What is an ADP Pay Stub?

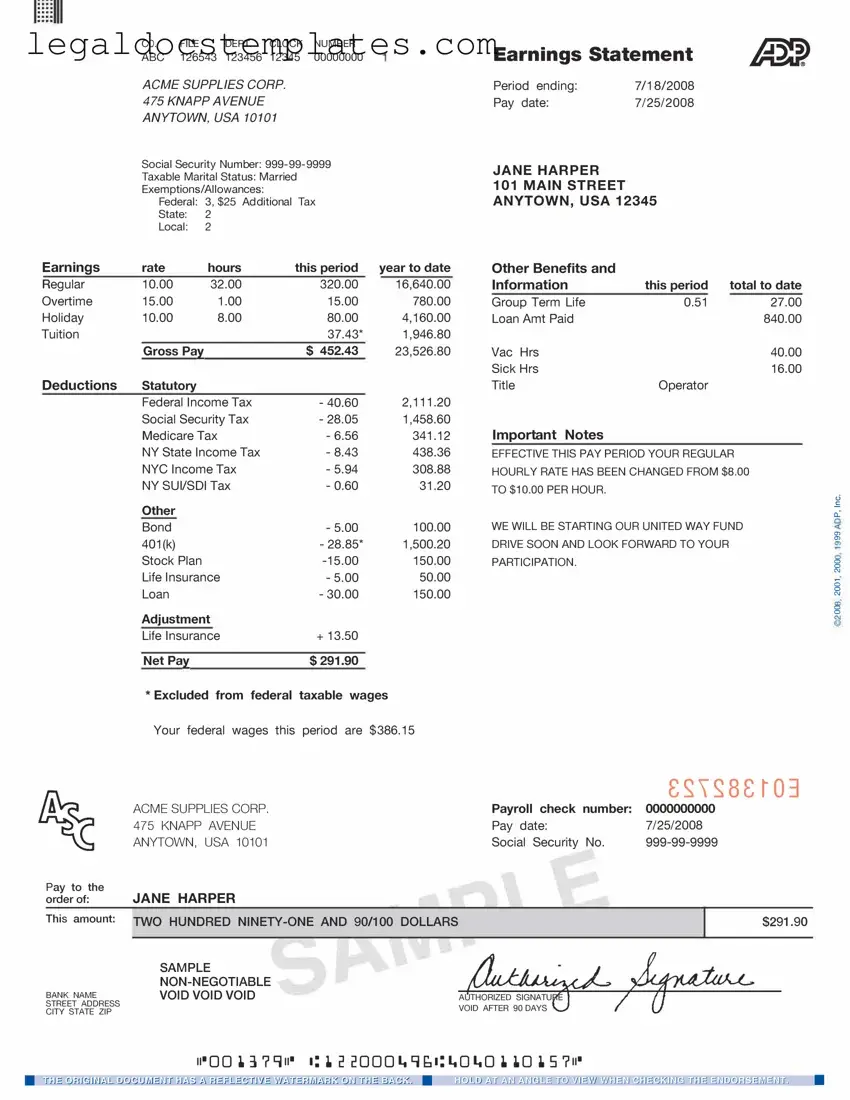

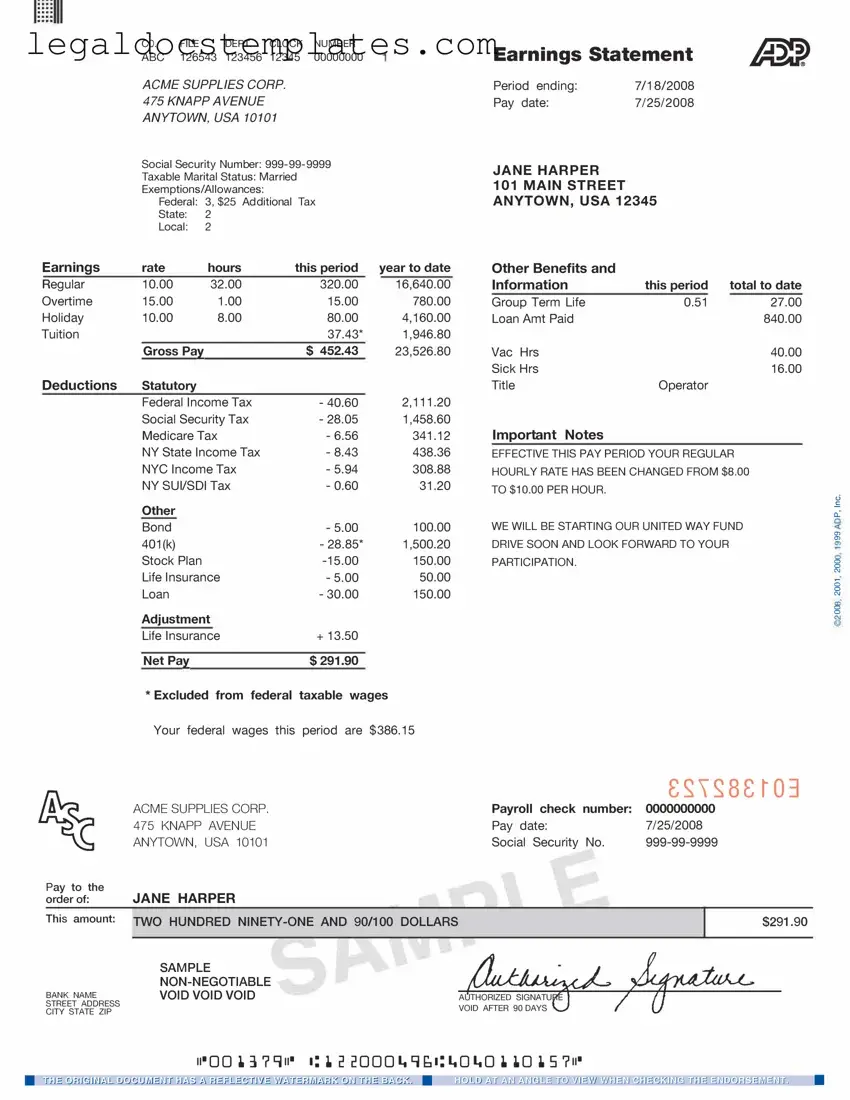

An ADP pay stub is a document produced by the payroll processing company ADP, which details an employee's earnings for a specific pay period. It includes information such as the employee's gross pay, taxes withheld, deductions, and net pay. Employers who use ADP for their payroll services provide these pay stubs to their employees as a record of their earnings and deductions.

How can I get a copy of my ADP pay stub?

To get a copy of your ADP pay stub, you typically need to:

-

Login to your ADP employee access account. If you don't have one, you may need to register for an account using the code provided by your employer.

-

Navigate to the pay statements section.

-

Select the pay stub you wish to view or download.

-

Download or print the pay stub for your records.

If you encounter any issues, it's advised to reach out to your company's HR or payroll department for assistance.

An ADP pay stub typically includes several pieces of important information:

-

Gross Pay:

The total earnings before any deductions are made.

-

Net Pay:

The amount an employee takes home after all deductions are made.

-

Taxes:

Details of federal, state, and any other taxes withheld from the gross pay.

-

Deductions:

Information on pre-tax and post-tax deductions, including health insurance, retirement contributions, and others.

-

Year-to-Date Totals:

Cumulative totals for pay and deductions for the year.

Why is it important to keep my ADP pay stubs?

Keeping your ADP pay stubs is important for several reasons:

-

