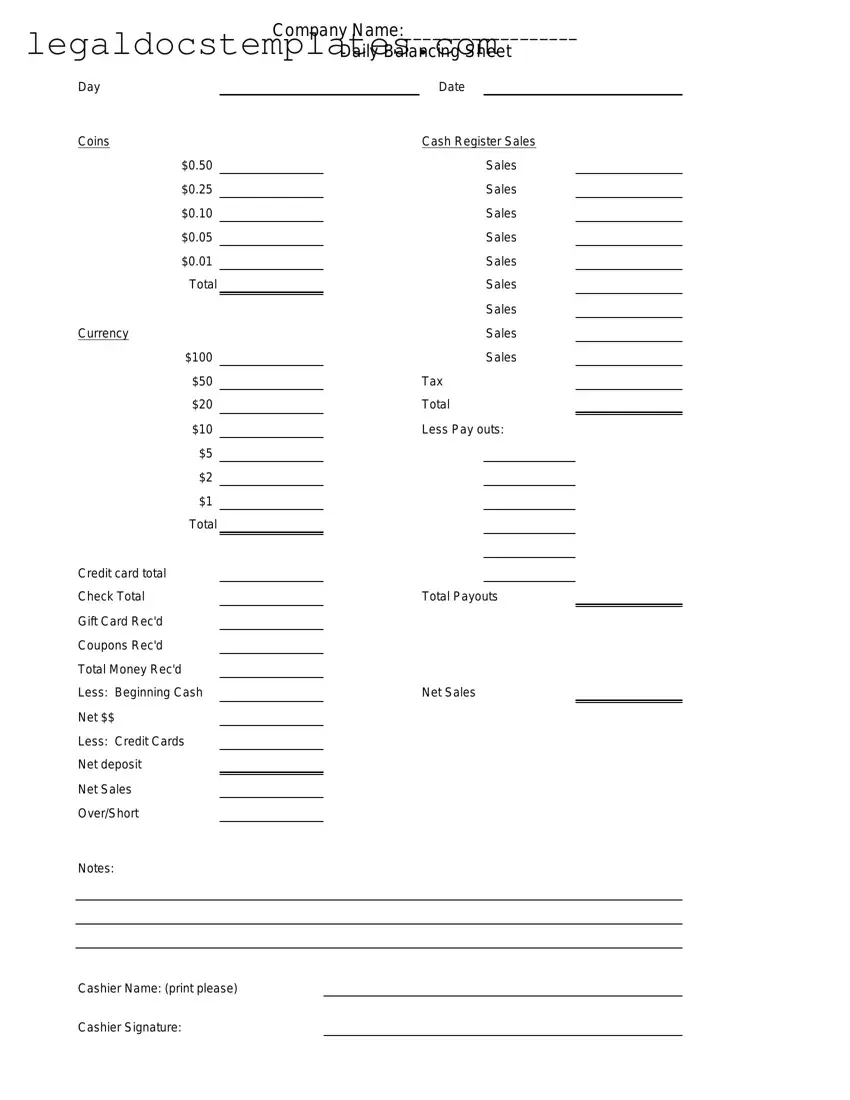

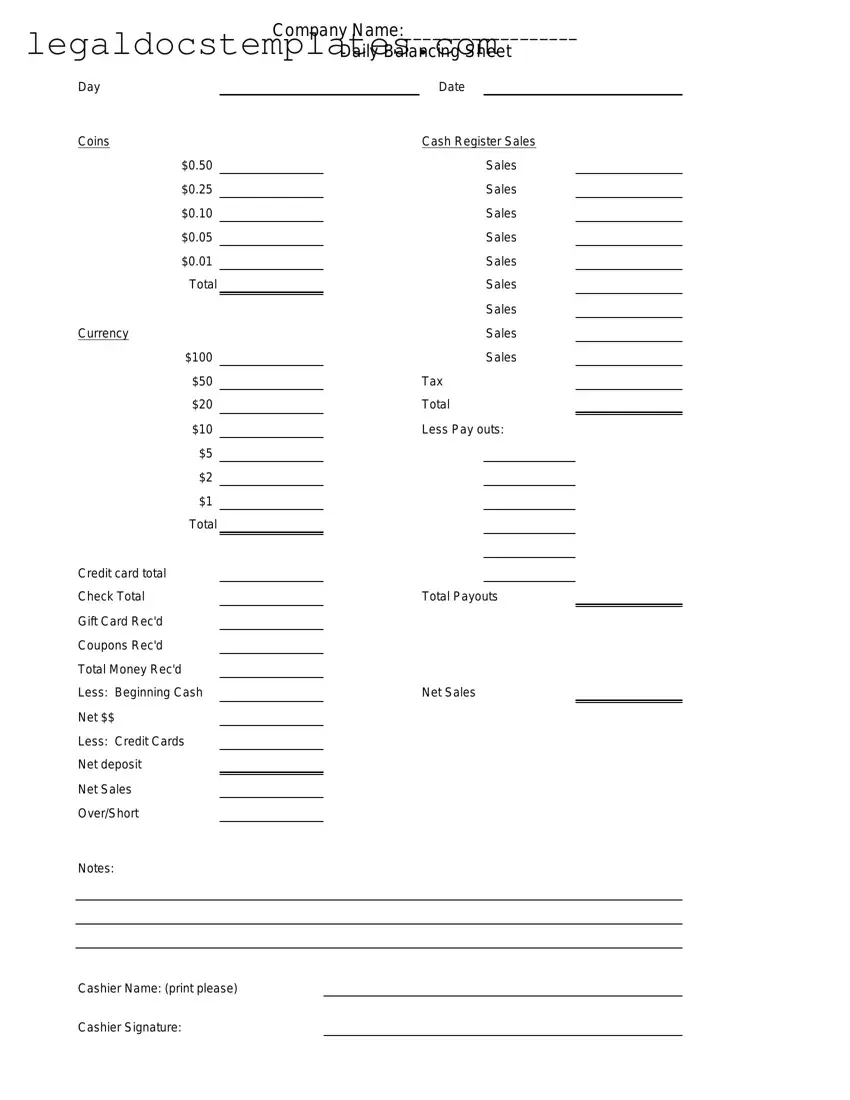

The Bank Deposit Slip is similar to the Cash Drawer Count Sheet because both are used to tally monetary transactions. While the Cash Drawer Count Sheet helps keep track of cash transactions throughout a business day, a Bank Deposit Slip is used when depositing money into a bank account, detailing cash and check amounts to ensure the bank processes them correctly.

A Sales Receipt works in conjunction with the Cash Drawer Count Sheet by providing a recorded transaction between a seller and a buyer. Each sale recorded on a Sales Receipt contributes to the total cash amount expected to be found in the cash drawer, allowing for easy verification against the Cash Drawer Count Sheet's tally.

Daily Sales Reports share similarities with the Cash Drawer Count Sheet as they compile the total sales made within a day. However, while the Cash Drawer Count Sheet focuses solely on cash transactions, Daily Sales Reports can include various forms of payment, offering a broader view of a day's revenue.

The Petty Cash Voucher is akin to the Cash Drawer Count Sheet in managing small cash transactions. The voucher records expenditures from a petty cash fund, and these transactions can be cross-referenced with entries in the Cash Drawer Count Sheet to ensure all cash movements are accounted for accurately.

An Inventory Control Sheet, though primarily used for tracking stock levels, can correlate with the information on a Cash Drawer Count Sheet. As items are sold and recorded on the Cash Drawer Count Sheet, these sales should reflect corresponding deductions in stock on the Inventory Control Sheet, providing a full-circle view of transactions and inventory status.

The Till Reconciliation Sheet directly parallels the functionality of the Cash Drawer Count Sheet by documenting the beginning and ending cash amounts in a cash register, including details on sales, refunds, and payouts. This process confirms the accuracy of cash handling and aligns with the Cash Drawer Count Sheet’s purpose to ensure that actual cash amounts match expected totals.

Financial Statements, particularly the cash flow statement, can contain summaries that reflect the daily operations recorded on Cash Drawer Count Sheets. These statements provide an overview of cash entering and leaving the business over a set period, integrating daily cash flow details into a broader financial analysis.

A Balance Sheet may also relate to the Cash Drawer Count Sheet by showing a snapshot of a company’s financial condition at a specific point in time, including cash on hand. As cash drawers are counted and reconciled, these figures feed into the cash assets line item on the Balance Sheet, giving stakeholders insight into the liquidity and operational efficiency of the business.