|

|

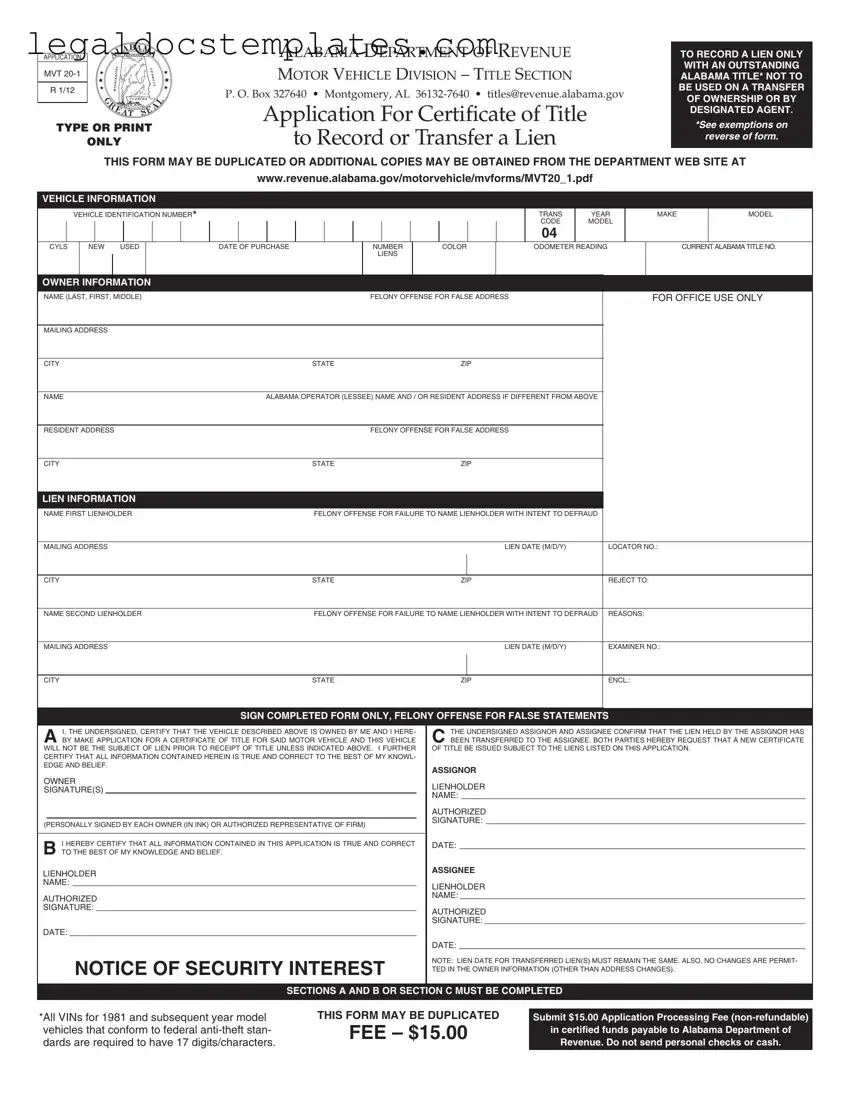

ALABAMA DEPARTMENT OF REVENUE |

|

APPLICATION |

|

|

MVT 20-1 |

|

MOTOR VEHICLE DIVISION – TITLE SECTION |

|

|

|

|

|

R 1/12 |

|

P. O. Box 327640 • Montgomery, AL 36132-7640 • titles@revenue.alabama.gov |

|

|

|

|

TYPE OR PRINT |

Application For Certificate of Title |

|

to Record or Transfer a Lien |

|

|

ONLY |

TO RECORD A LIEN ONLY WITH AN OUTSTANDING ALABAMA TITLE* NOT TO BE USED ON A TRANSFER OF OWNERSHIP OR BY DESIGNATED AGENT.

*See exemptions on reverse of form.

THIS FORM MAY BE DUPLICATED OR ADDITIONAL COPIES MAY BE OBTAINED FROM THE DEPARTMENT WEB SITE AT

www.revenue.alabama.gov/motorvehicle/mvforms/MVT20_1.pdf

VEHICLE INFORMATION

|

|

|

|

|

VEHICLE IDENTIFICATION NUMBER* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRANS |

YEAR |

|

|

MAKE |

|

MODEL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CODE |

MODEL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 |

|

|

|

|

|

|

|

|

|

|

|

CYLS |

|

NEW USED |

|

|

|

DATE OF PURCHASE |

|

|

|

NUMBER |

|

|

|

COLOR |

|

|

ODOMETER READING |

|

|

|

|

CURRENT ALABAMA TITLE NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME (LAST, FIRST, MIDDLE) |

|

|

|

|

|

|

FELONY OFFENSE FOR FALSE ADDRESS |

|

|

|

|

|

FOR OFFICE USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

ALABAMA OPERATOR (LESSEE) NAME AND / OR RESIDENT ADDRESS IF DIFFERENT FROM ABOVE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESIDENT ADDRESS |

|

|

|

|

|

|

FELONY OFFENSE FOR FALSE ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME FIRST LIENHOLDER |

|

|

|

FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE (M/D/Y) |

|

|

LOCATOR NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

REJECT TO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME SECOND LIENHOLDER |

