What is a Business Bill of Sale?

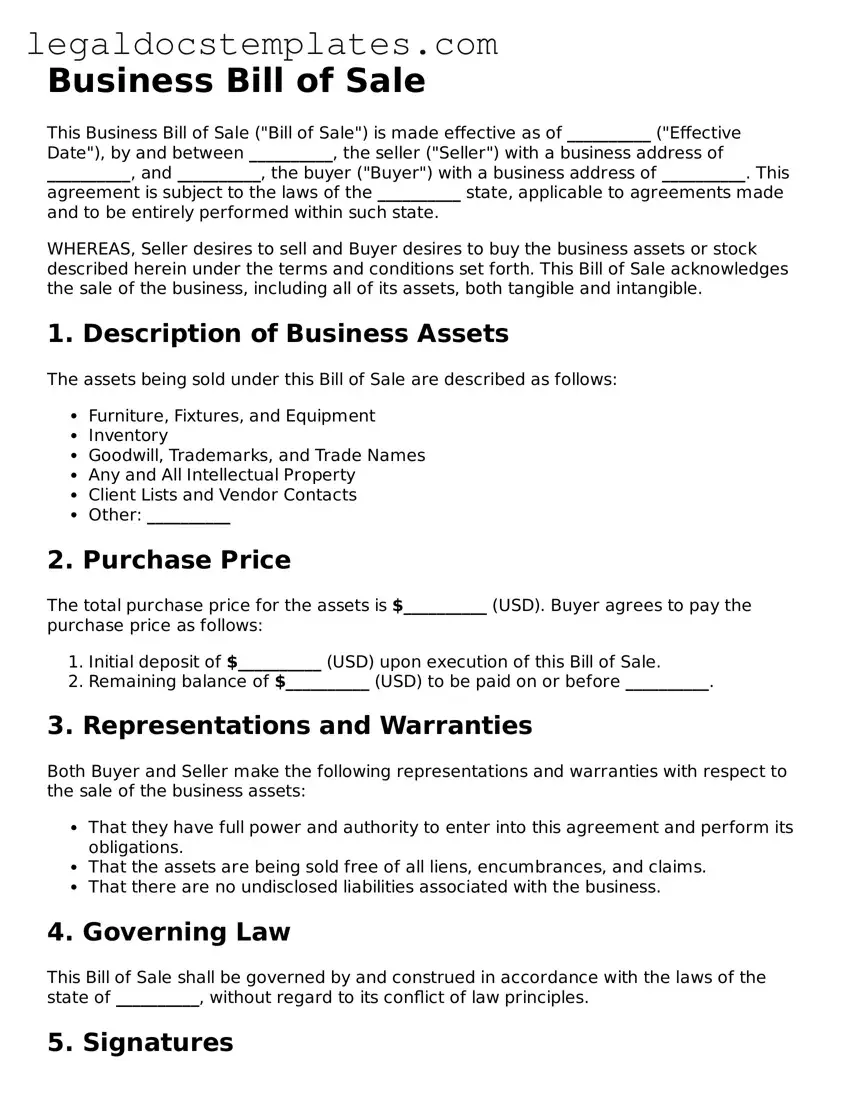

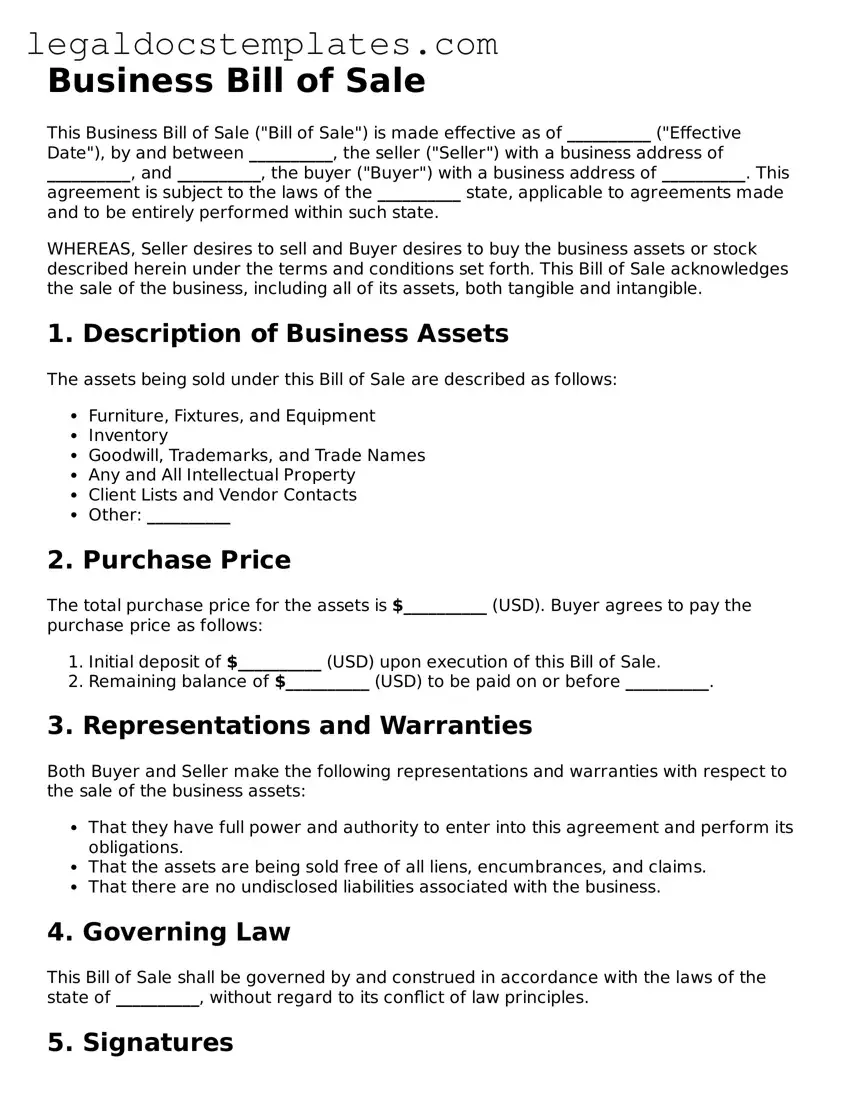

A Business Bill of Sale is a legal document that records the sale of a business from one party (the seller) to another (the buyer). It outlines the terms and conditions of the sale, including the purchase price, description of the business assets, and the transfer of ownership. This document serves as proof of the transaction, ensuring that both parties agree to the terms of the sale.

Why do I need a Business Bill of Sale?

Having a Business Bill of Sale is crucial for several reasons. It provides legal proof that the ownership of the business has been transferred from the seller to the buyer. This document helps in preventing misunderstandings or disputes by clearly defining the details of the transaction. It also ensures that both parties acknowledge the sale and understand their rights and obligations. Moreover, it may be required for tax purposes and for updating business records.

What should be included in a Business Bill of Sale?

The following elements are typically included in a Business Bill of Sale:

-

Identification of both the buyer and seller (names and addresses)

-

A detailed description of the business being sold

-

The purchase price and terms of the sale

-

A list of the business assets included in the sale

-

Warranties or representations made by the seller

-

Signatures from both parties, often notarized to verify authenticity

Is a Business Bill of Sale legally binding?

Yes, a Business Bill of Sale is a legally binding document when it is signed by both the buyer and the seller. It acknowledges the transfer of ownership and can be used as evidence in court if any disputes arise regarding the business sale.

Do I need a lawyer to create a Business Bill of Sale?

While it is possible to create a Business Bill of Sale on your own, consulting a lawyer is recommended to ensure that the document complies with state laws and fully protects your interests. A legal professional can help tailor the bill of sale to your specific situation and advise you on any additional steps that may be needed to complete the sale.

