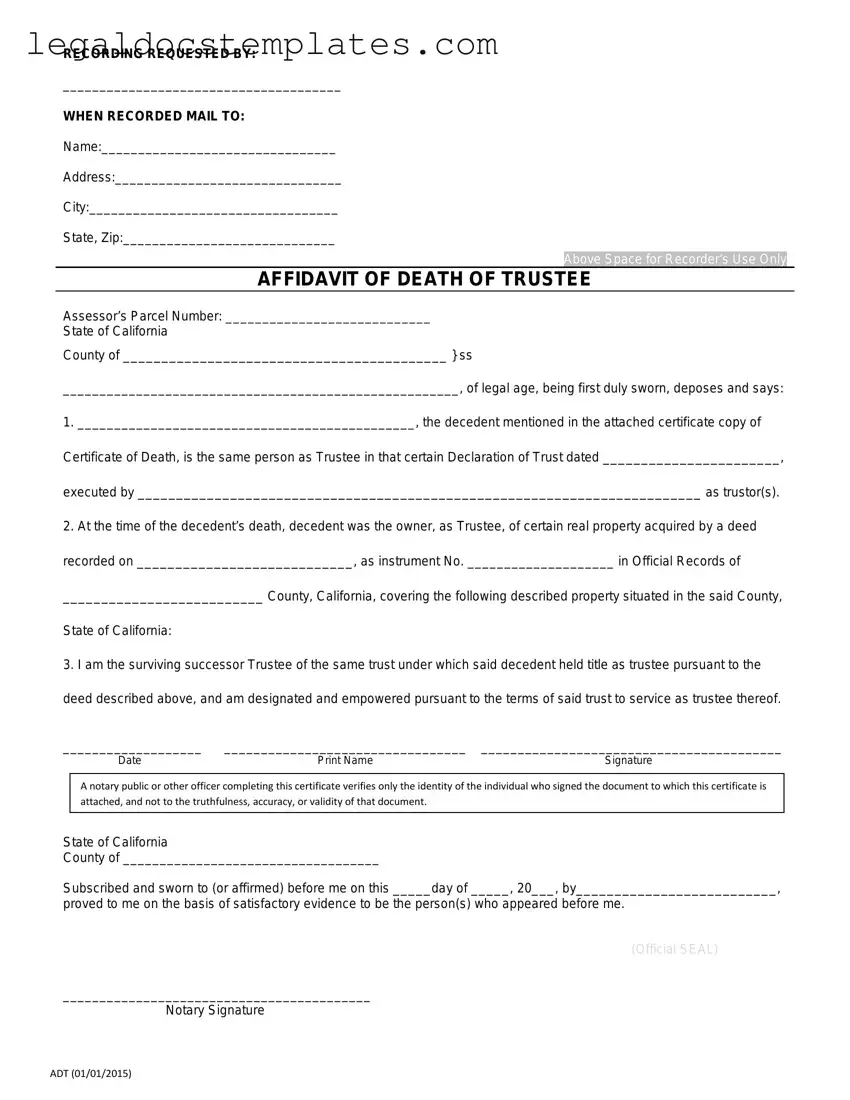

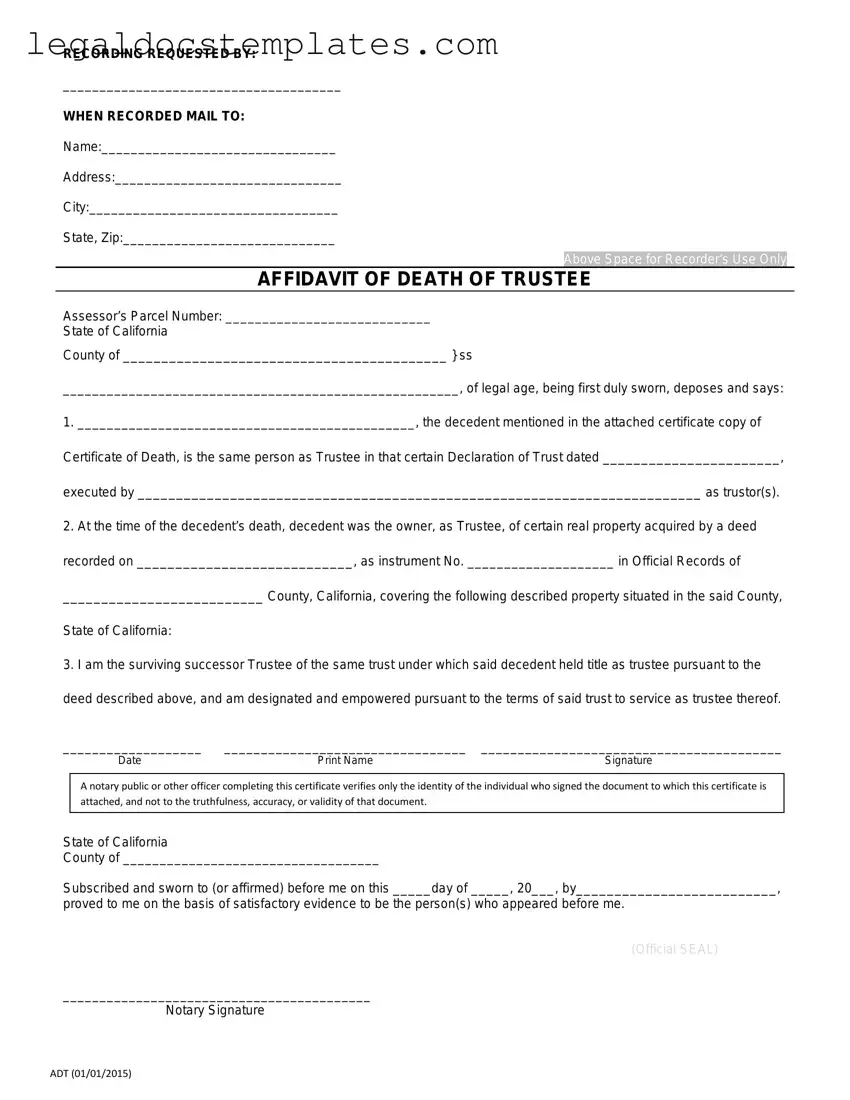

Fill Out Your California Affidavit of Death of a Trustee Template

The California Affidavit of Death of a Trustee form is a vital document used to officially notify financial institutions and government bodies that a trustee has passed away, leading to the transfer of control over assets held in a trust. This document plays a critical role in the smooth transition of property management and helps to avoid legal complications that can arise during such transfers. For those looking to ensure the seamless execution of a trust after the loss of a trustee, completing this form accurately is crucial. Click the button below to start filling out your form.

Access California Affidavit of Death of a Trustee Now

Fill Out Your California Affidavit of Death of a Trustee Template

Access California Affidavit of Death of a Trustee Now

Access California Affidavit of Death of a Trustee Now

or

⇩ PDF Form

Don’t spend hours on this form

Complete California Affidavit of Death of a Trustee online in minutes, fully digital.