|

|

|

FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD |

|

REASONS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE (M/D/Y) |

|

|

EXAMINER NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

ENCL.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN COMPLETED FORM ONLY, FELONY OFFENSE FOR FALSE STATEMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I, THE UNDERSIGNED, CERTIFY THAT THE VEHICLE DESCRIBED ABOVE IS OWNED BY ME AND I HERE- |

|

|

THE UNDERSIGNED ASSIGNOR AND ASSIGNEE CONFIRM THAT THE LIEN HELD BY THE ASSIGNOR HAS |

|

A BY MAKE APPLICATION FOR A CERTIFICATE OF TITLE FOR SAID MOTOR VEHICLE AND THIS VEHICLE |

|

C BEEN TRANSFERRED TO THE ASSIGNEE. BOTH PARTIES HEREBY REQUEST THAT A NEW CERTIFICATE |

|

WILL NOT BE THE SUBJECT OF LIEN PRIOR TO RECEIPT OF TITLE UNLESS INDICATED ABOVE. I FURTHER |

|

OF TITLE BE ISSUED SUBJECT TO THE LIENS LISTED ON THIS APPLICATION. |

|

CERTIFY THAT ALL INFORMATION CONTAINED HEREIN IS TRUE AND CORRECT TO THE BEST OF MY KNOWL- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDGE AND BELIEF. |

|

|

|

|

|

|

|

|

|

|

ASSIGNOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNER |

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE(S) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

(PERSONALLY SIGNED BY EACH OWNER (IN INK) OR AUTHORIZED REPRESENTATIVE OF FIRM) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I HEREBY CERTIFY THAT ALL INFORMATION CONTAINED IN THIS APPLICATION IS TRUE AND CORRECT |

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

B TO THE BEST OF MY KNOWLEDGE AND BELIEF. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSIGNEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTICE OF SECURITY INTEREST |

|

NOTE: LIEN DATE FOR TRANSFERRED LIEN(S) MUST REMAIN THE SAME. ALSO, NO CHANGES ARE PERMIT- |

|

|

|

|

|

|

TED IN THE OWNER INFORMATION (OTHER THAN ADDRESS CHANGES). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*All VINs for 1981 and subsequent year model vehicles that conform to federal anti-theft stan- dards are required to have 17 digits/characters.

SECTIONS A AND B OR SECTION C MUST BE COMPLETED

THIS FORM MAY BE DUPLICATED |

Submit $15.00 Application Processing Fee (non-refundable) |

FEE – $15.00 |

in certified funds payable to Alabama Department of |

|

|

Revenue. Do not send personal checks or cash. |

|

|

Instructions

This form shall be typed or printed legibly.

Illegible forms will be returned.

This form is designed for use by a lienholder in order for an owner of a vehicle to comply with section 32-8-61, Code of Alabama 1975, where an owner creates a security interest in a vehicle.

This form may not be used on a transfer of ownership or by designated agents. Designated agents shall use form MVT 5-1E to record liens.

NOTE: Vehicle information and owner information shall be identical to information appearing on surrendered alabama title except for current mailing address and current alabama resident address.

SUPPORTING DOCUMENTS – This application shall be accompanied by the current Alabama title to this vehicle and the title fee (certified funds only) payable to the Alabama Department of Revenue.

Exemptions

(1)Effective January 1, 2012, no certificate of title shall be issued for any manufactured homes, trail- er, semi-trailer, travel trailer, or folding or collapsible camping trailer more than twenty (20) model years old. This exemption is applicable on January 1 of each year and applies to all manufactured homes, trailers, semi-trailers, travel trailers, and folding or collapsible camping trailers with a model year, as designated by the manufacturer, older than twenty (20) years from the current cal- endar year. All utility trailers, other than folding or collapsible camping trailers, are still exempt from titling regardless of the year model.

Example: As of January 1, 2012, all 1991 and prior year model manufactured homes, trailers, semi-trailers, travel trailers, and folding or collapsible camping trailers are exempt from the titling provisions of Chapter 8, Title 32, Code of Alabama 1975.

(2)Effective January 1, 2012, no certificate of title shall be issued for any motor vehicle more than thirty-five (35) model years old. This exemption is applicable on January 1 of each year and applies to all motor vehicles with a model year, as designated by the manufacturer, older than thir- ty-five (35) years from the current calendar year.

Example: As of January 1, 2012, all 1976 and prior year model motor vehicles are exempt from the titling provisions of Chapter 8, Title 32, Code of Alabama 1975.

(3)Effective January 1, 2012, no certificate of title shall be issued for a low speed vehicle. A low speed vehicle is defined as a four-wheeled motor vehicle with a top speed of not greater than 25 miles per hour, a gross vehicle weight rating (GVWR) of which is less than 3,000 pounds and complying with the safety standards provided in 49 C.F.R. Section 571.500. The term includes neighborhood electric vehicles.

NOTE: The exemption from titling does not invalidate any Alabama certificate of title that is currently in effect. However, no subsequent title, including a certificate of title to record or transfer a lien, can be issued if the vehicle is exempt from titling.