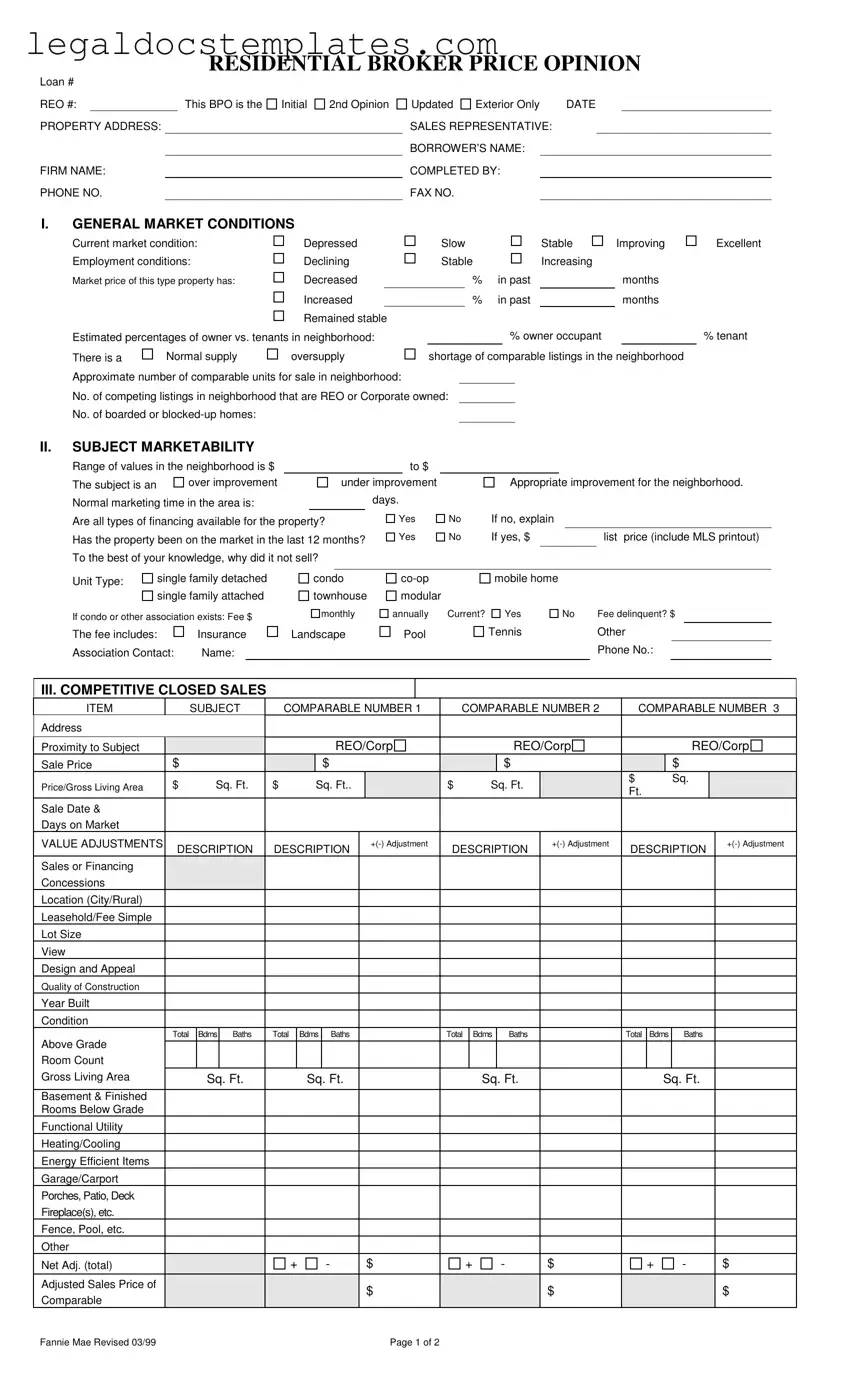

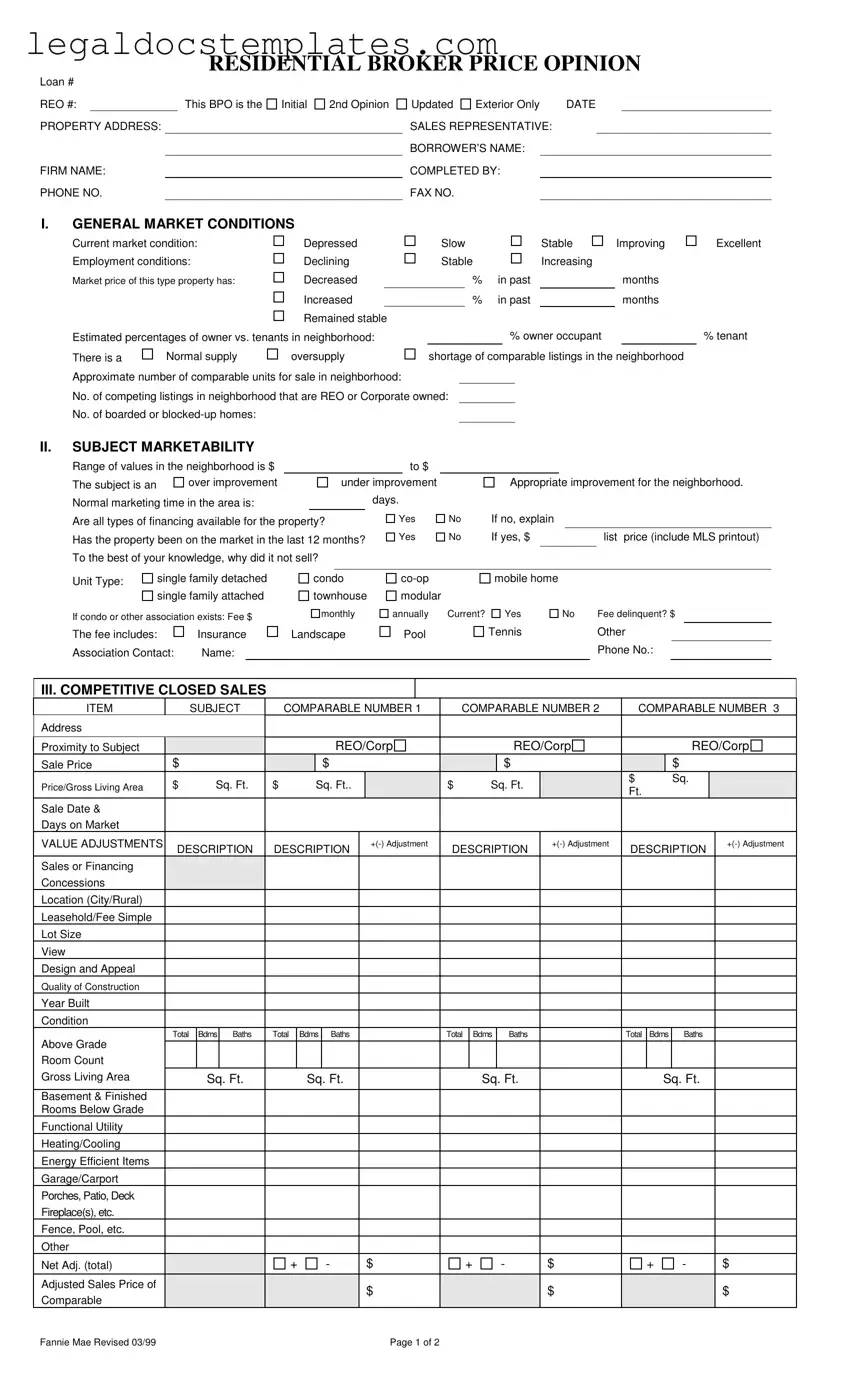

The Comparative Market Analysis (CMA) shares significant similarities with the Broker Price Opinion (BPO) form. Both documents provide an estimate of a home's market value, often used by real estate professionals to help sellers set listing prices or to inform buyers on offering prices. Like the BPO, a CMA lists comparable sales, market conditions, and adjustments for different features or conditions of the subject property versus the comparables. The main goal of both documents is to offer an accurate market value estimation based on current market trends and comparable sales data.

Appraisal reports, while more formal and detailed than BPOs, serve a parallel purpose of determining a property's value. Appraisals are typically required by lenders before loan approvals to ensure the property's market value meets or exceeds the loan amount. They include thorough inspections and often more detailed adjustments compared to BPOs, considering aspects of the property and market conditions to come to a finalized value. Appraisers are usually licensed professionals whose reports carry significant weight in financing decisions.

The Home Inspection Report, although distinct in its primary purpose from a BPO, shares the commonality of providing detailed information on the condition of a property. While a BPO assesses market value with a focus on sales and market data, home inspections concentrate on the physical state of the property, reporting on the condition of the home's systems, structure, and any repairs needed. However, both can influence the sale or purchase of a home by highlighting areas that may require attention before a transaction can be completed successfully.