They serve as proof of income, which is necessary for loans, mortgages, or rental agreements.

-

They help you understand and verify your deductions, taxes, and net pay, ensuring your payroll is processed correctly.

-

They are crucial for filing your tax return, as they provide the necessary income and tax information.

How often will I receive my ADP pay stub?

The frequency at which you receive your ADP pay stub depends on your employer's payroll schedule. Common payroll schedules include weekly, bi-weekly, semi-monthly, or monthly. You should receive a pay stub each time you are paid, corresponding to the chosen payroll schedule.

Can I access my ADP pay stubs from previous years?

Yes, in most cases. Many employers using ADP allow access to several years of historical pay stubs through the same ADP employee access account where current pay stubs are found. The available history might vary by employer, so if you cannot find what you're looking for, contact your HR or payroll department for help.

What should I do if there's an error on my ADP pay stub?

If you discover an error on your ADP pay stub, it's critical to act quickly:

-

Review your pay stub thoroughly to understand the nature of the error.

-

Collect any documents that support your claim of an error, like time cards or benefit enrollment confirmations.

-

Contact your company's HR or payroll department promptly to report the issue. Provide them with the supporting documents.

-

Follow up regularly until the issue is resolved, and verify the correction on your next pay stub.

Errors are best rectified promptly to ensure your pay and any affected deductions are correctly adjusted.