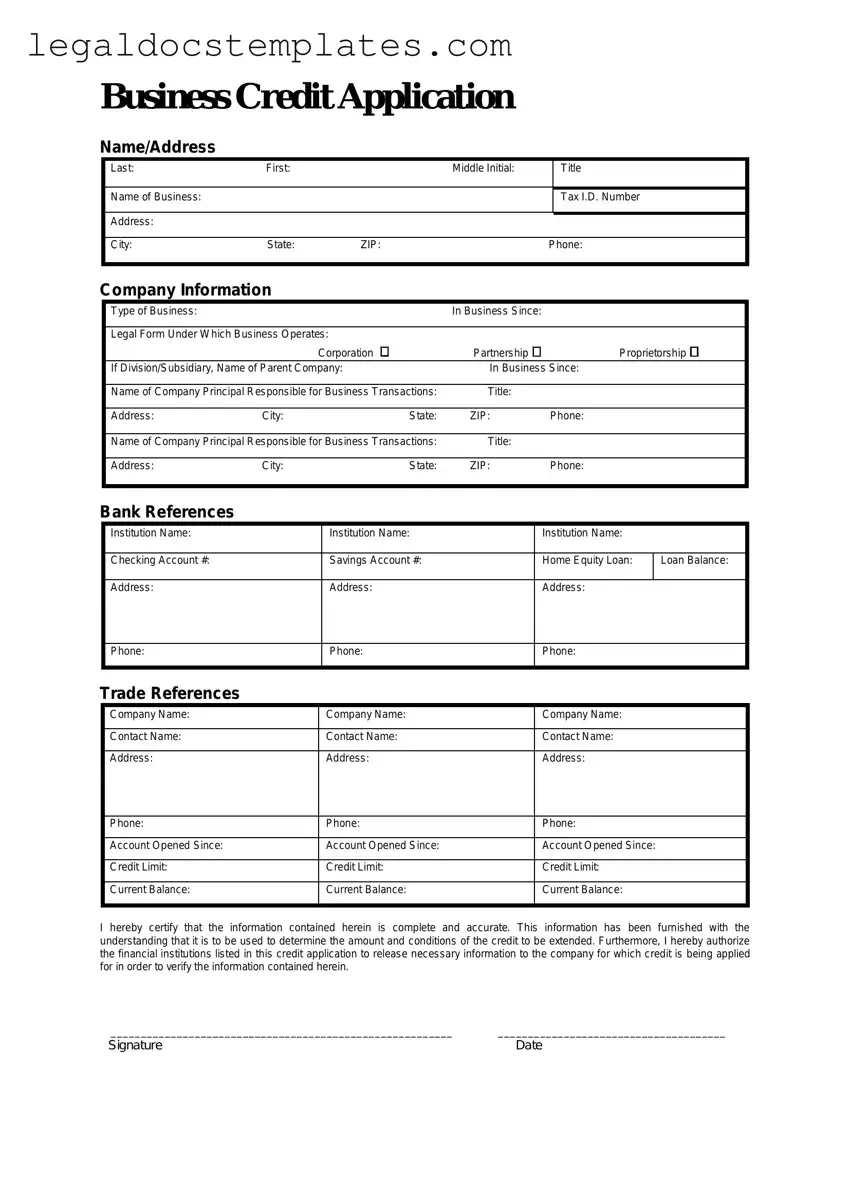

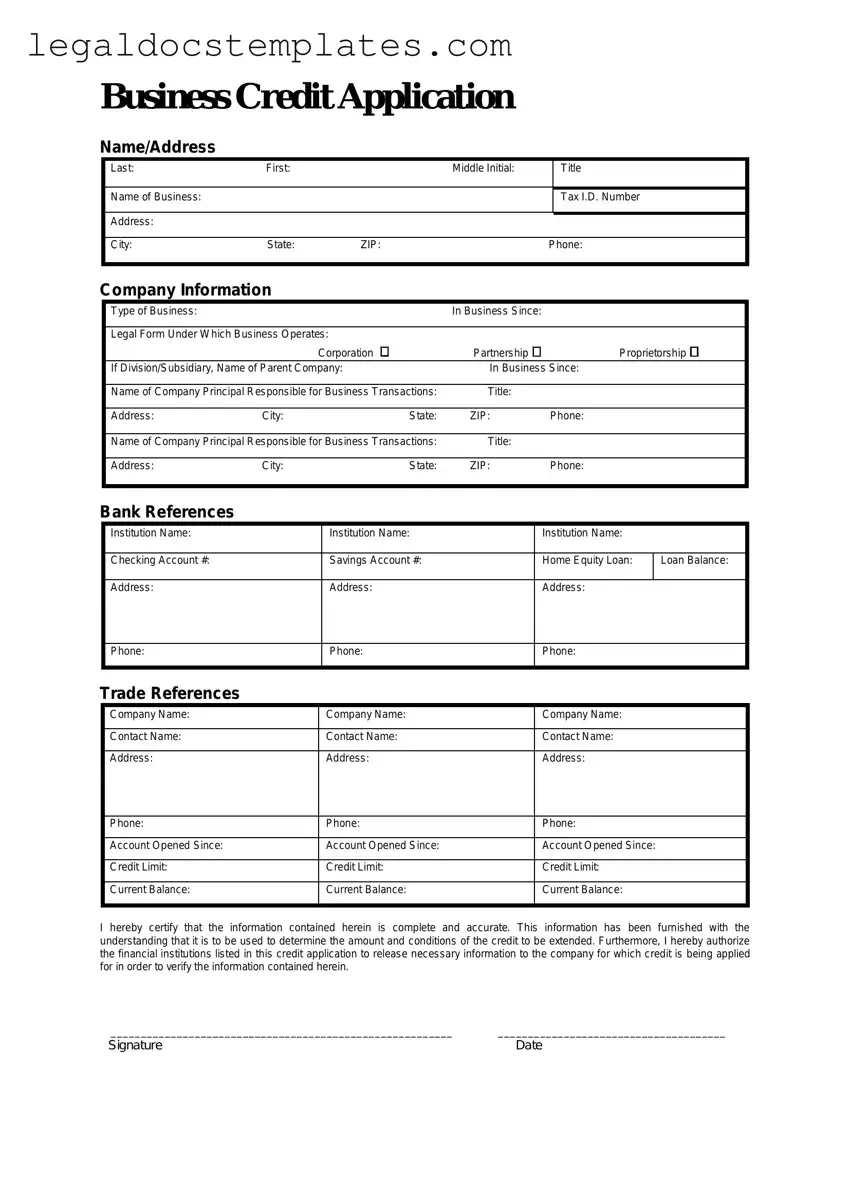

Filling out a Business Credit Application form is a critical step for any company seeking to establish or expand its credit line. However, during this process, several common mistakes can significantly impact the success of the application. One primary error is the failure to provide complete information. Applicants often overlook fields or assume certain details are not significant, leaving parts of the form blank. This oversight can delay the process as the lender may need to request additional information, or it might even lead to a decline in the application due to perceived lack of transparency.

Another frequent mistake is not double-checking the application for errors. Typos, incorrect figures, and outdated information can not only affect the credibility of your business but also result in financial discrepancies that could have been avoided. It's crucial to review all entries meticulously to ensure accuracy and reliability of the data provided.

Many businesses also neglect to verify their business credit score before applying. Understanding your credit score beforehand allows you to address any potential issues that could negatively impact the lender's decision. It also helps in setting realistic expectations and possibly improving your credit score before the application, thereby increasing your chances of approval.

A common pitfall is the misunderstanding of terms and conditions, leading to the mistake of not clarifying the loan terms before submitting the application. Businesses should fully understand the interest rates, repayment terms, and any other conditions tied to the credit. Not asking questions or assuming the terms are standard can lead to unexpected financial strains in the future.

Some applicants make the error of failing to provide sufficient collateral when required. Depending on the nature of the credit and the lender's requirements, collateral might be necessary to secure the loan. Failing to offer or properly document valuable assets that can serve as collateral weakens your application and can result in denial of the credit.

Omitting relevant financial documents is another mistake. A comprehensive package of financial statements, tax returns, and other relevant documents is often necessary to accompany a Business Credit Application. When businesses fail to attach all required documentation, they inadvertently prolong the process and diminish their credibility in the eyes of the lender.

Last but not least, businesses often neglect to consider the impact of existing debts. Lenders assess a company's debt-to-income ratio to determine its repayment capacity. When existing debts are not accurately reported or considered, it can lead to an overestimation of the ability to take on new debt, thereby jeopardizing the application. Thoroughly evaluating and disclosing all existing financial obligations is crucial for a successful credit application.

By avoiding these common mistakes, businesses can improve their chances of successfully securing credit, thereby supporting their growth and financial stability.