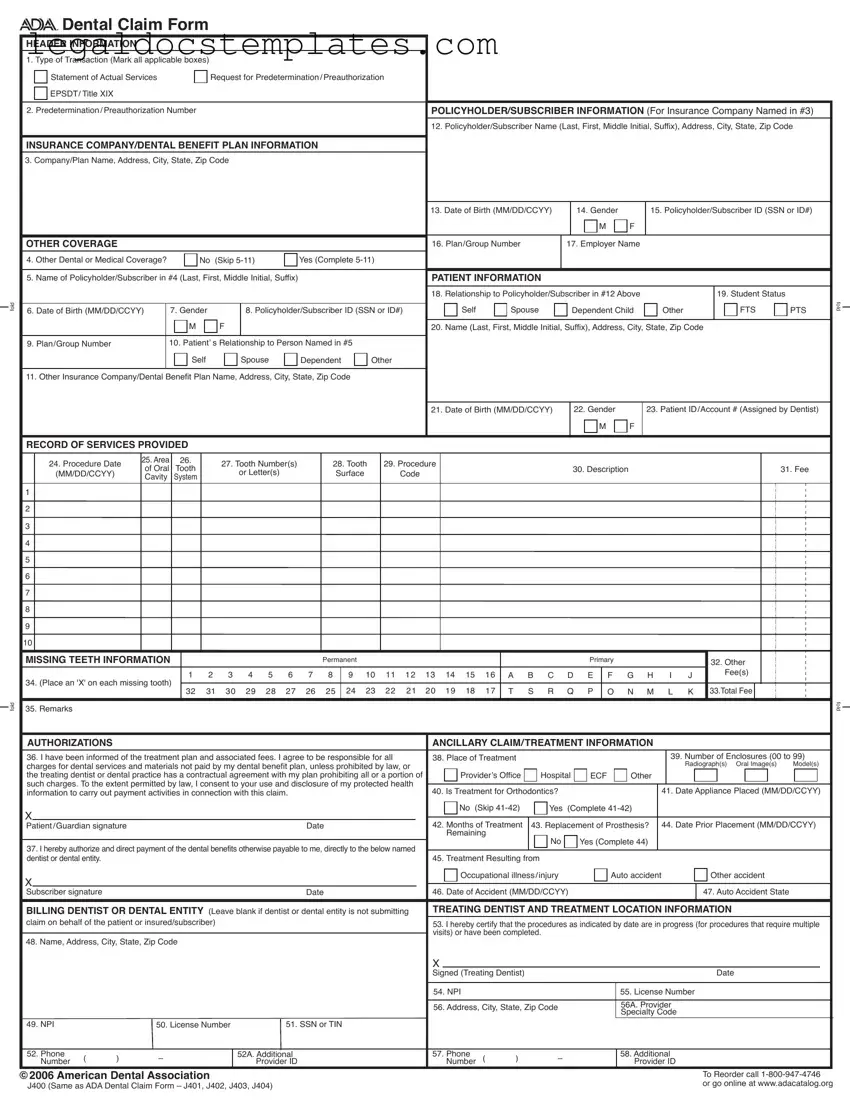

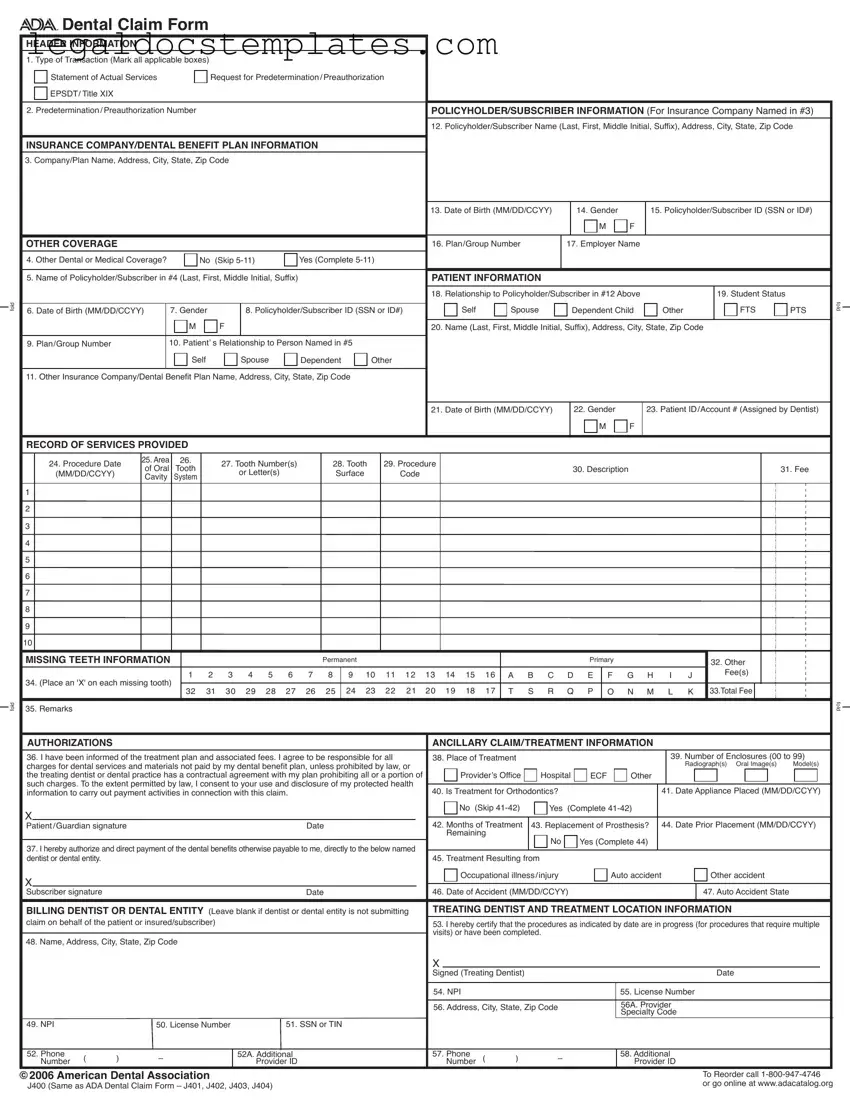

The ADA Dental Claim Form is quite similar to the Medical Claim Form used by healthcare providers to bill insurance companies for medical services provided. Both forms capture detailed information about the patient, insurance coverage, and the specific services rendered. They include sections for policyholder information, patient demographics, service provider details, and a breakdown of charges. The primary difference lies in the specific nature of services and codes reported—dental versus general medical.

Another document that resembles the ADA Dental Claim Form is the Prescription Drug Claim Form. This form is used by pharmacies to request reimbursement from insurance companies for medications dispensed to insured patients. Like the dental claim form, it collects information on the patient, prescriber, and insurance coverage, but instead focuses on the specific medications dispensed, their quantities, and associated costs.

The Vision Care Claim Form bears similarities to the ADA Dental Claim Form as well. Designed for optometrist and ophthalmologist offices, it details patient and insurance information, along with services provided, such as eye exams, glasses, or contact lens fittings. Both forms serve the purpose of detailing specialized healthcare services for insurance reimbursement, though they cater to different types of services (dental vs. vision care).

The Workers' Compensation Claim Form is used by employees to file for benefits due to a workplace injury or illness. While its primary function is to initiate a claim for workers' compensation benefits rather than direct billing to insurance, it similarly collects detailed information about the claimant, the employer, and the medical provider. The focus is on the nature of the injury or illness, treatments received, and work status, paralleling the data collection aspect of the ADA Dental Claim Form but for a different purpose.

The Health Insurance Claim Form (often known as the CMS-1500) is used by non-institutional providers to bill Medicare and other health insurance programs. Like the ADA Dental Claim Form, it collects detailed information about the patient, the provider, the insurance coverage, and the services provided, including detailed service codes and charges. Both forms are integral to the healthcare reimbursement process, though the CMS-1500 is broader in its application across various medical services.