Can a Business Bill of Sale be used for any type of business?

A Business Bill of Sale can be used for the sale of most types of businesses, whether it is a small sole proprietorship or a larger corporation. However, the specific assets and terms included may vary depending on the nature of the business and the agreement between the buyer and seller.

How is a Business Bill of Sale different from a Purchase Agreement?

A Business Bill of Sale and a Purchase Agreement serve related but distinct purposes. A Purchase Agreement outlines the terms and conditions under which the business will be sold, acting as a preliminary agreement before the transaction is finalized. The Business Bill of Sale, on the other hand, is executed at the time of the transaction to transfer ownership of the business officially. In essence, the Purchase Agreement is the promise to sell, while the Business Bill of Sale is the proof that the sale occurred.

What happens if I don’t use a Business Bill of Sale?

Not using a Business Bill of Sale can lead to various issues. Without this documented proof of sale, disputes can easily arise over the ownership of the business or the terms of the sale. It may also complicate financial record-keeping and tax reporting. In some jurisdictions, not having a Business Bill of Sale could even invalidate the sale, leaving the ownership transfer unrecognized by the law.

How do I ensure that my Business Bill of Sale is valid?

To ensure the validity of your Business Bill of Sale, make sure that it includes all necessary details about the sale, is clearly written, and is signed by both parties. It is also wise to have the signatures notarized. Additionally, checking with a legal professional or consulting state-specific requirements can help guarantee that your document is legally sound.

Can I modify a Business Bill of Sale after it’s been signed?

Once a Business Bill of Sale has been signed, it becomes a legally binding document, and alterations should not be made without the consent of both parties. If changes need to be made, it’s best to draft a new document or an amendment to the original agreement with the consent and signatures of both the buyer and the seller to maintain its legal integrity.