SIGNATURE

Copy of the Notice of Information Practices (Privacy) has been given to the applicant. (Not required in all states, contact your agent or broker for your state's requirements.)

PERSONAL INFORMATION ABOUT YOU, INCLUDING INFORMATION FROM A CREDIT OR OTHER INVESTIGATIVE REPORT, MAY BE COLLECTED FROM PERSONS OTHER THAN YOU IN CONNECTION WITH THIS APPLICATION FOR INSURANCE AND SUBSEQUENT AMENDMENTS AND RENEWALS. SUCH INFORMATION AS WELL AS OTHER PERSONAL AND PRIVILEGED INFORMATION COLLECTED BY US OR OUR AGENTS MAY IN CERTAIN CIRCUMSTANCES BE DISCLOSED TO THIRD PARTIES WITHOUT YOUR AUTHORIZATION. CREDIT SCORING INFORMATION MAY BE USED TO HELP DETERMINE EITHER YOUR ELIGIBILITY FOR INSURANCE OR THE PREMIUM YOU WILL BE CHARGED. WE MAY USE A THIRD PARTY IN CONNECTION WITH THE DEVELOPMENT OF YOUR SCORE. YOU MAY HAVE THE RIGHT TO REVIEW YOUR PERSONAL INFORMATION IN OUR FILES AND REQUEST CORRECTION OF ANY INACCURACIES. YOU MAY ALSO HAVE THE RIGHT TO REQUEST IN WRITING THAT WE CONSIDER EXTRAORDINARY LIFE CIRCUMSTANCES IN CONNECTION WITH THE DEVELOPMENT OF YOUR CREDIT SCORE. THESE RIGHTS MAY BE LIMITED IN SOME STATES. PLEASE CONTACT YOUR AGENT OR BROKER TO LEARN HOW THESE RIGHTS MAY APPLY IN YOUR STATE OR FOR INSTRUCTIONS ON HOW TO SUBMIT A REQUEST TO US FOR A MORE DETAILED DESCRIPTION OF YOUR RIGHTS AND OUR PRACTICES REGARDING PERSONAL INFORMATION.

(Not applicable in AZ, CA, DE, KS, MA, MN, ND, NY, OR, VA, or WV. Specific ACORD 38s are available for applicants in these states.)

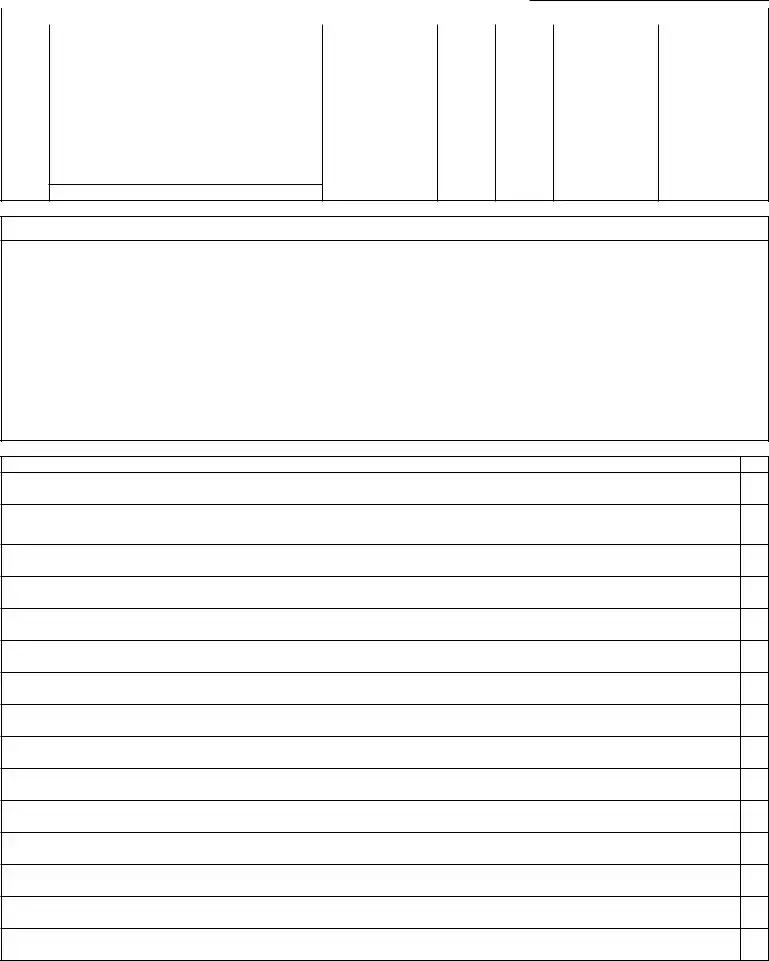

Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects that person to criminal and civil penalties (In Oregon, the aforementioned actions may constitute a fraudulent insurance act which may be a crime and may subject the person to penalties). (In New York, the civil penalty is not to exceed five thousand dollars ($5,000) and the stated value of the claim for each such violation). (Not applicable in AL, AR, AZ, CO, DC, FL, KS, LA, ME, MD, MN, NM, OK, PR, RI, TN, VA, VT, WA and WV).

Applicable in AL, AR, AZ, DC, LA, MD, NM, RI and WV: Any person who knowingly (or willfully in MD) presents a false or fraudulent claim for payment of a loss or benefit or who knowingly (or willfully in MD) presents false information in an application for insurance is guilty of a crime and may be subject to fines or confinement in prison.

Applicable in Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company, Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the department of regulatory agencies.

Applicable in Florida and Oklahoma: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony (In FL, a person is guilty of a felony of the third degree).

Applicable in Kansas: Any person who, knowingly and with intent to defraud, presents, causes to be presented or prepares with knowledge or belief that it will be presented to or by an insurer, purported insurer, broker or any agent thereof, any written statement as part of, or in support of, an application for the issuance of, or the rating of an insurance policy for personal or commercial insurance, or a claim for payment or other benefit pursuant to an insurance policy for commercial or personal insurance which such person knows to contain materially false information concerning any fact material thereto; or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act.

Applicable in Maine, Tennessee, Virginia and Washington: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Applicable in Puerto Rico: Any person who knowingly and with the intention of defrauding presents false information in an insurance application, or presents, helps, or causes the presentation of a fraudulent claim for the payment of a loss or any other benefit, or presents more than one claim for the same damage or loss, shall incur a felony and, upon conviction, shall be sanctioned for each violation by a fine of not less than five thousand dollars ($5,000) and not more than ten thousand dollars ($10,000), or a fixed term of imprisonment for three (3) years, or both penalties. Should aggravating circumstances be present, the penalty thus established may be increased to a maximum of five (5) years, if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

Applicable in Utah: Any person who knowingly presents false or fraudulent underwriting information, files or causes to be filed a false or fraudulent claim for disability compensation or medical benefits, or submits a false or fraudulent report or billing for health care fees or other professional services is guilty of a crime and may be subject to fines and confinement in state prison.

THE UNDERSIGNED IS AN AUTHORIZED REPRESENTATIVE OF THE APPLICANT AND REPRESENTS THAT REASONABLE INQUIRY HAS BEEN MADE TO OBTAIN THE ANSWERS TO QUESTIONS ON THIS APPLICATION. HE/SHE REPRESENTS THAT THE ANSWERS ARE TRUE, CORRECT AND COMPLETE TO THE BEST OF HIS/HER KNOWLEDGE.