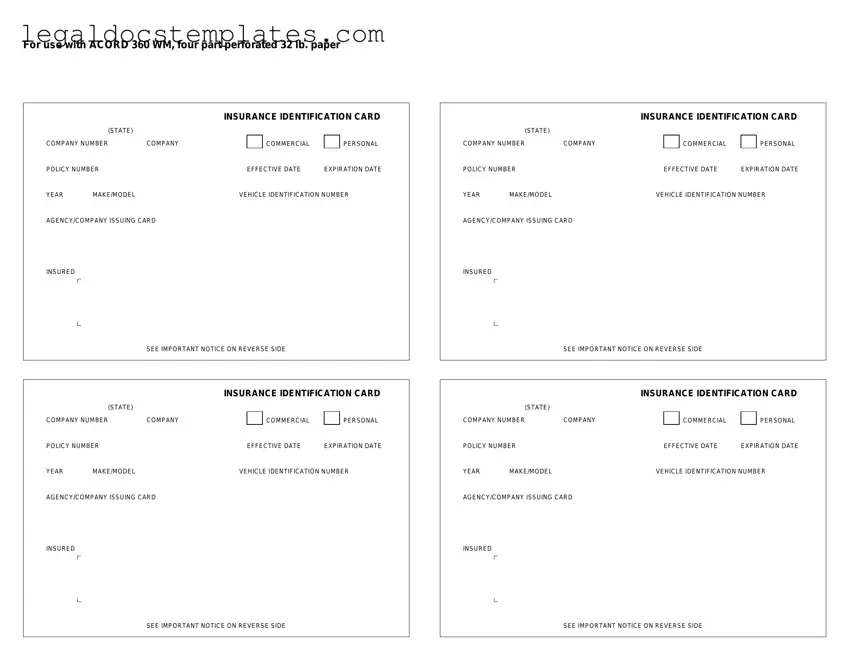

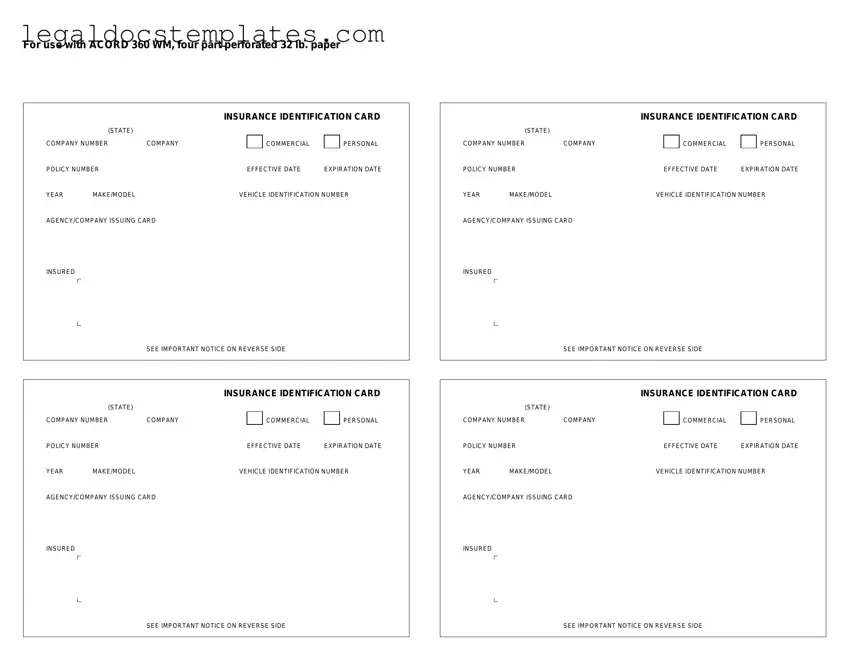

The Acord 50 WM form, familiar to many in the insurance and vehicle registration sectors, bears similarities to a variety of other documents utilized across different contexts. One such document is the Insurance Identification Card, typically required by law to be carried in vehicles in many states to prove that a driver has the minimum required level of auto insurance. Like the Acord 50 WM, it lists the vehicle's make, model, year, and VIN, as well as the insurance policy number and effective dates, serving as a quick reference for law enforcement and accident-response teams.

Another document resembling the Acord 50 WM form is the Certificate of Liability Insurance. This certificate serves as proof that a business holds liability insurance, detailing the policy's scope, limits, and effective dates. While it pertains more to business operations rather than individual vehicle coverage, both documents function as official forms of verification for insurance coverage, essential for mitigating risks and demonstrating compliance with legal or contractual obligations.

The Vehicle Registration Certificate also shares similarities with the Acord 50 WM form. Issued by the state department of motor vehicles, it provides official evidence of a vehicle's registration. Details like the vehicle's description, the owner's name, and the registration expiration date parallel some of the information found on the Acord 50 WM, although the latter focuses more on insurance coverage than on registration status.

Similarly, the Proof of Insurance Letter, which can be provided by an insurance company to its policyholders, echoes the functions of the Acord 50 WM form. This letter verifies that the policyholder has an active insurance policy, detailing the coverage types, amounts, and policy dates. It is commonly used for transactions requiring proof of insurance, such as leasing a building or securing financing.

The Coverage Summary Sheet, often part of a larger insurance documentation package, also has parallels with the Acord 50 WM form. It summarizes the key aspects of an insurance policy, including coverages, limits, deductibles, and policy periods. While more comprehensive, it serves a similar purpose: providing a clear and concise overview of insurance coverage.

The Insurance Binder, another document in the insurance realm, temporarily provides proof of insurance coverage until a permanent policy is issued. Like the Acord 50 WM, it details the insured’s name, the coverage limits, and the effective period of the temporary coverage, acting as a placeholder that assures third parties of the insured’s current protection.

The Auto Insurance Declaration Page is a document that outlines the specifics of an auto insurance policy, including the policyholder’s information, the covered vehicles, and the coverage types and limits. This page is often the first part of an insurance policy, making it easily comparable to the Acord 50 WM form in terms of presenting essential insurance details at a glance.

Last, the Financial Responsibility Card is issued in certain states to drivers who need to prove financial responsibility for meeting minimum insurance requirements. Though not an insurance document per se, it serves a similar purpose to the Acord 50 WM form by verifying to authorities that the driver has met specific financial criteria to legally operate a vehicle.