Listing Agreements contain details that can be found in a BPO, such as the property's projected selling price and current market analysis, albeit for a different purpose. These contracts between sellers and real estate agents outline the terms under which a property will be marketed, including the list price which often relies on data similar to what's found in a BPO. The intersection between these documents lies in their use of market data to inform decisions related to selling properties.

The Purchase Agreement, while primarily a legal document formalizing the agreement between buyer and seller regarding the terms of a sale, often relies on information found in a BPO. The agreed-upon sale price can be influenced by the BPO's determination of property value, making these documents indirectly connected. As negotiations progress, the value indicated by the BPO can serve as a basis for discussions on final sale price and terms.

Real Estate Owned (REO) Property Reports are closely related to BPOs in the context of foreclosed properties owned by lenders. These reports assess the value of REO properties to aid in pricing for resale, taking into account factors like condition, market comparables, and repair needs, much like a BPO. The goal is to sell the property efficiently and for a price reflective of its market value, making both documents integral to the process of handling REO listings.

Lastly, the Property Condition Report, similar to sections of the BPO, offers an overview of the physical state and needed repairs for a property. While it does not directly assess market value, it impacts the valuation process by detailing repair costs and issues that may affect the property’s sale price. Understanding the property's condition is crucial for accurate pricing strategies, making this report complementary to the valuation objectives of a BPO.

Unknown

Unknown

Investor

Investor