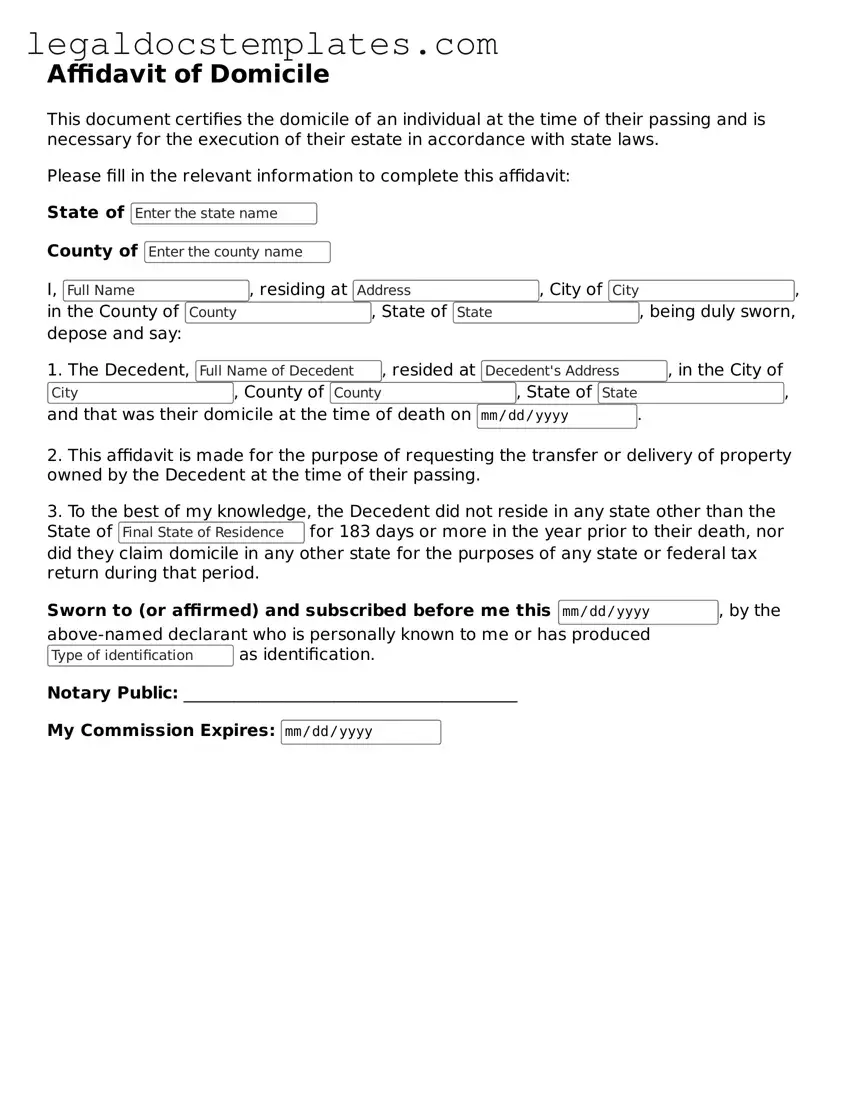

When filling out an Affidavit of Domicile, many individuals overlook the importance of accuracy in their details. This document, crucial for estate settlement and transfer of securities, requires precise information about a deceased person's legal residence at the time of death. A common mistake is entering incorrect or outdated information, leading to unnecessary delays and legal complications. It's imperative to verify all details, especially addresses and dates, to ensure the affidavit's validity.

Another frequent error is neglecting to have the document notarized. For an Affidavit of Domicile to be legally binding, it must be signed in the presence of a notary public. This official acts as an unbiased witness, verifying the identity of the signer. Some people mistakenly believe that a simple signature will suffice, but failure to notarize the document can result in its rejection by financial institutions and legal entities, thwarting the execution of the deceased's estate.

Additionally, individuals often fail to attach necessary supporting documents. An Affidavit of Domicile may require accompanying proof of the deceased's domicile, such as utility bills, property tax receipts, or a driver’s license. Omitting these critical pieces of evidence can render the affidavit incomplete, leading authorities to question the claims made within the document.

There's also a common oversight in not consulting legal counsel before submitting the affidavit. Legal terminology and the nuances of estate law can confuse those unfamiliar with such matters. By seeking advice from a legal professional, individuals can ensure that the affidavit complies with state laws and meets all requirements, thereby avoiding potential legal hurdles.

Misunderstanding the purpose of the document is yet another mistake. Some people confuse an Affidavit of Domicile with other legal documents, such as a last will and testament or a death certificate. Understanding the specific function of this affidavit - to declare the deceased's primary place of residence - is critical for correctly filling it out and using it for its intended legal purposes.

Incorrectly identifying the affiant—the person completing the affidavit—is a mistake with significant implications. The affiant must have direct knowledge of the deceased's residence history and legal domicile. Mistakenly identifying someone with secondhand knowledge or no direct knowledge at all can invalidate the affidavit.

Not updating the affidavit when circumstances change is also a pitfall. If new information comes to light regarding the deceased's domicile or if there was an error in the initial filing, the document should be corrected and re-submitted. Failing to do so can perpetuate inaccuracies and legal inconsistencies.

Submitting the form to the wrong institution or agency is a logistical error many people make. Understanding which entities require the affidavit—and which do not—is essential for the efficient administration of the deceased's estate. Misdirected submissions can lead to delays and confusion.

Finally, hastily completing the form without reviewing it for errors is a widespread issue. Even small mistakes, such as typographical errors or incorrect dates, can significantly impact the affidavit's acceptance. Taking the time to carefully review and double-check the document can prevent these avoidable errors.