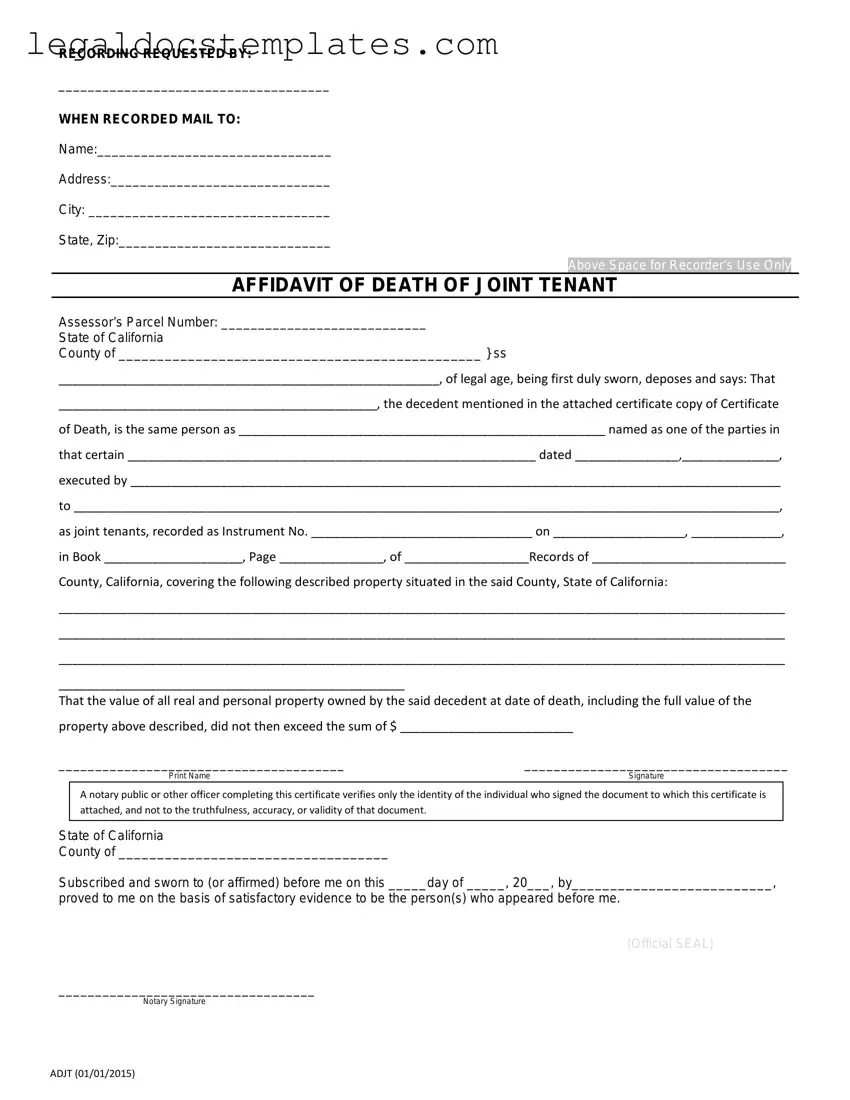

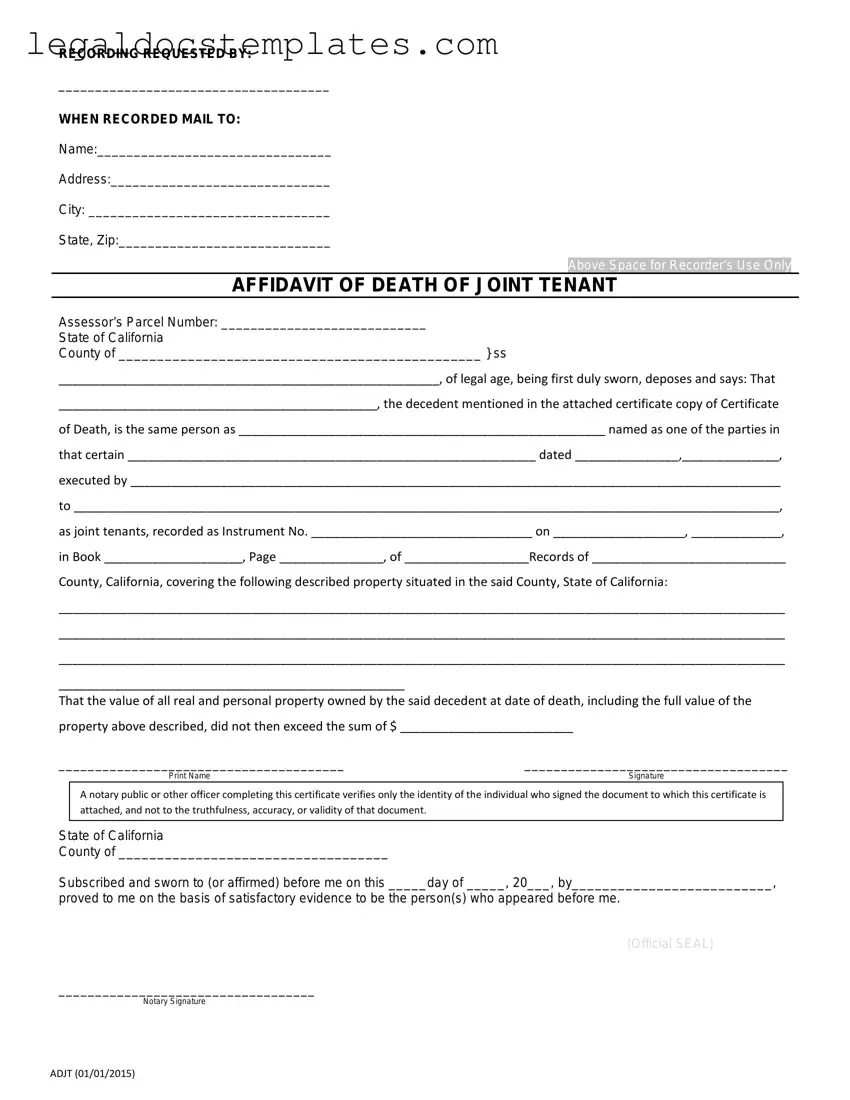

Fill Out Your California Death of a Joint Tenant Affidavit Template

The California Death of a Joint Tenant Affidavit form is a legal document used to update the title of a property when one of the property owners, holding the property as joint tenants, passes away. This form serves to provide proof of death and remove the deceased individual's name from the property title, ensuring that the property transfers smoothly to the surviving joint tenant(s). For assistance in completing and filing this crucial document, click the button below.

Access California Death of a Joint Tenant Affidavit Now

Fill Out Your California Death of a Joint Tenant Affidavit Template

Access California Death of a Joint Tenant Affidavit Now

Access California Death of a Joint Tenant Affidavit Now

or

⇩ PDF Form

Don’t spend hours on this form

Complete California Death of a Joint Tenant Affidavit online in minutes, fully digital.