The Patient Registration Form, commonly used in both medical and dental practices, gathers patient demographic and insurance information at the point of service. Although not a claim form per se, it captures many of the same initial data points as the ADA Dental Claim Form, such as patient name, contact information, insurance details, and relationship to the policyholder. This form is crucial for the backend billing processes, including the completion of claim forms.

The Durable Medical Equipment (DME) Claim Form is used to bill for rental or purchases of equipment intended for medical use at home, like wheelchairs or hospital beds. Similar to the ADA Dental Claim Form, it requires information about the patient, the prescriber/provider, and the insurance coverage. The main difference lies in the type of services and items billed, focusing on equipment rather than procedural services.

The Automobile Personal Injury Protection (PIP) Claim Form is used for billing auto insurance carriers for medical treatment following an auto accident. It shares similarities with the ADA Dental Claim Form in that it captures patient information, details of the insurance policy, and specifics of the medical services provided due to the accident. However, it is tailored to auto insurance and personal injury protection coverage specifics.

The Travel Insurance Claim Form is used by individuals to claim for medical services received or losses incurred while traveling. Though its primary purpose is broader, covering a range of benefits like trip cancellations and lost luggage, the sections related to medical services resemble those in the ADA Dental Claim Form. Both require detailed documentation of services received, costs, and insurance information, even though the contexts in which they are used differ significantly.

The Disability Insurance Claim Form, used to apply for benefits under a disability insurance policy, gathers comprehensive information about the claimant's medical condition, treatment history, and ability to work. While focused more on the disability aspect and less on detailed billing for specific services (like the ADA Dental Claim Form), it nonetheless collects extensive health and provider information to substantiate a claim for benefits based on health conditions that impact the claimant's life and work.

Dental Claim Form

Dental Claim Form